A Modern Guide to B2B Indicators of Interest

Indicators of interest are the digital breadcrumbs your prospects leave behind. They're the actionable clues that tell you what they need, when they need it, and if they're a good fit for your solution.

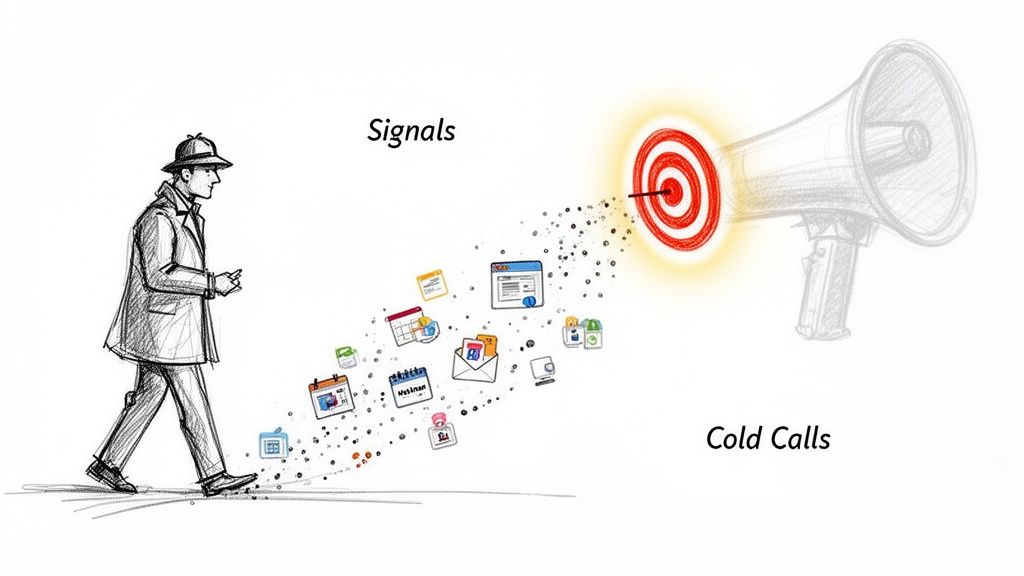

Think of it this way: old-school outreach is like shouting into a crowded stadium, hoping someone hears you. Signal-based selling is like walking up to the person waving a flag with your logo on it. These indicators let your sales team stop shouting into the void and start talking to people who are already listening.

Beyond Cold Calls: Why Indicators of Interest Matter

We've all seen it. An SDR stares at a massive list of cold accounts, feeling the weight of the day ahead. The old playbook is simple: make dozens of calls, send hundreds of generic emails, and just hope something lands. It’s a recipe for burnout, high rejection rates, and a whole lot of wasted energy.

The modern sales motion is a complete strategic shift. It’s less of a brute-force attack and more like a detective following a trail of evidence. Instead of blasting the same message to everyone, top-performing teams hunt for indicators of interest—the subtle hints prospects drop online that show they’re getting ready to buy.

Shifting from Volume to Precision: A Quick Comparison

This isn't just a small tweak; it's a fundamental shift in philosophy. The old way is a numbers game, a relentless focus on activity volume. The new way is a precision game, built on timing and relevance. One is based on luck, the other on evidence.

- Old Method (Volume): An SDR gets a static list of 200 companies that match your Ideal Customer Profile (ICP). They then spend hours digging for basic info, making cold calls with zero context, and dealing with abysmal connection rates. It's a grind.

- New Method (Precision): An SDR gets a dynamic, prioritized list. These accounts don't just fit the ICP—they've also just visited your pricing page, downloaded a case study, or had a key decision-maker start a new role.

This one change transforms an SDR from a generic cold caller into a timely, relevant problem-solver. It directly attacks the biggest pain point in sales development: all those wasted hours spent chasing ghosts. You focus your team’s effort exactly where it’s most likely to pay off.

A huge piece of this puzzle is third-party intent data, which tells you what’s happening outside your own website. We break it all down in our guide on what is intent data.

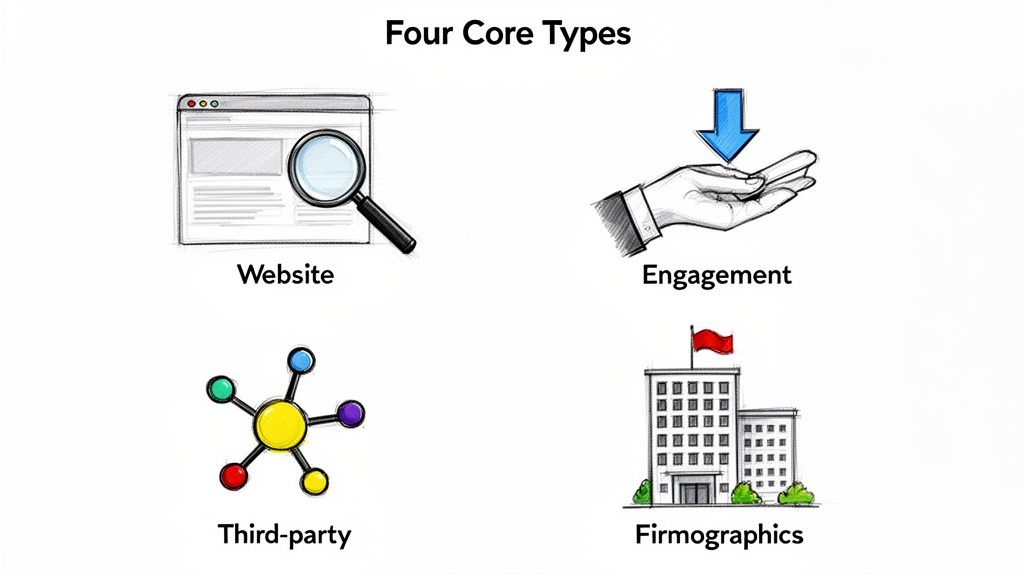

The Four Core Types of Buying Signals

Not all buying signals are created equal. Far from it.

Think of an SDR as a detective. Some clues are faint whispers, while others are practically a signed confession. Learning to tell the difference is what separates top performers from everyone else. It’s the key to knowing where to spend your time and how to craft outreach that actually lands.

These indicators of interest fall into four main buckets, and each one tells you a different part of the prospect's story. If you only look at one, you’re trying to solve a puzzle with most of the pieces missing. The real magic happens when you see how they all fit together.

1. First-Party Website Behavior

These are the most valuable signals, hands down. Why? Because they’re happening on your home turf—your website. This is what a prospect does when they're actively researching your solution. It’s the digital equivalent of someone walking into your store and looking around.

Every click tells a story. A quick visit to your blog suggests mild curiosity. But a long visit to your pricing page? That’s a five-alarm fire. You need to act on that immediately.

A prospect spending more than two minutes on your pricing page is one of the strongest buying signals you can get. That isn't just research; it's serious consideration.

These signals are your secret weapon because your competitors can't see them. It's your head start. Key examples include:

- High-Intent: Multiple visits to key product or solution pages.

- High-Intent: Watching a full product demo video.

- Critical Intent: Starting the "Request a Demo" form but not finishing.

2. Active Engagement Signals

While website behavior is about what prospects do anonymously, active engagement is what happens when they willingly identify themselves. They trade their contact info for something valuable, stepping out from the shadows and turning from a visitor into a known lead.

This is a direct invitation to start a conversation. They've given you permission to reach out, so your follow-up should be timely and directly related to what they engaged with.

For instance, someone downloading a top-of-funnel eBook on industry trends is probably just starting their research. But someone who registers for a product-focused webinar? They're much further along and signaling a deeper interest in what you specifically offer.

3. Third-Party Intent Data

This is where you get to see what your target accounts are doing across the rest of the internet, long before they ever find your website. It’s like seeing the "digital body language" of an entire company.

This data flags when a target account suddenly starts researching topics, problems, or competitors related to your business. Maybe several people from that company are all reading reviews of "sales automation platforms." That’s a massive signal that they’re in-market, giving you a chance to engage a net-new opportunity before anyone else.

4. Strategic Firmographic Triggers

Finally, firmographic triggers aren’t about individual research behavior. They’re about company-level events that create a perfect window of opportunity for a purchase. These are changes at an organization that signal a new need or a fresh budget.

- New Executive Hire: A new VP of Sales is almost always hired to make changes. They're most open to new tools in their first 90 days.

- Company Funding: A recent funding round means they have cash to spend on tools that will fuel growth.

- Hiring Sprees: If a company is posting tons of new sales roles, they're going to need software to support that growing team. Very soon.

To give you a clearer picture of how these signals stack up against each other, here’s a quick comparison.

Comparing the Four Main Types of B2B Buying Signals

This table breaks down each signal type, showing you where it comes from, how strong the intent usually is, and the best way for an SDR to jump on it.

| Signal Type | Example | Typical Intent Level | Actionable Next Step |

|---|---|---|---|

| Website Behavior | Visited the pricing page 3 times | Very High | Immediate, personalized call/email referencing their potential interest in ROI. |

| Active Engagement | Downloaded an eBook on "AI in Sales" | Medium | Nurturing email sequence offering more resources on the same topic. |

| Third-Party Data | Company is researching your competitors | High | Proactive outreach to key personas, highlighting your unique differentiators. |

| Firmographic Trigger | Just hired a new CMO | Medium to High | Welcome/congratulatory email to the new hire, offering relevant industry insights. |

Bringing these four types of signals together gives you a complete, 360-degree view of your target accounts. It’s how you move from guessing to knowing exactly who to call and what to say.

For a deeper dive into quantifying these signals, check out this great guide on understanding lead scoring in HubSpot.

How to Turn Raw Signals Into Actionable Outreach

Getting a flood of buying signals feels like a win, but it can quickly turn into a nightmare. When your team is drowning in raw indicators of interest without a clear path forward, they do what anyone would do: they fall back on old habits. They start working through a static, alphabetical list of accounts.

The real trick isn't just collecting signals. It's turning them into a prioritized, actionable game plan for your sales team.

This comes down to a simple but powerful framework that balances two things: fit and interest. "Fit" is all about how well an account matches your Ideal Customer Profile (ICP). "Interest" is about the strength and timing of their recent buying signals. An account that scores high on both? That's your #1 call.

The goal is to get out of reactive mode and into proactive engagement. Stop asking, "What happened last week?" and start giving your team a list that answers, "Who should I call right now, and why?"

This shift is a massive efficiency booster. One of the biggest drags on sales development is all the non-selling work. Recent benchmarks show reps spend just 30% of their week actually selling. The other 70% gets eaten by admin tasks like research and data entry. (If you want to dig into that, this 2025 sales development report has some great insights.) A smart prioritization model gives that time back.

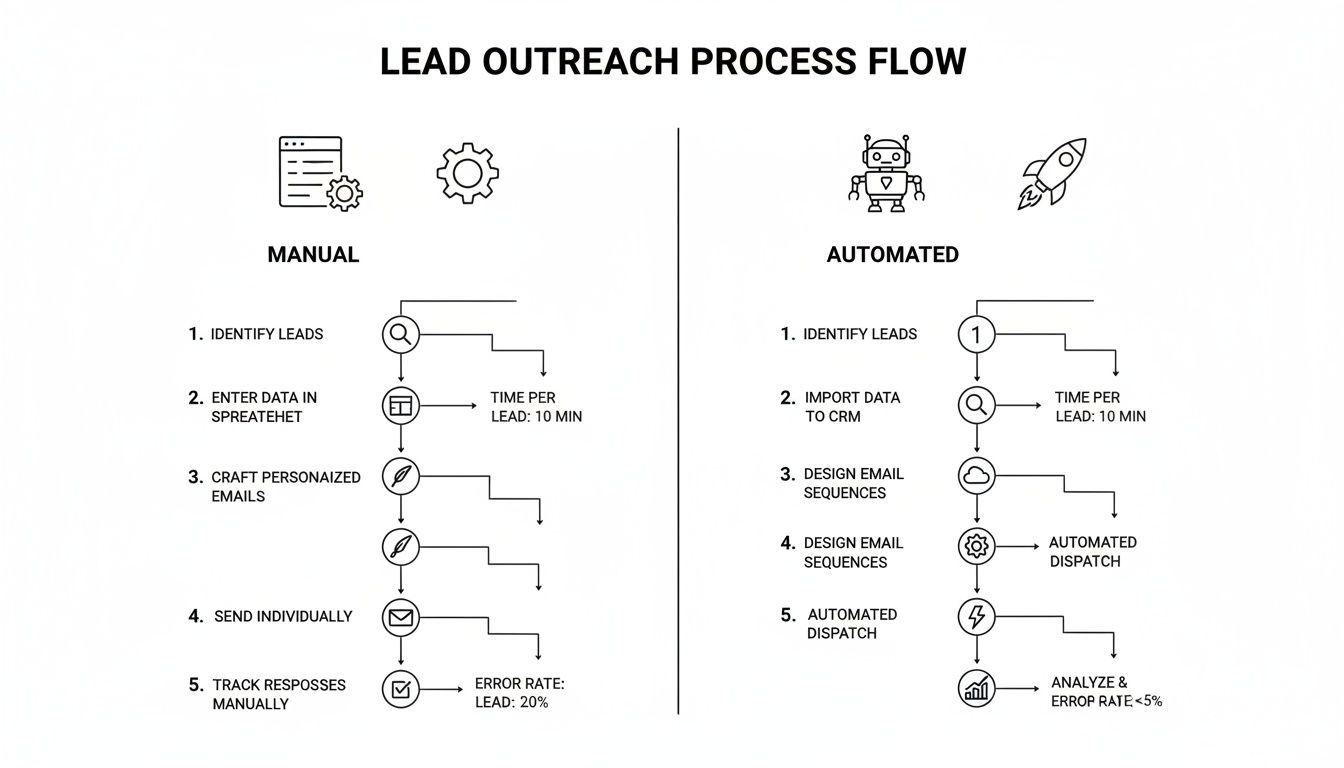

Manual Spreadsheets vs. Automated Workflows: A Comparison

So, how do you actually put this into practice? The difference between a manual and automated approach is the difference between a leaky raft and a speedboat.

- The Manual Way (Spreadsheet Hell): A RevOps manager spends Monday morning exporting data from a dozen different tools, trying to stitch it all together. They cross-reference CRM data with website analytics and third-party intent scores. It’s a tedious, error-prone mess that’s already stale by the time the SDRs see it. The result is a static list that doesn't adapt to real-time signals.

- The Automated Way (AI-Driven Workflow): An integrated platform does all this heavy lifting in real-time. It’s constantly processing signals, scoring accounts on fit and interest, and creating prioritized tasks right inside your team's CRM. This delivers a dynamic to-do list where every single action is backed by a specific, timely signal. Reps can see the why and act instantly.

An integrated system transforms a messy spreadsheet into a dynamic engine for outbound lead generation.

Creating a Prioritized Task List

The end result of an automated system is a simple, powerful task list that gives each SDR their next best action. Here’s what that looks like in the real world:

- Action Plan for Priority 1 (Hot): These are ICP-fit accounts that hit your pricing page in the last 24 hours. Your Action: Immediate, personalized multi-channel outreach (call + email). Reference the potential business case they're building. No exceptions.

- Action Plan for Priority 2 (Warm): Target accounts where you're seeing multiple contacts researching topics related to your solution. Your Action: Reach out to the most relevant persona, acknowledging their team's research and offering a high-value asset like a competitor comparison guide.

- Action Plan for Priority 3 (Nurture): Companies that downloaded a top-of-funnel eBook or just hired a new executive. Your Action: Enroll them in a longer-term, educational nurture sequence. The goal is to build trust, not book a meeting tomorrow.

By systematically ranking these indicators of interest, you ensure your team’s most precious resource—their time—is always pointed at the accounts most likely to convert. You're not just giving them data; you're giving them direction.

Building Your Sales Playbook for High-Intent Signals

So, you've prioritized your accounts. The clock is officially ticking. Having a hot lead is great, but it's worthless without a clear, immediate plan of attack. This is where a sales playbook comes in—a set of predefined, actionable steps that turn strong indicators of interest into actual conversations.

The alternative? Leaving it all to chance. Your reps fire off generic, one-size-fits-all emails that get deleted on sight. A solid playbook ensures every high-intent signal is met with a timely, relevant, and context-aware response that acknowledges exactly where that buyer is in their journey.

This flowchart spells out the difference between a disorganized, manual outreach process and a streamlined, signal-based workflow. The contrast is pretty stark.

It's clear how an automated, signal-first approach cuts through the chaos, turning manual guesswork into an effective system for turning interest into action.

Playbook 1: The Pricing Page Visitor

A visit to your pricing page is one of the loudest buying signals you'll ever get. This person isn't just kicking tires or researching a problem—they are actively evaluating solutions and trying to figure out the investment. Sending a generic "just checking in" email here is a massive own-goal.

Comparing Outreach Approaches

- The Wrong Way (Generic): A bland email that completely ignores the context. It's self-serving and immediately delete-worthy.

- The Right Way (Actionable): A helpful, non-pushy multi-touch sequence that acknowledges their journey and provides value.

Actionable Steps for Your Team:

- Email Within 1 Hour: Send a helpful, low-pressure email.

- Subject: Resources for [Their Company Name]

- Body Snippet: "Hi [Name], often when people are exploring our pricing, they're building a business case for a solution like ours. To help, here’s a one-page guide on calculating the ROI of [Your Solution Category]. Happy to walk you through it if that's helpful."

- Follow-up Call (Day 2): Use a value-driven script.

- Talking Point: "I'm calling because I saw your team was looking into solutions like ours. I'm not trying to sell you right now, but I wanted to be a resource as you evaluate your options. What's the main challenge you're hoping to solve?"

Playbook 2: The New Executive Hire

When a new leader joins a target account, a window of opportunity swings wide open. They have a mandate to make changes and are often most receptive to new ideas and tools within their first 90 days. Your outreach needs to position you as a strategic partner who can help them score early wins.

Comparing Outreach Approaches:

- The Wrong Way (Generic): Congratulating them and immediately asking for a meeting. This just feels self-serving.

- The Right Way (Actionable): Congratulating them and offering a valuable, relevant resource that genuinely makes their new job easier.

Actionable Steps for Your Team:

- LinkedIn Connection (Day 1): Send a personalized connection request.

- Note: "Congrats on the new role at [Company]! Looking forward to seeing what you accomplish. I've been following [Topic related to their role] and thought you might find this industry report useful."

- Email Follow-up (Day 3): Offer insights, not a sales pitch.

- Subject: Congrats on the new role!

- Body Snippet: "Hi [Name], saw the news about your new role—congratulations! Leaders in your position are often tasked with [Key Initiative] in the first 90 days. Here's a quick playbook we put together for C-level execs on achieving that. No pitch, just a resource I thought you'd find valuable."

Pipeline generation is the lifeblood of B2B growth. The median pipeline created by each SDR stands at $2.8 million annually, underscoring their huge revenue impact. Yet, with outbound SDRs averaging 94.4 daily activities, cold call conversion hovers at a dismal 2%. Signal-based playbooks are designed to fix this broken equation. To learn more, explore these key sales statistics that can shape your strategy.

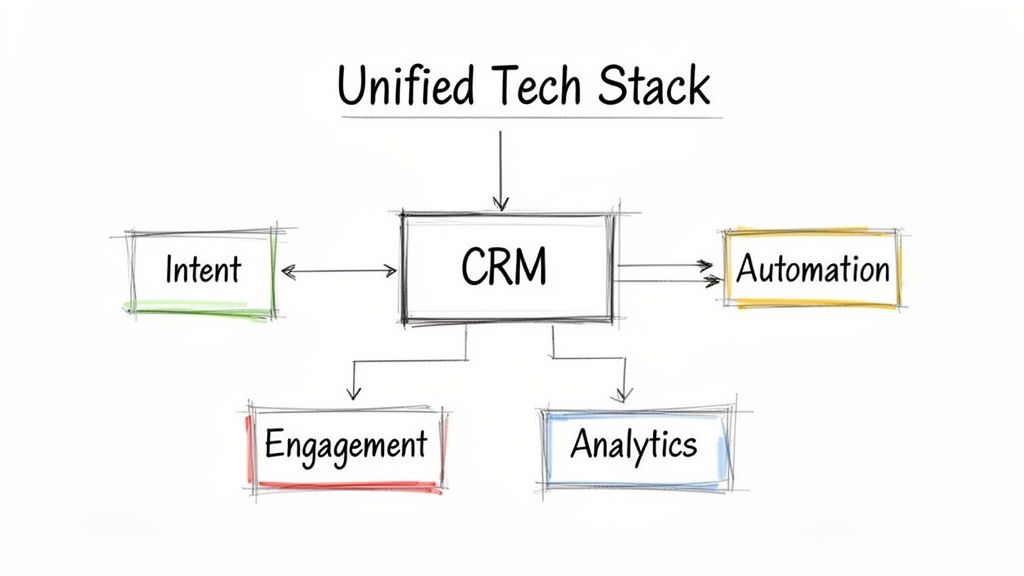

The Right Tech for a Signal-Based Sales Motion

A signal-based sales strategy is only as good as the engine running it. Without the right tech, the best indicators of interest just become noise—a flood of data that creates more busywork than actual pipeline.

This is where so many teams stumble. They try to patch together a system with duct tape and good intentions, but it just ends up slowing reps down. You’ve probably seen it: reps juggling separate tools for intent data, sales engagement, and the CRM, constantly switching tabs and copy-pasting info. It's a clunky, infuriating workflow that kills productivity.

A modern, integrated tech stack fixes this by getting all your tools to talk to each other. It’s not about just having the tools; it’s about making them work together as one cohesive machine.

Comparing a Disjointed vs. a Unified Stack

The difference in workflow and results between a disconnected and an integrated tech stack is night and day.

- Disjointed Stack (The Problem): This creates operational headaches that will absolutely kneecap your sales motion. Intent data lives in one tool, engagement sequences in another, and account history is trapped in the CRM. Reps burn precious hours just trying to connect the dots, and hot signals go cold before anyone can act.

- Unified Platform (The Solution): This setup transforms the entire workflow by living natively inside your CRM. It connects signal detection, task prioritization, and outreach into one fluid motion. It's the difference between handing your team a box of car parts and giving them the keys to a finely tuned engine.

The core idea is simple: bring the work to the rep, don't make the rep hunt for the work. A platform that automatically creates and prioritizes tasks inside the CRM eliminates the friction that kills momentum.

This native approach just works. It drives adoption because it fits into a rep's existing habits, and it guarantees better data hygiene since activities are logged automatically. Suddenly, leaders have real visibility into what’s driving performance.

This kind of efficiency has never been more critical. We’ve seen 36% of B2B companies downsize their SDR teams as they pivot away from high-volume, low-return outbound. The reason is simple: reps were spending only 36% of their time actually selling.

To get a signal-based motion right, you need the right tools in your corner. For a closer look at what's out there, you can explore this guide on the best LinkedIn automation tools for lead generation that complement an integrated approach. By building a seamless engine, you empower your team to act on the best indicators of interest with speed and precision.

Frequently Asked Questions

Even with a killer strategy, switching to a signal-based sales motion is going to bring up some questions. Here are the straight, actionable answers to the hurdles I see teams hit all the time when they start focusing on indicators of interest.

How Do I Start Without an Intent Data Tool?

Good news: you don't need to drop five figures on a third-party tool to get started. The best signals are already hiding in plain sight on your own website and in your own apps. This is your first-party data, and your competitors can't see it.

Your Action Plan:

- Identify Your "Money" Pages: Work with marketing to define which pages signal the highest intent. This is usually your pricing, case study, and integration pages.

- Set Up Tracking & Alerts: Use tools like HubSpot or even Google Analytics to create notifications for your sales team when a target account visits these pages.

- Launch a Pilot Playbook: Create a simple two-step outreach sequence (email + call) specifically for these high-intent visitors and measure the results for 30 days.

This data is pure gold. Use it.

What's the Biggest Mistake Teams Make?

Easy. Treating every signal like it’s a fire alarm. A lead downloading an industry report is worlds apart from a key decision-maker from a target account hitting your integrations page three times in a week. If you treat them the same, you’ll burn out your reps on low-quality follow-ups.

The key is to avoid signal paralysis by creating a simple hierarchy. Not all clues are created equal; a pricing page visit is a smoking gun, while a blog view is just a footprint. Actionable prioritization is non-negotiable.

Your Action Plan:

- Create a Simple Scoring System: Don't overcomplicate it. Give a demo request 10 points, a pricing page view 5 points, and a blog visit 1 point.

- Define Thresholds for Action: Decide what score triggers immediate outreach versus what score puts a lead into a nurture sequence.

- Train Your Team: Ensure every SDR understands the difference and knows exactly what to do when a "10-point" lead comes in.

How Can I Get My Sales Team to Adopt This?

Adoption comes down to one simple thing: make it easier for them to win. If your new process adds more clicks, more logins, or more confusion to a rep’s day, it’s dead on arrival. The signals have to show up where they already work—inside their CRM.

Frame it as the before-and-after it truly is. The old way was digging through spreadsheets and guessing who to call. The new way is a prioritized to-do list of warm accounts waiting for them every morning.

When you show them how it directly leads to:

- Less time wasted on dead-end cold calls.

- More time spent talking to people who actually want to hear from them.

- Better conversations because they walk in with real context.

...they'll connect the dots pretty fast. Better signals lead to more qualified meetings, which lead straight to bigger commission checks. Adoption won't be a problem.

Stop drowning in data and start closing deals. MarketBetter turns buyer signals into a prioritized to-do list for your SDRs, right inside Salesforce and HubSpot. See how you can build a predictable outbound motion at https://www.marketbetter.ai.