Improving Customer Lifetime Value for Real Growth

For years, marketers have been stuck on a hamster wheel, pouring cash into acquiring new customers while the ones they already have are quietly slipping out the back door. It's a costly, exhausting, and ultimately unsustainable way to grow. The old model focused on a one-time transaction. The new, smarter model focuses on the entire relationship.

The real engine of growth isn't just getting new faces in the door; it's about keeping them around and making sure their value grows over time. That's where we need to shift our focus from one-off sales to improving customer lifetime value.

Why CLV Is Your Most Important Growth Metric

Thinking in terms of Customer Lifetime Value (CLV) completely changes the game. It forces you to stop asking, "How much did this customer spend today?" and start asking, "How much revenue will this customer generate over their entire relationship with us?"

This simple shift is the difference between surviving quarter-to-quarter and building a truly resilient, profitable business.

The True Impact of CLV on Your Business

When you really lean into improving CLV, the benefits ripple out across the whole company. It’s not just a vanity metric for the marketing team; it becomes a core philosophy that shores up your financials and sharpens your brand.

Here’s what a healthy CLV actually gets you:

- Predictable Revenue Streams: Loyal customers who buy again and again create a stable financial foundation. This makes forecasting and planning a whole lot less stressful compared to the unpredictable nature of constantly chasing new leads.

- Increased Profitability: Here's a hard truth: it is always cheaper to keep a customer than to find a new one. A high CLV means you’re spending less on acquisition for every dollar you earn, which goes straight to your bottom line.

- Stronger Brand Advocacy: Happy, long-term customers are your best marketers. They’re the ones leaving glowing reviews and telling their friends about you, driving organic growth that you don’t have to pay for. This is far more powerful than any paid ad campaign.

One of the biggest mistakes I see is treating acquisition and retention like they're two different sports. They're not. Your acquisition strategy should be designed from day one to attract customers with high lifetime potential, and your retention efforts make sure that potential is realized.

To help you get a handle on the core ideas, here’s a quick breakdown of the concepts we'll be working with.

Key CLV Concepts at a Glance

| Concept | Description | Actionable Tip |

|---|---|---|

| CLV (Customer Lifetime Value) | The total net profit a business expects to make from a single customer over their entire relationship. | Action: Calculate your CLV, then set a specific goal to increase it by 10% in the next six months. |

| CAC (Customer Acquisition Cost) | The total cost of sales and marketing efforts needed to acquire a single new customer. | Action: Compare your CLV to your CAC. A ratio below 3:1 means it's time to optimize your ad spend or boost retention. |

| Churn Rate | The percentage of customers who stop doing business with you over a specific period. | Action: Implement one new churn-reduction strategy this quarter, like a personalized check-in for at-risk customers. |

| Average Purchase Value (APV) | The average amount a customer spends in a single transaction. | Action: Test product bundling or a "customers also bought" feature on your checkout page to increase APV. |

| Purchase Frequency (PF) | How often the average customer makes a purchase from your business in a given period. | Action: Launch a simple email campaign that reminds customers to re-order a consumable product right before they run out. |

Understanding these pieces is the first step. They are the levers you can pull to directly influence your company's long-term financial health.

Understanding the Financial Benchmarks

So, what do these numbers look like in the wild? For e-commerce in 2025, the average CLV often hovers somewhere between $100 and $300. But that number is meaningless without context.

The real test of your business's health is the CLV-to-CAC ratio. A solid benchmark to shoot for is 3:1—meaning for every dollar you spend bringing a customer in, you get three dollars back over their lifetime. This ratio is what separates businesses that are just treading water from those building real, sustainable value.

If you're curious about where you stand, it’s worth digging into some customer value statistics to see how you stack up against current industry data.

How to Calculate and Segment Your CLV

Before you can boost your customer lifetime value, you need a clear picture of where you’re starting from. The math can look a little intimidating at first, but a simple, practical formula gives you a powerful baseline for understanding your business's health.

The goal here isn't just to land on a single number. Think of it less like a final grade and more like a diagnostic tool that shows you what’s working and what isn’t.

A Straightforward Method for CLV Calculation

At its core, CLV is about multiplying three key things: how much customers spend, how often they buy, and how long they stick around. This gives you that crucial baseline to measure against as you start rolling out new strategies.

Here’s how the basic formula breaks down:

- Average Purchase Value (APV): Total Revenue / Number of Purchases

- Purchase Frequency (PF): Total Purchases / Number of Unique Customers

- Average Customer Lifespan: The average time a customer remains active.

Just multiply these three together (APV x PF x Lifespan), and you've got your foundational CLV. If you want to go deeper, this article on how to calculate customer lifetime value unpacks some more advanced models.

But the real magic happens when you move beyond that one company-wide number. Averages can be incredibly deceiving because, let's be honest, not all customers are created equal. This is where segmentation becomes your secret weapon.

From Calculation to Actionable Segmentation

Imagine you run an online coffee subscription. Your average CLV might be $350. That’s a decent figure, but it completely hides the real story. Some customers might spend over $1,000 with you over their lifetime, while others bail after a single $50 order. Lumping them all together is a huge mistake because it means you treat them the same.

Effective segmentation is all about grouping customers by their actual value. It lets you stop the one-size-fits-all marketing and start putting your resources where they’ll generate the highest return. It’s the difference between shouting into a crowd and having a meaningful one-on-one conversation.

You can get started with three simple but powerful segments:

| Customer Segment | Characteristics | Your Strategic Action |

|---|---|---|

| High-Value Champions | These are your top 5-10%. They buy often, spend more, and tell their friends about you. | Treat them like VIPs. Give them exclusive access, early product releases, and personalized thank-you campaigns. Your goal is to turn them into advocates. |

| Middle-Tier Potentials | This is the bulk of your customer base. They're consistent but have plenty of room to grow in what they buy or how often. | Focus on upselling and cross-selling. Use targeted emails to introduce complementary products or tempt them with a higher subscription tier. |

| At-Risk or Low-Value | These are the customers who made one or two small purchases and then went quiet. They have a high risk of churning for good. | Try a re-engagement campaign with a compelling offer. If they don’t bite, it’s better to focus your budget on the other two groups. |

By segmenting, you transform CLV from a passive number on a dashboard into an active strategy. You can now allocate your marketing budget intelligently, focusing your best efforts on keeping your champions happy and growing your potentials—instead of wasting resources on customers who are unlikely to ever come back.

Building Loyalty Programs That Actually Work

Once you’ve got a handle on who your customers are, you can start moving past simple transactions and build real connections. This is where a smart loyalty program becomes one of your best tools for improving customer lifetime value.

And I’m not talking about those generic "buy ten, get one free" punch cards that just get lost in a wallet. A transactional approach gets you transactional loyalty, which disappears the moment a competitor offers a better deal.

Modern loyalty programs are all about making customers feel seen, understood, and genuinely appreciated. They create a sense of belonging that can turn a one-time buyer into a lifelong fan. The goal isn’t just a discount; it’s delivering value that goes way beyond the price tag.

Choosing the Right Loyalty Model

The structure of your loyalty program has to make sense for your business and, more importantly, for your customers. A points system that’s perfect for a high-frequency coffee shop will probably fall completely flat for a SaaS company that bills annually.

It's all about matching the reward to the customer's behavior and what they actually find valuable.

Let’s break down a few common models to see how they fit different businesses.

| Loyalty Model | Best For | Ineffective For | Actionable Example |

|---|---|---|---|

| Tiered Program | SaaS, Airlines, High-Value Retail | Low-frequency purchase businesses (e.g., mattress sales). | Action: Create "Bronze," "Silver," and "Gold" tiers. Gold members get priority support, early access to new features, and a dedicated account manager. |

| Exclusive Access | Fashion, CPG, Creator Economy | Commodity products with low brand differentiation. | Action: Give loyalty members first dibs on limited-edition products and an invite to an exclusive online community for skincare tips. |

| Value-Based Program | Ethical & Mission-Driven Brands | Price-sensitive markets where value alignment isn't a key driver. | Action: Let members direct a portion of their purchase to environmental causes, reinforcing what your brand stands for. Send them an impact report. |

Designing Rewards That Resonate

The best rewards feel personal and meaningful, not just like another transaction. This is where you can put your customer data to work and offer perks that really stand out.

Instead of just another coupon, think about rewards that make their experience with your product or brand even better.

Some of the most effective rewards I've seen include:

- Experiential Perks: Things like early access to sales, invitations to special events, or one-on-one consultations. You can't put a price on these kinds of memorable experiences.

- Personalized Surprises: Use their purchase history to send a surprise gift you know they'll love. Imagine sending a free bag of their favorite coffee roast on their one-year anniversary as a subscriber. It’s a small touch with a huge impact.

- Convenience Upgrades: Offer free shipping, faster customer support, or a more flexible return policy. These practical benefits remove friction and show you value their time.

You can even take personalization a step further with simple but powerful tactics. We've got a whole playbook on how to add a personal touch with video email automation that’s worth a look.

The psychology of a great loyalty program is simple. It's not about trapping customers; it's about making them feel so valued that they wouldn't want to go anywhere else. True loyalty is earned through consistent, positive experiences.

Investing in a solid program pays off, big time. Research shows that boosting customer retention by just 5% can increase profits anywhere from 25% to 95%. It's no surprise the loyalty management market is expected to explode from $13.31 billion in 2024 to $41.21 billion by 2032.

This isn't just a "nice-to-have" anymore; it's a core part of modern business strategy. When you focus on creating genuine value, you build a program that doesn't just work—it becomes a serious competitive advantage.

Using AI to Predict and Personalize the Customer Journey

Predictive analytics and AI aren't just trendy jargon; they are the engines that will drive the next wave of growth in customer lifetime value. These tools finally let you stop guessing what your customers will do next and start anticipating it.

Instead of just reacting to a customer's last purchase or complaint, AI lets you get ahead of their next move. It chews through massive datasets—purchase history, browsing behavior, support tickets, you name it—to spot the subtle patterns a human could never see. This is how you forecast future purchases, flag customers who are about to churn, and deliver personalized experiences before they even realize what they want.

Proactive Engagement Over Reactive Service

Think about the old model of customer service. It was almost entirely reactive. A customer has a problem, they call you, and maybe you fix it. This approach is slow, expensive, and it does absolutely nothing to build a real relationship.

AI flips that entire dynamic on its head. It makes a proactive model possible—one that anticipates needs and solves problems before they even surface. This shift from playing defense to playing offense is a complete game-changer for keeping customers around and increasing their value over time.

To see just how different these two worlds are, let's break down the practical differences. The old way relied on waiting for things to break, while the new, AI-powered approach is all about getting ahead of the curve.

Traditional vs AI-Powered CLV Strategies

| Aspect | Traditional Approach (Reactive) | AI-Powered Approach (Proactive) |

|---|---|---|

| Problem Identification | Customer reports an issue after it's already a problem. | AI flags potential issues based on behavior changes or usage data, triggering an automated check-in. |

| Communication | Generic, one-size-fits-all emails and canned support scripts. | Hyper-personalized offers and messages timed for maximum impact based on predictive models. |

| Customer Insight | Relies on historical reports and someone manually crunching numbers days or weeks later. | Uses real-time predictive models to forecast future behavior and identify opportunities instantly. |

| Outcome | Solves the immediate problem but does nothing to prevent the next one. | Builds loyalty by showing you understand and anticipate their needs, preventing problems from ever occurring. |

This isn't some far-off future, either. The move to proactive engagement is happening right now. By 2025, it's estimated that 95% of all customer interactions will involve AI in some capacity. The companies already on board are seeing massive wins, with around 80% of businesses using AI-powered Customer Data Platforms reporting major boosts in customer satisfaction.

AI-Driven Personalization in Action

Let’s make this real. Imagine you run an online fashion store. In the past, you might blast out a generic "20% off everything!" email to your entire list and just hope for the best.

With AI, the approach is surgical.

- Action Step 1: An AI model analyzes a customer's browsing history, picking up on their preference for sustainable fabrics and a specific color palette.

- Action Step 2: It layers this with their purchase frequency, noticing they tend to buy a new item roughly every two months.

- Action Step 3: Right before that two-month mark hits, the system automatically triggers a personalized email showcasing new arrivals made from sustainable materials and in their favorite colors.

The result? The customer gets an offer that feels like it was made just for them, arriving at the exact moment they're most likely to buy. It's a textbook example of turning raw data into a genuine conversation.

The real breakthrough with AI isn't just about automation. It's about delivering empathy at scale. It allows you to give every single customer the kind of personal attention that was once only possible for a small handful of VIPs.

By using technologies that enable person-level identification, you can stitch together a truly unified view of each customer. This ensures every single touchpoint—from the ad they see to the product you recommend—is perfectly synced with their individual journey. This is how you turn one-time buyers into high-value, long-term advocates for your brand.

Actionable Plays for Each Stage of the Customer Lifecycle

If you want to systematically improve customer lifetime value, you have to align your actions with where the customer is in their journey. Generic tactics just fall flat. What really drives growth are specific plays for acquisition, retention, and advocacy.

Each stage demands a different approach, but they all compound to create a much more valuable customer relationship over time.

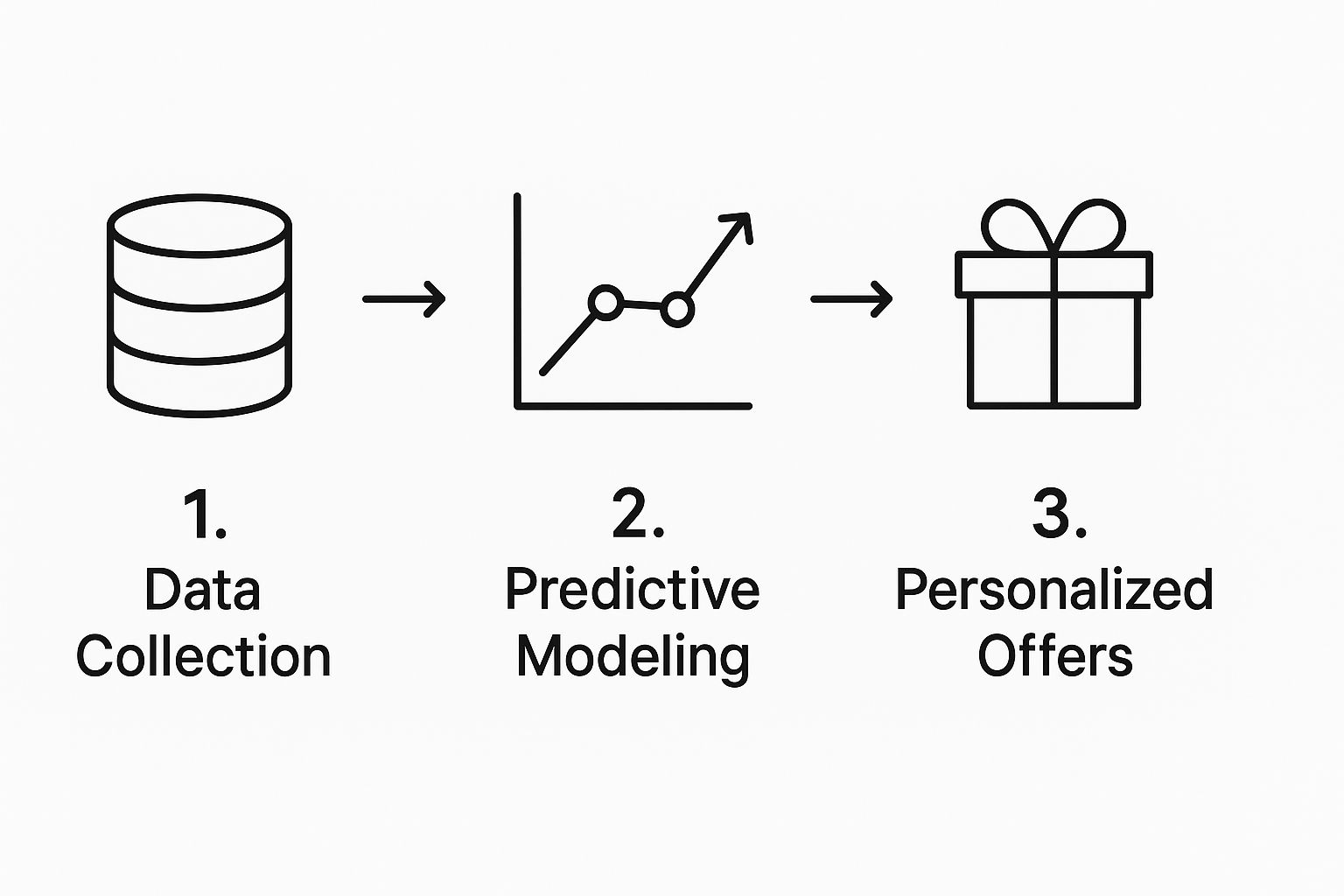

This simple workflow shows how data should inform the entire process, from collection right through to personalized outreach.

Think of this as the core engine for modern CLV optimization. It’s all about turning raw information into targeted actions that actually resonate with customers.

Sharpening Acquisition with High-CLV Lookalikes

Your first chance to boost CLV happens before someone even becomes a customer. Instead of casting a wide, expensive net, the goal is to attract prospects who mirror your existing high-value champions. This is a strategic shift from chasing quantity to pursuing quality.

- The Old Way: Running broad ad campaigns based on general demographic data. It's like shouting into a crowd and just hoping the right person hears you.

- The Actionable Play: Build lookalike audiences in your ad platforms using the data from your top 10% of customers. You're no longer targeting "males aged 25-40." You're targeting people who share thousands of data points with your most profitable segment, focusing your budget on leads predisposed to have a higher lifetime value from day one.

Driving Retention Through Proactive Support

Once a customer is on board, the game changes. The focus shifts to keeping them happy and engaged. But retention isn't just about preventing cancellations; it's about making the experience so seamless they wouldn’t even consider leaving. This means solving problems before they happen.

The most effective retention strategy is one the customer never sees. It’s the proactive support ticket opened by an AI that detected an issue, or the perfectly timed check-in email that anticipates a question. It shows you're paying attention.

To really maximize CLV, it's crucial to implement effective strategies to reduce customer churn at every single stage.

Fueling Advocacy with VIP Treatment

Your most loyal customers are your greatest marketing asset. Period. But advocacy has to be earned. The final stage of the lifecycle is about turning happy customers into active promoters of your brand. This requires moving beyond standard rewards and creating a sense of true exclusivity.

- The Standard Method: Offering points for referrals. It’s functional, sure, but it can feel transactional and impersonal.

- The Actionable Play: Create a "Customer Advisory Board" or an exclusive VIP community for your top-tier customers. Give them early access to new features, solicit their feedback on your product roadmap, and offer them experiences money can't buy. This transforms them from customers into partners, creating powerful brand evangelists who do the selling for you.

Engaging with these advocates requires consistent, personalized communication. For a great framework on keeping these valuable conversations going, our guide on how to never miss a follow-up is packed with practical tips.

By implementing tailored plays at each lifecycle stage, you create a powerful system for compounding customer value over time.

Common Questions We Hear About CLV

When you start digging into customer lifetime value, a few practical questions always pop up. Let's tackle them head-on, based on what we see work for marketing teams every day.

What’s a Good CLV to CAC Ratio?

This is the big one. How do you know if you're spending the right amount to get a customer?

The gold standard we see most healthy businesses aim for is a 3:1 ratio. For every dollar you spend to acquire a customer, you should be getting three dollars back over their lifetime. It’s the sweet spot that balances investing in growth with healthy profitability.

Here’s a quick gut-check for your numbers:

- Below 1:1: You're losing money on every new customer. Action: Immediately pause your worst-performing ad campaigns.

- 1:1 to 2:1: You're either breaking even or barely profitable. Action: Focus on low-cost retention tactics like a re-engagement email campaign.

- 3:1 or higher: Now you're talking. Action: Identify your best acquisition channels and consider scaling your investment there.

Imagine you run a subscription box service. If your average customer lifetime value is $240 and it costs you $80 to acquire them, you've hit that perfect 3:1 ratio. If your CAC was $120, you'd be at 2:1, which should prompt a hard look at your retention game or maybe even your pricing.

Of course, this isn't set in stone. Keep an eye on your industry benchmarks—what's great for SaaS might be different for e-commerce. Context is key.

How Often Should We Recalculate CLV?

Things change fast. Customer behavior shifts, you launch new products, and market dynamics evolve. Your CLV calculation can't be a "set it and forget it" metric.

For most mid-market companies, running the numbers quarterly is a good rhythm. It aligns perfectly with financial planning and gives you a regular checkpoint.

But if you're in a fast-paced space like e-commerce where purchase frequency is high, you might want to refresh it monthly. Doing so lets you spot trends much earlier and react before they become problems. For businesses with really long sales cycles, a semi-annual review might be all you need.

A pro tip? Tie a CLV recalculation to major events, like a big product launch or a new pricing rollout. It's the cleanest way to see how your strategic moves are actually impacting long-term customer value.

How Can We Improve CLV on a Tight Budget?

You don't need a massive budget to start moving the needle on CLV. In fact, some of the highest-impact plays are surprisingly low-cost. It’s all about focusing on retention and smart, personalized communication.

If you’re strapped for cash, start here with these actionable, low-cost tactics:

- Wake up sleeping customers. Set up a simple automated re-engagement email campaign for customers who haven't purchased in a while. Action: Create a 3-email sequence offering a small incentive in the last email.

- Offer smart upsells. Look at purchase history and suggest relevant add-ons or upgrades. Action: Add a "Frequently Bought Together" section to your product pages.

- Launch a referral program. Give existing customers a small discount or credit for bringing in a friend. Action: Use a tool like ReferralCandy to set up a simple "Give $10, Get $10" program in an afternoon.

- Get scientific with your emails. A/B test your subject lines for reactivation campaigns. Finding a winner can double your open rate without costing a dime.

These aren't flashy, but they work. They build momentum and generate the revenue you can reinvest into bigger initiatives down the road.

The smartest CLV strategies often start small. Low-cost retention tactics deliver incredible ROI and build the foundation for more ambitious, long-term growth.

Boosting customer lifetime value isn't a one-and-done project. It's a process of making consistent, measurable improvements. Each small win compounds, creating stronger revenue streams and the kind of predictable growth that builds lasting businesses.

Ready to supercharge your CLV? Try the marketbetter.ai AI-Powered Marketing Platform today at https://www.marketbetter.ai