Top Voice of Customer Examples to Boost Growth in 2025

Understanding your customer is the core of any successful marketing strategy. The Voice of the Customer (VoC) is the process of systematically gathering, analyzing, and acting on customer insights to drive tangible business growth. It's about listening to what customers are saying about your brand, products, and services across multiple channels, and then using that intelligence to make smarter, data-driven decisions. Without a clear VoC program, businesses risk developing products no one wants, launching campaigns that don’t resonate, and losing customers to more attentive competitors.

This article moves beyond theory to provide a deep dive into actionable voice of customer examples from leading brands. We will dissect the methods they use, compare their approaches, and provide a clear, replicable playbook you can use to transform customer feedback into your most powerful marketing engine. You will see firsthand how companies leverage everything from quantitative metrics like NPS to the qualitative goldmines found in social media conversations and live chat logs.

By breaking down these real-world scenarios, you'll learn not just what these companies did, but how they did it and why it worked. We'll explore the specific tactics behind:

- Net Promoter Score (NPS) Surveys

- Customer Journey Mapping with Voice Data

- Online Review Analysis and Response

- Social Media Listening and Sentiment Analysis

- Customer Advisory Boards and Focus Groups

- Live Chat and Customer Service Interaction Analysis

- Post-Purchase and Transaction Surveys

- Employee Feedback as a Voice of Customer Proxy

Each example is designed to give your marketing, sales, and product teams a blueprint for implementing these powerful techniques to enhance customer loyalty, refine your product, and significantly improve your marketing ROI.

1. Net Promoter Score (NPS) Surveys: The Loyalty Benchmark

The Net Promoter Score (NPS) is a cornerstone metric for gauging customer loyalty. It’s built around a single, powerful question: "On a scale of 0-10, how likely are you to recommend our company/product/service to a friend or colleague?" This simple rating segments customers into three distinct groups:

- Promoters (9-10): Your most loyal, enthusiastic advocates.

- Passives (7-8): Satisfied but unenthusiastic customers vulnerable to competitors.

- Detractors (0-6): Unhappy customers who can damage your brand through negative word-of-mouth.

The true value of NPS as a voice of customer example, however, comes from the open-ended follow-up question: "What is the primary reason for your score?" This is where raw, unfiltered customer feedback provides actionable insights.

Strategic Analysis: Beyond the Score

While the final NPS score (Promoters % - Detractors %) is a useful KPI for tracking loyalty over time, the qualitative feedback is the real prize. Unlike a multi-question satisfaction survey that can prime users for specific answers, the simplicity of NPS captures top-of-mind sentiment. A detailed survey might reveal nuanced feelings about ten different features, but NPS tells you what actually matters most to the customer in that moment.

For instance, a SaaS company might notice a drop in its NPS. The quantitative score signals a problem, but the qualitative responses reveal the why. Detractors might consistently mention "a confusing user interface after the recent update," while Promoters praise the "responsive customer support." This VoC data gives teams specific areas to address and strengths to double-down on.

Key Insight: The NPS score tells you what is happening with customer loyalty, but the follow-up feedback tells you why. This qualitative data is essential for root cause analysis and targeted action.

Actionable Takeaways & Implementation

To effectively use NPS as a voice of customer tool, move beyond just collecting scores.

- Segment Your Feedback: Don't just analyze all feedback in one bucket. Tag and categorize responses by theme (e.g., "Pricing," "UI/UX," "Support," "Feature Request"). Compare themes between Promoters and Detractors to see what drives loyalty versus what causes churn.

- Close the Loop: Create a system to respond to feedback, especially from Detractors. A simple, personalized email acknowledging their issue and outlining steps for resolution can turn a negative experience into a positive one. Action Step: Set a team KPI to respond to all Detractor feedback within 24 hours.

- Integrate with Your CRM: Connect your NPS tool (like Delighted or AskNicely) to your CRM. This enriches customer profiles with loyalty data, allowing sales and support teams to tailor their interactions. For example, a support agent can see if they are speaking with a Promoter or a Detractor, adjusting their approach accordingly.

By pairing the simple quantitative metric with rich qualitative feedback, NPS becomes one of the most efficient and powerful voice of customer examples for any business to implement.

2. Customer Journey Mapping with Voice Data

Customer Journey Mapping goes beyond a simple timeline of interactions; it's a strategic visualization of the entire customer experience, enriched with direct feedback. This method involves charting every touchpoint a customer has with your brand-from initial awareness to post-purchase support-and overlaying that map with their actual thoughts, feelings, and pain points collected through voice of customer (VoC) channels.

This approach transforms an internal process map into a living, breathing empathy map. While a standard flowchart shows what steps a customer takes, a VoC-enriched journey map shows how they feel during those steps. For instance, British Airways uses this technique to understand the traveler's experience, pinpointing frustrations at baggage check-in or moments of delight during in-flight service by integrating feedback directly into the journey map.

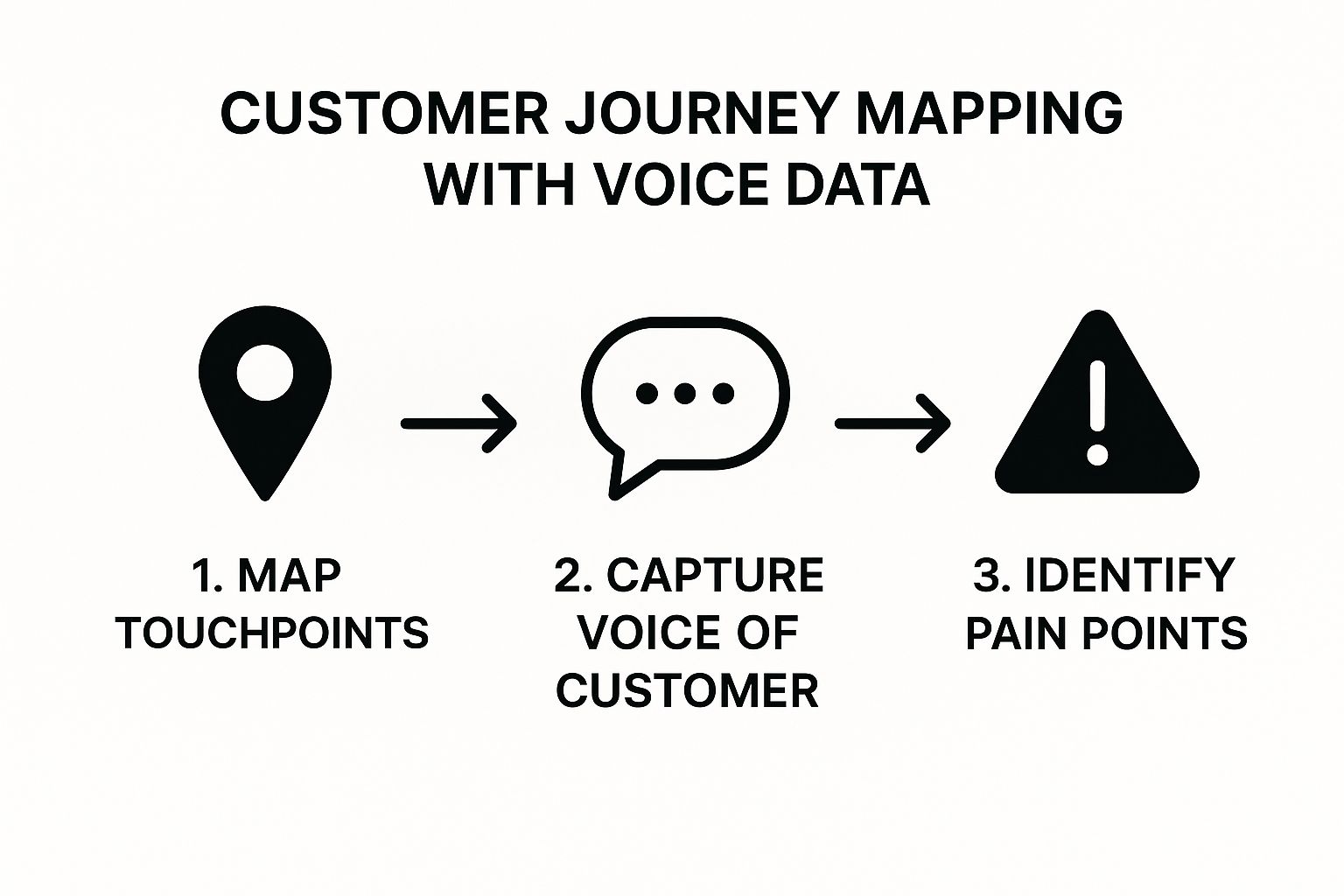

The following infographic illustrates the core process of integrating VoC data into a customer journey map.

This simple workflow ensures that the journey map is grounded in authentic customer feedback, not internal assumptions.

Strategic Analysis: Uncovering the "Why" Between Touchpoints

While analytics can show where customers drop off, voice data on a journey map reveals why. The true power of this method lies in identifying the emotional friction or delight between touchpoints. A customer might successfully complete a purchase, but the journey map could reveal their anxiety about unclear shipping information or frustration with a clunky payment form.

For example, a Starbucks journey map might combine mobile app usage data with in-app survey feedback. It could reveal that while customers love the "order ahead" feature, they feel "anxious" or "confused" when they arrive in-store and can't easily locate the pickup counter. This voice of customer example gives Starbucks a specific, emotionally charged pain point to solve-something quantitative data alone would miss.

Key Insight: A journey map without voice data is just a process diagram. Adding direct customer quotes, emotions, and feedback transforms it into a powerful tool for identifying the hidden friction and opportunities that define the customer experience.

Actionable Takeaways & Implementation

To create a journey map that drives real change, focus on integrating authentic VoC.

- Inject Real Quotes: Don't summarize feedback. Use direct quotes from surveys, reviews, or support calls at each touchpoint. Placing "I couldn't find the return policy anywhere!" on the "Post-Purchase" stage is far more impactful than a generic "poor information" label.

- Involve Frontline Teams: Your support, sales, and retail staff are a primary source of VoC. Host workshops where they contribute their knowledge of common customer frustrations and questions, adding another layer of qualitative data to the map. Action Step: Schedule a quarterly 90-minute workshop with your customer support team to update the journey map with new insights.

- Prioritize by Emotion: Use the emotional data on your map to prioritize fixes. A touchpoint that causes "frustration" or "distrust" should be a higher priority than one that is merely "okay." Create a "pain point matrix" that scores issues based on emotional severity and frequency.

By systematically embedding the customer's voice into every stage, journey mapping becomes less of an academic exercise and more of a strategic blueprint for customer-centric improvements. Learn more about how to get a deeper customer view with person-level identification on marketbetter.ai.

3. Online Review Analysis and Response

Online reviews are a raw, public, and continuous stream of customer feedback. Unlike solicited surveys where the brand controls the questions, reviews on platforms like Google, Yelp, Amazon, or industry-specific sites (e.g., Capterra for software) represent spontaneous customer sentiment. A systematic approach to monitoring, analyzing, and responding to these reviews transforms them from a passive reputation score into an active and powerful voice of customer example.

This process involves more than just damage control for bad reviews. It's about extracting patterns and themes from both positive and negative feedback. Companies can use this data to identify product flaws, service gaps, or competitive advantages directly from the customer’s perspective. For instance, a local restaurant might notice multiple Yelp reviews mentioning "slow service on weekends," prompting a change in staffing, while an e-commerce brand can use Amazon review themes to inform its next product iteration.

Strategic Analysis: Uncovering Public Sentiment

The public nature of reviews adds a layer of urgency and authenticity that private feedback channels lack. While an NPS survey provides internal data, a Google review influences countless potential customers. Analyzing this feedback means looking for trends in language, sentiment, and recurring topics.

For example, a hotel chain might find its 5-star reviews consistently praise the "friendly front-desk staff," while 1-star reviews frequently cite "outdated bathroom fixtures." This VoC data provides clear, prioritized directives: invest in staff training recognition to maintain a key strength and budget for bathroom renovations to fix a major detractor. This is a direct line to what customers value and what drives them away.

Key Insight: Online reviews are not just a customer service channel; they are a public focus group. The trends within them reveal what truly matters to your market and directly impact acquisition.

Actionable Takeaways & Implementation

To leverage online reviews as a strategic VoC tool, implement a structured system.

- Use Aggregation Tools: Manually tracking reviews across multiple platforms is inefficient. Use reputation management tools (like Birdeye or Podium) to aggregate all reviews into a single dashboard. This allows for sentiment analysis and theme tagging at scale.

- Develop Response Protocols: Create templates and guidelines for responding to both positive and negative reviews. A professional, timely response to a negative review can mitigate damage and show accountability, while engaging with positive reviews builds community and encourages brand loyalty. Action Step: Draft three response templates—one for positive, one for negative, and one for mixed reviews—and set a 24-hour response SLA.

- Translate Feedback into Action: Establish a clear process for escalating recurring feedback to the relevant departments. If multiple reviews mention a specific software bug, that information must be routed directly to the product development team. Action Step: Create a monthly "Voice of the Customer" report summarizing top review themes and present it to department heads.

By treating public reviews with the same analytical rigor as internal surveys, businesses can tap into a highly influential and honest source of customer insight.

4. Social media Listening and Sentiment Analysis

Not all customer feedback comes through direct channels. Social media platforms are vast, real-time focus groups where customers openly discuss their experiences, frustrations, and desires regarding brands. Social media listening is the process of monitoring these platforms for mentions of your company, products, and competitors to capture this unsolicited voice of the customer.

This method goes beyond simply tracking mentions; it involves sentiment analysis, which uses AI to classify the emotional tone of a conversation as positive, negative, or neutral. While online reviews capture a post-experience summary, social listening captures the in-the-moment reaction. For instance, a brand like Nike can track real-time reactions to a new shoe launch, while a fast-food chain like Wendy's can identify and respond to a customer service complaint on Twitter within minutes.

Strategic Analysis: Tapping into the Unfiltered Conversation

Unlike surveys or reviews where customers are prompted for feedback, social media conversations are spontaneous and candid. This provides an unvarnished look into what customers truly think. The power lies in aggregating thousands of these individual mentions to identify macro trends.

A software company might notice a sudden spike in negative sentiment on Twitter and Reddit. By analyzing the conversations, they could discover a critical bug in their latest update that wasn't caught in testing. Conversely, a CPG brand might see a user-generated trend emerge around a new way to use their product, creating an unexpected marketing opportunity. To further understand how public sentiment can be captured and managed effectively, exploring methods like social media reputation monitoring can be incredibly insightful.

Key Insight: Social media listening provides access to the unsolicited, real-time voice of the customer, offering raw insights that formal feedback channels often miss. Sentiment trends can act as an early warning system for problems and an opportunity radar for market trends.

Actionable Takeaways & Implementation

To turn social chatter into a strategic asset, you need a systematic approach.

- Define Your Keywords: Go beyond just your brand name. Track common misspellings, product names, key executive names, and campaign hashtags. Also, monitor competitor brand names to gain competitive intelligence and identify opportunities where their customers are dissatisfied.

- Engage, Don't Just Monitor: Use social listening as a customer service and engagement tool. Respond publicly to praise and offer to take complaints to a private channel like DMs to resolve them. This proactive engagement shows that you are listening and value customer feedback. Action Step: Designate a point person responsible for monitoring brand mentions and responding within two hours during business hours.

- Channel Insights to Product Teams: Create a workflow to share relevant social media insights with product, marketing, and sales teams. A recurring theme of customers requesting a specific feature, for example, is powerful VoC data that should directly inform your product roadmap. This can be more efficient than waiting for formal survey cycles. Explore how to automate the scanning of various channels to streamline this process.

5. Customer Advisory Boards and Focus Groups: The Strategic Dialogue

While surveys capture broad sentiment, Customer Advisory Boards (CABs) and focus groups provide a forum for deep, strategic dialogue. These are structured, moderated sessions with a select group of customers chosen to represent key segments. This method moves beyond reactive feedback to proactively involve customers in a company's strategic direction.

- Customer Advisory Boards (CABs): Typically long-term, strategic partnerships with high-value B2B customers. They meet periodically to advise on product roadmaps, market trends, and high-level strategy.

- Focus Groups: Usually short-term, tactical sessions designed to gather in-depth feedback on a specific topic, such as a new feature, marketing campaign, or user interface design.

The power of this voice of customer example lies in the direct, unscripted interaction. Compared to a one-way survey, these are two-way conversations. They allow companies to explore the nuances behind customer opinions, ask follow-up questions in real-time, and build stronger relationships.

Strategic Analysis: Beyond Surface-Level Feedback

CABs and focus groups are invaluable for qualitative, forward-looking insights that quantitative data cannot provide. A survey might tell you that 30% of users are unhappy with a feature, but a focus group can reveal the emotional context, workflow disruptions, and specific pain points causing that dissatisfaction.

For instance, Salesforce leverages its Customer Success Advisory Board not just for product feedback, but to understand the evolving challenges of their enterprise clients. This direct dialogue informs their entire go-to-market strategy, ensuring their solutions align with the future needs of their most important customers. This approach turns feedback into a collaborative partnership.

Key Insight: These forums provide a direct line to your most strategic customers, allowing you to validate your roadmap and co-create solutions before investing significant development resources.

Actionable Takeaways & Implementation

To maximize the value of these interactive sessions, a structured approach is critical.

- Define a Clear Charter and Goals: Don't just "get feedback." For a CAB, define its purpose, member expectations, and the specific strategic areas it will influence. For a focus group, have a clear research question you need to answer (e.g., "Is our new pricing model clear and fair?").

- Select a Diverse Cohort: Avoid the pitfall of only inviting your happiest customers. A valuable board includes a mix of promoters, passives, and even thoughtful detractors representing different user personas, industries, and company sizes. This diversity prevents confirmation bias and uncovers a wider range of perspectives.

- Demonstrate Action and Close the Loop: These high-touch voice of customer methods require follow-through. Start each meeting by recapping feedback from the previous session and showing exactly how it was implemented. Action Step: Create a "You Said, We Did" slide for the start of every CAB meeting to explicitly link their feedback to company actions.

By facilitating a structured, ongoing dialogue, advisory boards and focus groups transform the voice of the customer from a lagging indicator into a leading strategic asset.

6. Live Chat and Customer Service Interaction Analysis

Your customer service channels are a goldmine of raw, unsolicited customer feedback. Analyzing interactions from live chat, support tickets, and phone calls transforms routine service conversations into a powerful voice of customer (VoC) program. Instead of waiting for customers to fill out a survey, this method captures their sentiment and pain points in the moment.

This approach treats every interaction as a valuable data point. It involves systematically reviewing, tagging, and quantifying conversations to uncover recurring themes, identify friction points in the customer journey, and gauge overall sentiment. This provides a direct, unfiltered line into what customers are actually experiencing, which is often more honest than solicited survey responses.

Strategic Analysis: Beyond Problem-Solving

While the primary goal of a support interaction is to solve a customer's immediate problem, the secondary, strategic value is immense. The aggregate data from thousands of these conversations reveals systemic issues that a single survey might miss. It’s the difference between asking a customer about their experience and listening to them describe it in their own words.

For example, an e-commerce company might notice a sudden spike in live chats about "discount code not working." While agents can resolve each case individually, the VoC analysis flags this as a widespread technical issue for the product team. Similarly, a SaaS company might find that 20% of support tickets mention confusion around a specific feature, signaling a clear need for better in-app guidance or a tutorial video.

Key Insight: Customer service interactions are not just a cost center; they are a real-time research and development hub. Analyzing this voice of customer data turns reactive problem-solving into proactive product and process improvement.

Actionable Takeaways & Implementation

To leverage service interactions as a robust voice of customer example, you must structure the data collection and analysis.

- Systematic Tagging and Categorization: Implement a mandatory tagging system in your help desk software (like Zendesk or Intercom). Agents should tag every conversation with relevant themes (e.g., "Billing Issue," "Feature Request," "UI Bug") and sentiment (Positive, Negative, Neutral). This structures the qualitative data for quantitative analysis.

- Create Cross-Functional Feedback Loops: Don't let insights remain siloed within the support team. Create a formal process for sharing summarized findings with product, marketing, and operations teams on a regular basis. Action Step: Implement a bi-weekly 30-minute meeting between support leads and the product team to review top issue tags.

- Fuel Your Knowledge Base: Use the most common questions and problems identified in chats and tickets to build a comprehensive self-service knowledge base or FAQ section. This not only empowers customers but also reduces support ticket volume, freeing up agents to handle more complex issues.

By treating every customer conversation as a piece of the VoC puzzle, companies can gain continuous, actionable insights that improve the entire customer experience.

7. Post-Purchase and Transaction Surveys: Capturing In-the-Moment Feedback

Post-purchase or transactional surveys are targeted feedback requests sent immediately following a specific customer interaction. Unlike relationship surveys like NPS that measure overall loyalty, these focus on the micro-experience, capturing sentiment while the details are still fresh in the customer's mind. This approach provides granular feedback on critical touchpoints.

These surveys are often triggered automatically after key events:

- Purchase Confirmation: Asking about the checkout process.

- Product Delivery: Inquiring about shipping speed and packaging.

- Support Ticket Resolution: Evaluating the helpfulness of the agent.

- Service Completion: Rating the quality of the service provided, like Uber's ride rating.

The power of this voice of customer example lies in its immediacy and specificity. It isolates variables, allowing you to pinpoint exactly which part of the customer journey is excelling or failing.

Strategic Analysis: Isolating Touchpoint Performance

The strategic value of transactional surveys is their diagnostic precision. If a company's overall Customer Satisfaction (CSAT) score is declining, it's difficult to know where to start fixing things. Transactional surveys act like a magnifying glass on individual stages of the customer lifecycle, providing clear, actionable data that broad surveys lack.

For instance, an e-commerce brand might have a high overall satisfaction score but receive consistently poor ratings on its "delivery experience" survey. This VoC data immediately flags a problem not with the product or the website, but with the third-party logistics partner. Without this isolated feedback, the shipping issue could have been incorrectly blamed on the product itself, leading to wasted resources trying to fix the wrong problem.

Key Insight: Transactional surveys move beyond general sentiment to provide a precise, real-time performance review of specific business operations, from checkout usability to support agent effectiveness.

Actionable Takeaways & Implementation

To maximize the value of post-interaction surveys, focus on speed and specificity.

- Keep it Short and Relevant: The survey should be hyper-focused on the specific interaction. If you're asking about a support call, limit questions to the agent's performance and the resolution. A one or two-question survey has a much higher completion rate.

- Automate and Time it Right: Use marketing automation or CRM triggers to send the survey as soon as the transaction is complete. A hotel sending a checkout survey a week later will get far less valuable feedback than one sent within an hour. Action Step: Set up an automated workflow to send a delivery feedback survey 24 hours after your shipping provider confirms delivery.

- Create Service Recovery Workflows: Immediately route negative feedback (e.g., a 1-star delivery rating) to a dedicated team. A prompt, personal follow-up to resolve the issue can turn a detractor into a loyal customer by demonstrating that you are listening and care. For a deeper dive into how this works, you can learn more about optimizing post-purchase feedback on marketbetter.ai.

By focusing on these specific moments, you collect a stream of highly relevant, actionable insights that enable continuous, targeted improvements across every customer touchpoint.

8. Employee Feedback as Voice of Customer Proxy: The Internal Source

Sometimes, the most insightful voice of customer data doesn't come directly from the customer but from the employees who interact with them daily. Front-line staff, such as sales associates, support agents, and service technicians, are a rich, untapped reservoir of customer sentiment, pain points, and emerging needs. This method treats their observations as a valuable proxy for direct customer feedback.

Unlike structured surveys that capture a single moment in time, employee feedback is continuous and contextual. An in-store retail associate hears dozens of candid product comments a day, while a call center agent can identify a recurring technical issue long before it appears in satisfaction scores. This approach systematizes the collection of these organic, real-time insights.

Strategic Analysis: Beyond Hearsay

The power of using employees as a voice of customer proxy is its immediacy and raw, unfiltered nature. It helps bridge the gap between high-level metrics and the day-to-day customer reality. This isn't just about anecdotal evidence; it's about creating a formal channel to aggregate front-line intelligence. Where a customer survey might provide a lagging indicator of a problem, employee feedback often acts as a leading indicator.

For example, a restaurant manager might notice servers consistently reporting that customers are asking for more vegetarian options. This qualitative data, gathered systematically, provides a strong signal for menu development, often faster than a formal customer survey would. Similarly, B2B account managers can report on the "hallway talk" from client meetings, revealing underlying concerns about pricing or a competitor's new feature that would never be captured in a formal feedback request.

Key Insight: Front-line employees hear what customers say when they aren't "on the record." This provides access to candid, unsolicited feedback that is crucial for identifying hidden problems and latent opportunities.

Actionable Takeaways & Implementation

To transform employee observations into a structured VoC program, you need a clear process.

- Create Formal Intake Channels: Don't rely on casual conversations. Implement dedicated Slack channels (#customer-feedback), simple forms, or a section in your CRM for employees to log customer insights. The goal is to make it easy and part of their routine. Action Step: Create a simple Google Form with fields for "Customer Comment," "Product/Service Mentioned," and "Suggested Action," and share it with all customer-facing teams.

- Train for Observation: Coach your teams on what to listen for. This includes not just direct complaints or praise but also competitor mentions, feature "workarounds" customers have developed, and questions that indicate confusion about your product or service.

- Validate and Correlate: Treat employee-sourced feedback as a directional indicator. Use this intelligence to guide more direct research. If agents report a common complaint, deploy a targeted micro-survey to the affected customer segment to quantify the issue's impact. This validates the qualitative insight with quantitative data.

By empowering employees to be the eyes and ears of the business, you create a responsive and powerful feedback loop that is one of the most cost-effective voice of customer examples to implement.

8 Voice of Customer Methods Comparison

| Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Net Promoter Score (NPS) Surveys | Low - single question, easy setup | Low - minimal tech and effort | Loyalty metric, revenue correlation, benchmarking | Quick pulse on customer loyalty post-interaction | Simple, standardized, predictive of growth |

| Customer Journey Mapping with Voice Data | High - multi-touchpoint, detailed | High - extensive data, cross-team | Holistic experience view, pain points, emotions | Complex CX improvements, cross-department projects | Deep insights, visual storytelling, strategic |

| Online Review Analysis and Response | Medium - multi-platform monitoring | Medium - tools & team for responses | Real-time sentiment, product/service insights | Reputation management, product/service feedback | Authentic, competitive intelligence, broad reach |

| Social Media Listening and Sentiment Analysis | High - vast data volume, filtering | High - advanced tools & analysts | Real-time trends, brand sentiment, crisis alerts | Brand monitoring, product launches, market trends | Unsolicited opinions, early issue detection |

| Customer Advisory Boards and Focus Groups | High - organizing, facilitation | High - time, personnel, coordination | Strategic input, detailed qualitative feedback | Strategic planning, product development, advocacy | High quality, relationship building, strategic |

| Live Chat and Customer Service Analysis | Medium - interaction capture | Medium - analysis tools & training | Issue identification, sentiment, operational gaps | Customer service improvement, operational insights | Immediate feedback, large interaction volume |

| Post-Purchase and Transaction Surveys | Low-Medium - trigger-based | Low-Medium - integrated systems | Specific, timely feedback on transactions | Transaction-focused feedback, service/process checks | High accuracy, actionable, good response rates |

| Employee Feedback as Voice of Customer Proxy | Medium - internal feedback systems | Medium - training and forums | Proxy customer insights, trend spotting | Frontline insight capture, cost-effective research | Unfiltered customer reactions, engages employees |

From Listening to Leading: Building Your VoC Action Plan

Throughout this article, we've explored a powerful spectrum of voice of customer examples, moving from broad sentiment gauges like Net Promoter Score (NPS) surveys to the granular, qualitative insights found in live chat transcripts and employee feedback. We've seen how leading companies don't just collect data; they orchestrate a symphony of feedback channels to compose a comprehensive, actionable understanding of their customer's world. The core lesson is clear: an effective Voice of Customer (VoC) program isn't a single instrument but a full orchestra, with each method playing a vital, complementary role.

The most successful strategies weave these disparate channels together. For instance, the qualitative complaints surfacing in your online review analysis should directly inform the quantitative questions in your next post-purchase survey. Similarly, the strategic guidance from a Customer Advisory Board can provide the "why" behind the "what" you see in your social media sentiment analysis. This integration transforms feedback from a series of disconnected comments into a cohesive, strategic narrative that drives business growth.

Synthesizing Your VoC Strategy: Key Takeaways

The journey from passive listening to proactive leadership begins with understanding how these different VoC methods compare and contrast. Each offers a unique lens through which to view your customer experience.

- Proactive vs. Reactive: Methods like Customer Advisory Boards and targeted NPS surveys are proactive, allowing you to guide the conversation and explore future needs. In contrast, social media listening and online review analysis are reactive, giving you an unfiltered look at what customers are saying organically. A balanced program needs both to anticipate trends and respond to immediate issues.

- Qualitative vs. Quantitative: Live chat analysis provides rich, qualitative data full of emotion and specific context. Transactional surveys, on the other hand, deliver structured, quantitative data that is easy to track over time. Combining them allows you to measure the scale of a problem and understand its human impact.

- Direct vs. Indirect: Focus groups are a form of direct feedback where you are actively soliciting input. Employee feedback often serves as an indirect or proxy channel, revealing customer pain points through the experiences of your front-line teams. Both are critical for a 360-degree view.

Your Actionable Roadmap to a World-Class VoC Program

Moving from theory to practice requires a deliberate, phased approach. You don't need to implement all eight methods at once. Instead, build a strong foundation and expand over time.

- Start with Your Core Channels: Identify the two most critical feedback points for your business model. For a B2C e-commerce brand, this might be online review analysis and post-purchase surveys. For a B2B SaaS company, a combination of NPS surveys and customer service interaction analysis could be the ideal starting point.

- Establish an Insight-to-Action Loop: Don't let feedback sit in a spreadsheet. Create a clear process for analyzing incoming data, identifying a key insight, assigning ownership for an action, and implementing a change. For example, if multiple support tickets mention a confusing checkout step, the action is to create a task for the UX team to investigate and redesign it.

- Scale and Integrate Your Efforts: Once you have a functional loop for your initial channels, begin layering in additional methods. Use insights from one channel to fuel another. Did a customer journey mapping session reveal a gap in post-purchase communication? Design a transactional survey to specifically measure satisfaction with that part of the experience. To effectively implement a robust VoC strategy and gather insights from various channels, consider utilizing dedicated customer feedback management software.

- Close the Loop: The final, most crucial step is communicating back to your customers. Let them know you heard their feedback and show them what you did about it. This builds immense trust and encourages continued engagement, transforming customers from passive buyers into active partners in your brand's evolution. By mastering the strategies behind these voice of customer examples, you're not just improving a product; you're building an unbreakable customer relationship.

Ready to turn customer conversations into your most powerful growth engine? marketbetter.ai uses advanced AI to analyze your customer feedback, reviews, and support tickets, automatically surfacing the actionable insights you need to build better products and experiences. Stop guessing what your customers want and start knowing by visiting marketbetter.ai to see how we can help you lead your market.