How to Calculate Marketing ROI: 5 Copy-Paste Formulas With Worked Examples [2026]

Your CFO doesn't care about impressions, followers, or "brand awareness." They want one number: for every dollar spent on marketing, how many dollars came back?

That's marketing ROI — and 73% of teams get it wrong. They either give all credit to the last click (ignoring the 6-month nurture that warmed the deal), or they leave out real costs like tools, headcount, and agency fees.

This guide gives you 5 copy-paste formulas for calculating marketing ROI at the campaign, channel, and program level — each with a fully worked example. No theory. No fluff. Just the math your CFO will accept.

The Foundational Marketing ROI Formula

Before you get lost in complex attribution models and channel-specific metrics, you have to master this one formula. Think of it as your financial North Star. It keeps your strategy grounded in business reality and translates all your hard work into a language the C-suite and finance teams actually understand.

Getting this right isn't just about crunching numbers; it's about proving your department's value. Once you can confidently show how campaigns contribute to the bottom line, budget conversations stop being defensive and start being strategic.

Let's start with the foundational formula, then work through each variation.

A Practical Example of the Formula

Let's put it into practice. Imagine you launched a new campaign with a total investment of $150,000. After a few months, you can directly attribute $500,000 in new revenue back to it.

Here's the math: ($500,000 - $150,000) / $150,000 = 2.33

Your ROI is 233%.

This means for every dollar you put in, you got back $2.33 in return. A simple number like this is incredibly powerful. It gives you a clear, objective measure of success and lets you compare apples to apples. Now you can easily see if your new social media campaign is outperforming last quarter's email push.

Actionable Takeaway: Mastering the basic ROI formula is the first step toward data-driven marketing. It transforms your performance from a matter of opinion into a statement of financial fact, enabling smarter budget allocation and strategic planning. Start by applying this formula to your single biggest campaign from the last quarter.

Breaking Down the Components

To get a reliable ROI figure, you have to be crystal clear about what goes into each part of the formula. If your inputs are fuzzy, your output will be useless. This isn't just about ad spend versus revenue; it's about capturing the true cost and the attributable gain.

Here's a quick comparison of what to include in each part of the basic ROI formula.

| Component | What It Is | Common Mistakes to Avoid |

|---|---|---|

| Revenue from Marketing | The total sales revenue that is directly tied to a specific marketing campaign or effort. | Relying on guesswork. Without accurate tracking-like UTM codes or dedicated landing pages-you're just guessing how much money you actually made. |

| Marketing Cost | This includes every single expense related to the campaign. Think beyond just ad spend. | Forgetting "soft" costs. To get a true picture, you must include software fees, content creation costs, agency retainers, and even a portion of your team's salaries. |

Defining these terms upfront is non-negotiable. Ambiguity is the enemy of accurate ROI calculation, and getting this part right ensures your final number truly reflects your campaign's financial impact.

Gathering Accurate Data for Your Calculation

Your marketing ROI calculation is only as good as the numbers you feed it. Garbage in, garbage out. If the data is shaky, you'll get a misleading result, which can lead to disastrous decisions like cutting your best-performing campaigns or doubling down on ones that are secretly bleeding cash.

The first step is getting ruthlessly honest about what you're actually spending. This is about more than just your direct ad spend. To get the true picture of your investment, you have to account for everything that supports your marketing.

Think of it like building the complete financial story of a campaign. You need to include:

- Software and Tools: The subscription fees for your CRM, marketing automation, analytics platforms, and any design software you use.

- Creative and Production: All the money paid to freelancers, agencies, or contractors for things like content creation, video production, or ad creative.

- Team Costs: A portion of your marketing team's salaries, calculated based on the time they spent on that specific campaign.

Connecting the Dots Between Effort and Revenue

Once you have a firm handle on your costs, the next-and often trickier-part is tying revenue back to the right marketing activities. This is where so many marketers trip up.

How do you really know if that latest sale came from a social media ad, a blog post they read last month, or an email you sent yesterday? The answer is in how you assign credit, a process known as attribution modeling. It's a framework for assigning value to the different touchpoints a customer has with you before they finally buy.

A Quick Look at Common Attribution Models

Choosing the right attribution model is a big deal because each one can tell a completely different story about which channels are working. Single-touch models are simple but often paint an incomplete picture, while multi-touch models give you a more realistic view of the modern, messy customer journey.

Here's a comparison of the most common models:

| Attribution Model | How it Works | Best For | Potential Blind Spot |

|---|---|---|---|

| First-Touch | Gives 100% credit to the very first interaction. | Understanding which channels are best at generating initial awareness. | Ignores every subsequent touchpoint that nurtured the lead. |

| Last-Touch | Gives 100% credit to the final touchpoint before conversion. | Identifying your most effective "closer" channels. | Overlooks all the top- and mid-funnel activities that made the sale possible. |

| Linear (Multi-Touch) | Spreads credit equally across every touchpoint. | A balanced view that acknowledges the entire customer journey. | Fails to identify which touchpoints were the most influential. |

Actionable Takeaway: For most businesses, especially those with a longer sales cycle, a multi-touch model is the way to go. It prevents you from mistakenly axing top-of-funnel activities (like content or social media) that don't directly drive sales but are absolutely critical for filling your pipeline. If you're currently using a last-touch model, try switching to a linear view in your analytics platform to see how it changes your perception of channel performance.

Today's customer journey is messy and rarely linear. Relying on a single data point can warp your entire strategy. The better you get at connecting these dots, the smarter your decisions will be. This is where more advanced techniques, like using person-level identification, can give you a much deeper understanding of how individual people engage with your brand across all their devices and interactions.

Moving from Revenue to Profit-Based ROI

Looking at revenue-based ROI is a decent first step, but it can easily paint a deceptively rosy picture. I've seen it happen plenty of times: a campaign generates a ton of revenue and gets high-fives all around, but when you look closer, it was actually losing money because the costs of delivering the product were too high.

To get a truly honest view of your marketing's financial impact, you have to shift your focus from top-line revenue to bottom-line profit.

This is where Cost of Goods Sold (COGS) enters the conversation. COGS includes all the direct costs tied to creating your product or service-think raw materials, manufacturing labor, and shipping. When you subtract COGS from your revenue, you get your gross profit. That number is a much more accurate measure of what a campaign actually contributed to the business.

The Profit-Based Formula

Calculating your marketing ROI using gross profit gives you a brutally honest look at a campaign's real performance. The go-to formula is simple:

Marketing ROI = (Gross Profit - Marketing Investment) / Marketing Investment

Let's say a campaign brings in $80,000 in revenue. But the COGS associated with those sales was $40,000. That leaves you with a gross profit of $40,000. If you spent $10,000 on marketing, the math becomes ($40,000 - $10,000) / $10,000. The result? A 300% ROI. This is a profitability metric you can take to the bank, and you can dig deeper into its applications in this great analysis of marketing ROI on sprinklr.com.

For any business with tangible product costs-like e-commerce brands or manufacturers-this profit-centric approach isn't just a good idea; it's non-negotiable. It's how you ensure you're driving sustainable growth, not just celebrating vanity revenue.

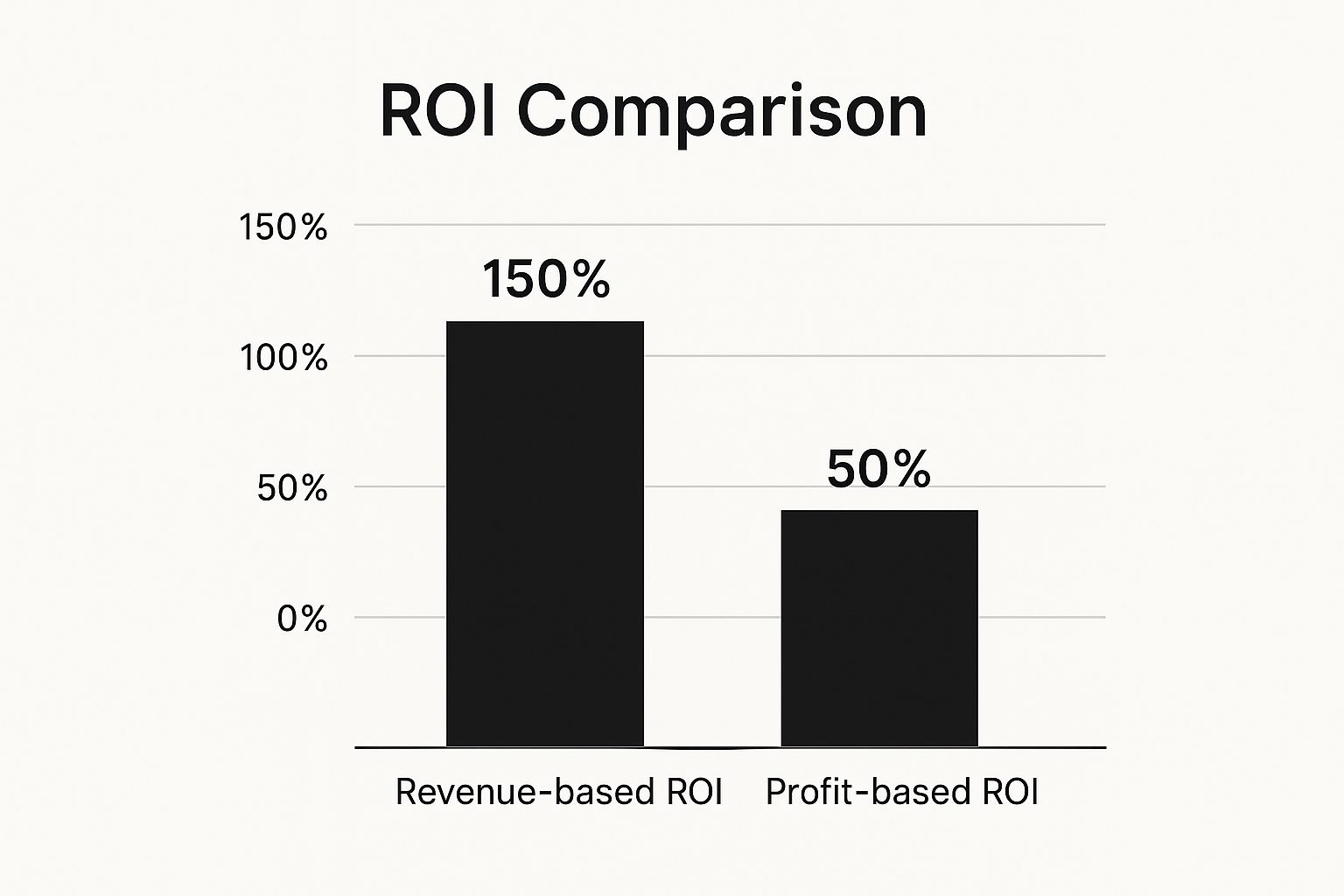

The infographic below shows just how drastically the ROI figure can change when you swap from revenue to profit for the exact same campaign.

As you can see, a campaign that looks like a winner on the surface can turn out to be far less impressive once you account for the real costs of doing business.

Revenue vs. Profit: A Real-World Comparison

Let's make this tangible. Imagine an e-commerce company launches a paid ad campaign for a new line of sneakers.

- Marketing Investment: $20,000

- Revenue Generated: $50,000

- Cost of Goods Sold (COGS): $30,000 (for materials, manufacturing, etc.)

Now, let's run the numbers using both methods.

| Metric | Calculation | Result | Interpretation |

|---|---|---|---|

| Revenue-Based ROI | ($50,000 - $20,000) / $20,000 | 150% | Looks great! The campaign generated $1.50 for every $1 spent. |

| Profit-Based ROI | ($20,000* - $20,000) / $20,000 | 0% | Oof. The campaign broke even. It didn't lose money, but it sure didn't make any. |

| *Gross Profit = $50,000 Revenue - $30,000 COGS |

This comparison slams home a critical truth: revenue tells you what you brought in, but profit tells you what you kept. Relying only on revenue ROI could trick you into scaling a campaign that is, in reality, just treading water.

Making this small but powerful adjustment to how you calculate ROI gives you the clarity to pour your budget into campaigns that don't just generate noise, but genuinely build a healthier, more profitable business. It's the difference between looking busy and being effective.

Calculating ROI Across Different Marketing Channels

Trying to apply one ROI formula to every marketing channel is a rookie mistake. It's like using a hammer for every job on a construction site-sure, you can bang a screw into the wall, but it's not the right tool and the results will be a mess.

Your marketing mix is (or should be) diverse. Each channel plays a different part. Because of that, your ROI calculation has to adapt to the unique nature of each one. Some channels deliver quick, trackable wins. Others are a slow burn, building value that compounds over months or even years. Getting this right is the key to setting sane expectations and putting your budget where it actually works.

The Great Divide: Short-Term vs. Long-Term Channels

The biggest split you'll see when calculating ROI is the timeline. You can't judge a six-month SEO project with the same yardstick you use for a two-week Google Ads campaign. One is a sprint; the other is a marathon.

-

Paid Digital Ads (Google & Meta): These channels are built for direct response. You can tie ad spend directly to clicks, leads, and sales, often within days. The data is clean, attribution is relatively straightforward, and you can calculate ROI fast enough to make smart decisions on the fly.

-

Content Marketing & SEO: This is about building an asset. A blog post you publish today might not generate a single lead for months. But over time, it could climb the ranks and drive organic traffic-and customers-for years to come. Calculating ROI here demands a longer view and a focus on metrics like traffic growth, keyword rankings, and assisted conversions.

Comparing ROI Calculation Across Marketing Channels

Let's get practical. How you approach calculating ROI for these two channel types is fundamentally different. The table below breaks down the key metrics, primary challenges, and the kind of timeline you should expect for each. It's all about measuring what matters for that specific strategy, not forcing everything into the same box.

| Channel | Key Metrics | Primary Challenge | Typical Time-to-Value |

|---|---|---|---|

| Paid Digital Ads | Cost Per Acquisition (CPA), Return on Ad Spend (ROAS), Conversion Rate | Rising ad costs and ad fatigue can crater your returns. Requires constant monitoring and optimization. | Immediate (Days to Weeks) |

| Content & SEO | Organic Traffic, Keyword Rankings, Assisted Conversions, Customer Lifetime Value (CLV) | Attributing revenue is tough. Content influences dozens of touchpoints over a long buyer journey. | Long-Term (Months to Years) |

This comparison makes it pretty clear: you need a blended approach. Paid ads give you the quick wins and immediate data you need to fuel growth now. Content and SEO build the sustainable, long-term engine that eventually lowers your dependency on paid channels.

For example, a paid search campaign might show an immediate 250% ROI in its first month. Awesome. Meanwhile, a content marketing initiative could look like a total loss for the first six months. But by year two, that same content might be driving thousands in monthly revenue with zero additional spend, pushing its long-term ROI far beyond what the paid campaign could ever achieve.

Understanding this dynamic stops you from killing long-term strategies before they've had a chance to bear fruit. A healthy marketing ecosystem needs both.

Even better, you can make them work together. Use insights from your paid campaigns to sharpen your SEO keyword strategy. Take a high-performing blog post and promote it with ads. You can even use automation to bridge the gap; our guide on video email automation playbooks shows how to repurpose content to nurture leads from all your channels. This is where the real magic happens.

How to Use ROI Insights to Refine Your Strategy

Figuring out your marketing ROI isn't the finish line. It's the starting pistol.

The real power of this number isn't just knowing it; it's what you do with it. This is the moment you shift from simply measuring marketing to actively steering the company's growth. Your ROI data is a roadmap, pointing straight to your biggest wins and your most expensive leaks.

The first move is always to break down your ROI findings. A single, blended number is a decent health check, but the juicy, actionable insights are buried at the campaign and channel level. Once you start comparing them, you'll see a clear split between your workhorses and your money pits. This is your chance to make sharp, data-backed decisions instead of just going with your gut.

Doubling Down or Diagnosing Problems

When you find a channel or campaign with a stellar ROI, the obvious first step is to give it more fuel. If your LinkedIn ads are pulling in a 450% ROI, it's a strong signal to think about upping the budget.

But don't stop there. Dig deeper. What specific ad creative is killing it? Which targeting parameters are hitting the mark? What message is resonating so well? The real leverage comes from replicating those winning ingredients across your other campaigns. That's how you multiply your impact.

On the flip side, a low ROI isn't an automatic death sentence for a campaign. It's an invitation to put on your detective hat and figure out what's broken. A campaign with a negative return could be suffering from a simple, fixable issue that's holding it back from being a top performer.

Before you pull the plug, investigate these usual suspects:

- Audience Mismatch: Are you actually talking to the right people? Your targeting might be way too broad or aimed at a group that just doesn't care.

- Weak Creative or Offer: Is your ad copy boring? Is your offer a genuine solution to a real problem for the audience you're trying to reach?

- Friction on the Landing Page: A confusing layout, a slow load time, or a clunky form can absolutely murder your conversion rates and sink your ROI.

Actionable Takeaway: A low ROI doesn't mean failure-it means you have a specific problem to solve. Pick your worst-performing campaign and run an A/B test on one variable this week: the headline, the call-to-action, or the primary image. This methodical testing can often turn an underperforming campaign into a profitable one.

Building Your Case for Future Budgets

Your historical ROI data is the single most persuasive tool you have for budget season. When you can walk into a meeting with a clear, data-driven projection, the entire conversation changes.

You're no longer just asking for money. You're presenting a business case for a predictable return on that investment.

Frame your request around concrete outcomes. For instance: "Last quarter, our paid search campaigns generated a 300% ROI. With an extra $50,000, we project we can bring in $150,000 in new revenue." This is a world away from a vague plea for more funds.

You can see how this plays out in the real world by checking out the marketing ROI success stories in our case studies. This is how you prove marketing isn't just a cost center-it's the engine that drives growth.

Try our Marketing Plan Generator — generate a complete AI-powered marketing plan in minutes. No signup required.

Common Questions About Marketing ROI

Even with the right formulas and data, a few questions always pop up when you start digging into your marketing ROI. Let's tackle the ones I hear most often so you can measure and interpret your numbers with more confidence.

What Is a Good Marketing ROI?

This is the million-dollar question, and the honest answer is: it depends.

You'll hear people throw around a 5:1 ratio-that's $5 in revenue for every $1 spent-as a general benchmark. But that number is pretty meaningless without context. A "good" ROI is completely relative to your industry, your profit margins, and the very nature of your business.

For instance, a high-margin software company could be thrilled with a 3:1 ROI, knowing that customer will likely stick around for years. On the other hand, a low-margin e-commerce business might need a 10:1 ratio just to break even after factoring in the cost of goods and shipping.

Actionable Takeaway: The best thing you can do is stop chasing a generic number. Instead, figure out your own baseline ROI and make it your mission to consistently beat it. Your real goal is to outperform your last quarter, not some arbitrary industry average. Calculate your overall marketing ROI for the last six months to establish your benchmark today.

How Do I Calculate ROI for Long-Term Strategies Like SEO?

Measuring the ROI for long-game channels like SEO or brand building requires a different mindset. You can't track them with the same instant gratification as a paid ad campaign. Instead, you have to get comfortable tracking the leading indicators that predict future revenue.

For SEO, that means you're watching metrics like:

- Growth in organic traffic: More non-paid visitors is the clearest sign that your efforts are gaining traction.

- New keyword rankings: Nailing top spots for high-value keywords is directly tied to future traffic and leads.

- Leads from organic search: You have to track how many inquiries, sign-ups, or demo requests are coming straight from your organic efforts.

From there, you can start to assign a dollar value to these wins. Use your average lead-to-customer conversion rate and your customer lifetime value (CLV) to build a financial model. This lets you show the tangible, long-term impact of your SEO investment, even before all the revenue has hit the bank.

What Are the Most Common Mistakes When Calculating Marketing ROI?

I see marketers trip over the same few hurdles all the time. These mistakes can seriously skew your results and lead you to make some pretty bad decisions down the line.

Here are the big ones to watch out for, comparing the common mistake to the better approach:

| Common Mistake | The Better Approach | Why it Matters |

|---|---|---|

| Forgetting hidden costs | Include everything: software, freelance fees, and even a portion of team salaries. | Forgetting these costs will make your ROI look way better than it actually is. |

| Relying on last-touch attribution | Use a multi-touch model (like linear or time-decay) to see the whole customer journey. | Last-touch devalues all the critical top-of-funnel work that got the customer there. |

| Measuring revenue instead of profit | Subtract the Cost of Goods Sold (COGS) to calculate ROI based on gross profit. | A campaign can drive huge revenue but still lose money if your margins are thin. |

| Ignoring long-term value | Factor in Customer Lifetime Value (CLV) when assessing a campaign's success. | Focusing only on immediate sales is shortsighted and undervalues loyalty and retention. |

At marketbetter.ai, we help you move beyond basic calculations. Our AI-powered platform gives you the deep attribution modeling and real-time analytics you need to not only measure your true ROI but also optimize it across every channel. See how you can connect your marketing efforts directly to profit by exploring our platform.