Customer Acquisition Cost Calculator for Smart Marketing

Trying to grow your business without knowing what it costs to land a single customer is like driving with a blindfold on. It’s a gamble. A customer acquisition cost calculator is what takes the blindfold off, turning your vague marketing spend into a hard number that tells you if your growth strategy is actually working—or just burning cash.

Why You Can't Afford to Ignore Your CAC

Let's be blunt: ignoring your Customer Acquisition Cost (CAC) is one of the fastest ways to run a business into the ground. This isn't just another metric to track. It’s the key indicator of your marketing’s viability and the ultimate guardrail for your profitability. Think of it as a financial health check for your entire growth engine.

When you have a firm grip on your CAC, you stop guessing and start making smart, data-backed moves. This clarity is crucial for a few big reasons:

- It proves your business model works. A sustainable company has to acquire customers for less than they're worth over their lifetime (their Lifetime Value, or LTV). Without tracking CAC, you have no idea if you're building a profitable business or just a very expensive hobby. For example, if your LTV is $1,000 and your CAC is $1,200, you're losing money on every sale. The business model is broken.

- It tells you where to put your money. Knowing which channels bring in customers for the lowest cost is a superpower. You can finally double down on what’s working and cut the fat. Comparing the CAC of your Google Ads campaigns versus your content marketing efforts, for instance, shows you exactly where to invest for the best returns.

- It sharpens your strategy. Are you actually ready to scale up your ad spend? Your CAC gives you the answer. It lets you build a predictable growth plan based on real numbers, not wishful thinking. Actionable Step: Create a simple rule: "We will not scale ad spend on a channel until its CAC is below X."

The Stakes Are Getting Higher

The pressure to nail this metric is more intense than ever. Digital channels are crowded and noisy, which means the price tag for winning a new customer is climbing. Fast. This isn’t just a small bump; it’s a major market shift that’s hitting every single business.

Customer acquisition cost has surged by an astonishing 222% between 2013 and 2025. It’s a brutal combination of rising ad prices and fierce competition, with brands now losing an average of $29 for every new customer they bring in.

This trend makes a customer acquisition cost calculator an essential tool, not a nice-to-have. Tracking this metric is no longer optional—it's about survival.

If you don't have this insight, you're flying blind, pouring money into unprofitable channels while your competitors make smarter, more efficient decisions. The interactive calculator in this guide is your first step toward taking back control, and we've seen firsthand how powerful that can be in our customer acquisition case studies.

Breaking Down the Customer Acquisition Cost Formula

On the surface, the customer acquisition cost formula seems simple enough: divide your total sales and marketing spend by the number of new customers you brought in over a specific time. Easy, right?

But here’s the trap: the real work—and where most businesses stumble—is in figuring out what "total spend" actually means. A lazy calculation that only includes ad spend will give you a dangerously misleading number.

To get a true picture of your CAC, you have to go way beyond your monthly ad budget. You need a full-funnel view of every single dollar that helps win a new customer. For a deeper look at the mechanics, this guide on Customer Acquisition Cost calculation is a great resource for boosting ROI.

Identifying Every Cost Component

So, what exactly should you be adding up? Let’s break down what most people include versus the critical expenses that are too often forgotten.

Commonly Included Costs (The Obvious Stuff):

- Direct Ad Spend: This is the no-brainer. It’s what you pay Google, Meta, LinkedIn, and any other ad platform.

- Campaign-Specific Fees: Think agency retainers or one-off project fees for specific marketing campaigns.

Frequently Forgotten Costs (The Stuff That Really Matters):

- Salaries and Commissions: This is often the biggest line item. The compensation for your entire marketing and sales team absolutely has to be in there.

- Software and Tools: The monthly or annual fees for your CRM, analytics platforms, email marketing software, and the rest of your tech stack add up.

- Content Creation Expenses: Paying freelance writers, designers, or video producers? That’s an acquisition cost.

- Overhead Allocation: A slice of your general business overhead, like office rent or utilities, that supports your sales and marketing teams.

An incomplete cost analysis is worse than no analysis at all. Only counting ad spend might make your CAC look fantastic, but it’s a vanity metric. It creates a false sense of security that leads to terrible budget decisions and kills any chance of sustainable growth.

Putting It Into Practice: A B2B SaaS Example

Let's make this real. Imagine a B2B SaaS company trying to figure out its CAC for the last quarter (Q3). First things first, they have to meticulously gather all their expenses.

Here's their cost breakdown for July, August, and September:

- Total Ad Spend: $40,000 (running campaigns on LinkedIn and Google Ads)

- Marketing & Sales Salaries: $75,000 (for their three-person go-to-market team)

- Software Subscriptions: $5,000 (for their CRM, analytics, and email tools)

- Content & Creative: $10,000 (for freelance writers and a video editor)

Add it all up, and their Total Sales & Marketing Costs for Q3 come to $130,000.

During that same three-month window, their efforts brought in 260 new paying customers.

Now the math is straightforward: $130,000 / 260 = $500.

Their true CAC for the quarter is $500 per customer. This detailed approach gives them a number they can actually trust and use to make smart decisions. Once you've nailed this, the next step is understanding how person-level identification can refine your attribution to get even more granular.

Your Interactive Customer Acquisition Cost Calculator

Alright, enough with the theory. Let's put this into practice.

All the formulas and principles we've covered come to life with a real tool. This interactive customer acquisition cost calculator is built to give you a fast, clear snapshot of how efficiently your sales and marketing machine is running.

Just plug your numbers into the fields below and get your CAC instantly.

Inputting Your Data: A B2B SaaS Walkthrough

Let's stick with that B2B SaaS company from the last section to see how this works in the real world. They've pulled their numbers for Q3 and are ready to see where they stand.

As a quick reminder, here's what their quarter looked like:

- Total Sales & Marketing Costs: $130,000 (This bundles everything—salaries, ad spend, software tools, you name it.)

- New Customers Acquired: 260

They pop those two figures into the calculator. $130,000 in the first field, 260 in the second. Hit 'calculate,' and the magic happens.

Your CAC Result: $500 per customer

That $500 isn't just a random number; it's a critical piece of business intelligence. It tells the team exactly what it cost them, on average, to win each new client last quarter.

Turning Your CAC Into Actionable Insight

So, what does that $500 CAC actually mean for the business? This is where the real analysis begins, comparing the cost to the value.

Let's say their average customer pays $200 a month and sticks around for two years. That gives them a lifetime value (LTV) of $4,800.

When you put the two side-by-side—a $500 cost to acquire a $4,800 customer—you’re looking at a very healthy LTV to CAC ratio of over 9:1. That’s a sign of a highly profitable and sustainable acquisition model.

But what if their LTV was only $600? Suddenly, their 1.2:1 ratio would be a massive red flag. They'd be barely breaking even on each customer, signaling an urgent need to either slash acquisition costs or find a way to increase customer value.

Actionable Step: Use this comparison to set your budget. If your LTV is $4,800, you might set a target CAC of $1,600 (a 3:1 ratio) and approve any channel that comes in under that number.

This is how a simple customer acquisition cost calculator turns two data points into a powerful, actionable directive for your entire growth strategy.

How Your CAC Stacks Up to Industry Benchmarks

So you’ve calculated your Customer Acquisition Cost. That’s a huge first step. But the number itself—say, $50—doesn’t tell you much on its own. Is that good? Bad? A sign you should be popping champagne or a five-alarm fire?

The answer, of course, is: it depends.

A $300 CAC might be a fantastic deal for a B2B SaaS company selling enterprise contracts, but it would sink an e-commerce store selling t-shirts. Context is everything. This is where industry and channel benchmarks become your strategic compass. They help you figure out if you’re winning the race or just spinning your wheels.

Industry Norms and Why They’re All Over the Map

Every industry plays by its own rules, and that dramatically impacts acquisition costs. Factors like the length of the sales cycle, the level of competition, and the average customer value create wildly different financial landscapes. A fintech company, for example, has to navigate heavy regulations and fierce competition, pushing its CAC way higher than a direct-to-consumer retail brand.

In e-commerce, keeping a lid on this cost is more critical than ever, with ad expenses rising and margins getting squeezed. The average CAC for e-commerce businesses globally hovers around $70. But even that number needs a closer look.

- Food and Beverage: Averages $53

- Fashion: Sits around $66

- Jewelry: Can climb to $91 per new customer

You can dig deeper into e-commerce CAC insights to see how these benchmarks are trending. The point is, a one-size-fits-all approach just doesn't work. You have to zoom in on your specific market to get a real sense of how you're performing.

Average Customer Acquisition Cost by Industry and Channel

To give you a clearer picture, it helps to see how CAC varies not just by industry, but also by the channels used to reach customers. Some channels are built for low-cost volume, while others target high-intent buyers at a premium.

Here’s a comparative look at typical CAC values across different sectors and the marketing channels they often rely on.

| Industry / Channel | Average CAC Range | Key Influencing Factors |

|---|---|---|

| Travel | $7 - $99 | Seasonality, booking value, competition from aggregators |

| Retail (E-commerce) | $10 - $70 | Product margin, brand loyalty, return rates |

| Consumer Goods | $22 | Brand recognition, distribution channels, repeat purchase rate |

| SaaS | $150 - $495+ | Contract value (LTV), sales cycle length, churn rate |

| Paid Search (PPC) | $50 - $100+ | Keyword competition, Quality Score, industry |

| Social Media Ads | $30 - $80 | Platform (e.g., Facebook vs. LinkedIn), targeting precision |

| Email Marketing | $10 - $50 | List quality, engagement rates, automation sophistication |

| Content Marketing/SEO | $25 - $75 | Content quality, domain authority, keyword difficulty |

Understanding these ranges helps you set realistic goals and identify which levers you can pull to bring your own costs in line. A high CAC in a competitive channel might be perfectly acceptable if it brings in high-value customers, while a low CAC from another might not be worth it if the churn rate is through the roof.

Channel Performance Is a Game Changer

Beyond your industry, the marketing channels you lean on will make or break your CAC. This is where you can get really tactical. Not all channels are created equal, and knowing their individual performance is key to optimizing your budget.

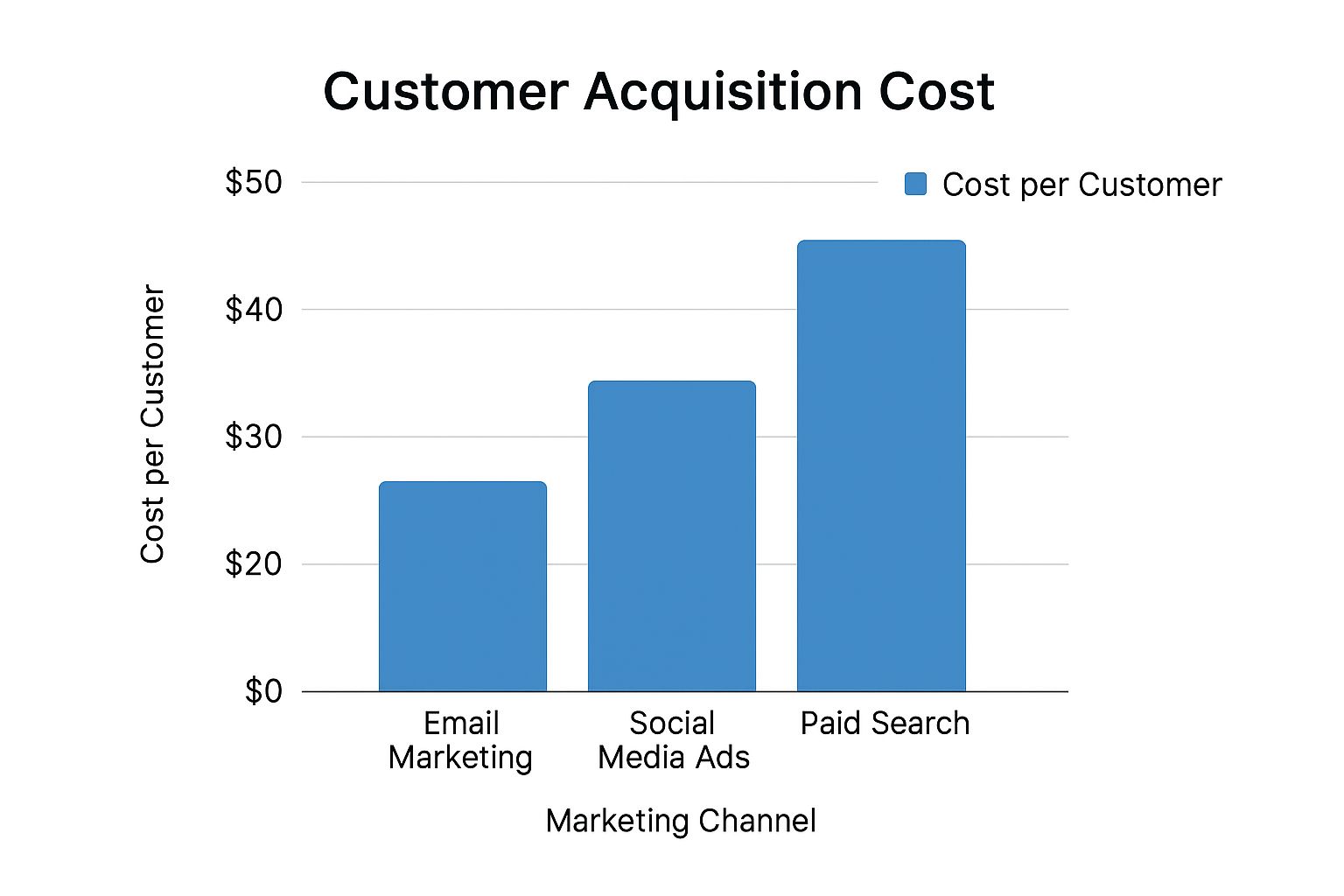

This infographic breaks down the typical customer acquisition cost for three popular channels.

As you can see, something like email marketing is incredibly efficient from a cost perspective, while paid search requires a much bigger investment to acquire each customer.

But this isn't about ditching expensive channels for cheap ones. It's about building the right mix. A high-cost channel like paid search often delivers customers with much higher intent and lifetime value, easily justifying the upfront spend. Your job is to build a balanced portfolio that hits a blended CAC that works for your business model.

Actionable Takeaway: Don't just look at your overall CAC. Break it down channel by channel. If your social media CAC is $80 while the benchmark is $30, that's a clear signal to investigate your ad creative, targeting, or landing page performance immediately.

When you start comparing your numbers to these benchmarks, opportunities jump out. You might discover you’re overspending on an inefficient channel or realize there’s an untapped, low-cost channel your competitors are completely ignoring. This is how you move from just knowing your CAC to actively driving it down.

Actionable Strategies to Lower Your CAC

Alright, you've calculated your Customer Acquisition Cost. That was the diagnosis. Now it's time for the cure.

Driving that number down isn't about gutting your marketing budget until there's nothing left. It’s about making every single dollar work harder. You need smarter, more efficient strategies that pull in the right customers without hitting the brakes on growth.

This means getting beyond the mindset of just pouring more money into ads. The real goal is to build a more effective acquisition engine—the kind that moves you from renting an audience on paid channels to owning one through sustainable, long-term assets.

Double Down on Conversion Rate Optimization

One of the absolute fastest ways to slash your CAC is to get more juice from the traffic you already have. Think about it: every visitor who lands on your site and leaves without converting is a missed opportunity and, very often, wasted ad spend.

This is where Conversion Rate Optimization (CRO) becomes your most powerful lever.

Instead of paying more to attract new eyeballs, you focus on converting a higher percentage of the ones already looking. Following established Conversion Rate Optimization Best Practices isn't just a good idea; it's a direct path to a healthier CAC.

A simple A/B test on a landing page—changing a headline, tweaking a call-to-action button, or simplifying a form—can realistically double its conversion rate. That single action effectively cuts your cost per acquisition for that channel in half without spending one extra penny on ads. Actionable Step: Launch one A/B test this week on your highest-traffic landing page. Test your main headline against a new version focused on a different benefit. Track the results for 14 days.

Build a Referral Engine That Actually Works

Referrals are the gold standard of customer acquisition, period. A customer who comes in through a referral usually has a higher lifetime value and a dramatically lower CAC than someone you brought in through a cold ad campaign.

But a great referral program doesn't just happen by accident. You have to build it with intention.

- Offer Two-Sided Incentives: Reward both the person referring and the new customer. A classic "Give $20, Get $20" model is way more compelling than a one-sided offer.

- Make It Effortless: Don't make people hunt for their referral link. Embed it right in their user dashboard, on post-purchase pages, and even in their email signatures.

- Time Your Ask Perfectly: The best moment to ask for a referral is immediately after a great experience, like a 5-star review or a successful customer support chat.

A referral from a trusted source bypasses most of the skepticism new prospects have, which shortens the sales cycle and shrinks the marketing effort needed to get the deal done.

Shift Focus from Acquisition to Retention

This might sound backward, but one of the smartest ways to make your CAC sustainable is to get obsessive about keeping the customers you already have. The metric that tells this story is the LTV:CAC ratio—the relationship between Customer Lifetime Value and Customer Acquisition Cost.

Let's look at two scenarios:

| Scenario | CAC | Customer LTV | LTV:CAC Ratio | Business Health |

|---|---|---|---|---|

| Scenario A | $200 | $600 | 3:1 | Healthy |

| Scenario B | $200 | $250 | 1.25:1 | At Risk |

In both cases, the cost to land a new customer is identical. But by focusing on retention and boosting LTV, Scenario A has a profitable, scalable model. A higher LTV gives you breathing room, turning what looks like an expensive CAC into a perfectly justifiable investment.

Improving retention through solid onboarding, proactive support, and loyalty programs makes every dollar you spend on acquisition exponentially more valuable. You can also get smarter about identifying which leads are most likely to stick around. For instance, using tools for https://marketbetter.ai/playbooks/ai-lead-scoring helps your team focus on prospects with the highest potential LTV, which directly shores up your overall LTV:CAC ratio.

Common Questions About Calculating CAC

Even with a handy calculator, a few practical questions always pop up once you start digging into the numbers. Getting the details right is what turns CAC from a simple metric into a powerful tool for making smarter business decisions.

Let's walk through some of the most common hurdles people face.

How Often Should I Calculate CAC?

This is probably the first question everyone asks. The best rhythm I've found is a mix of monthly and quarterly check-ins.

- Monthly calculations are your tactical pulse check. They’re perfect for seeing how a new campaign is performing or spotting weird trends before they snowball into bigger problems.

- Quarterly calculations give you a more strategic, big-picture view. Looking at a three-month chunk of data smooths out any random monthly spikes or dips. This gives you much more reliable numbers for planning your next quarter's budget.

Actionable Comparison: A monthly check might show a high CAC due to a new, experimental campaign. A quarterly view, however, might reveal that the customers from that campaign have a much higher LTV, justifying the initial cost. Relying only on the monthly snapshot could lead you to prematurely kill a winning strategy.

Should I Segment My CAC by Channel?

Absolutely. In fact, if you're not doing this, you're flying blind.

Calculating a single, blended CAC for the whole business is a decent starting point, but the real gold is in the segmentation. Your blended CAC might look perfectly healthy, but it could be hiding one channel that’s wildly profitable and another that’s just burning cash.

For instance, your CAC from organic search might be $50, while your paid social ads are costing you $250 per customer. Without breaking it down, you'd never see the obvious opportunity to shift your spend for a much better return. For anyone serious about budget optimization, analyzing CAC per channel is non-negotiable.

How Does Geography Impact My CAC?

This is a big one that often gets overlooked. Your acquisition costs can swing wildly from one region to another.

Things like market saturation, the number of local competitors, and even average consumer income all play a huge role. It’s exactly why a one-size-fits-all marketing campaign rarely works when you go national, let alone global.

A great example of this is the average cost per install (CPI) for mobile apps, which is a key part of CAC for many businesses. In North America, the average CPI was $5.28. But in Europe (EMEA) and Asia-Pacific (APAC), those costs were way lower at $1.03 and $0.93, respectively.

Those numbers make it pretty clear why understanding your regional performance is critical. You can dig into more global acquisition cost trends to see how your target markets stack up.

Is It Possible for CAC to Be Too Low?

It sounds a bit crazy, but yes, a super-low CAC can actually be a red flag.

While efficiency is always the goal, a rock-bottom CAC might mean you aren't investing enough to actually grow. It could be a sign that you're only targeting a tiny, easy-to-reach niche and leaving massive market opportunities on the table.

It could also mean you're acquiring low-quality customers—the kind who sign up for a deal and churn out a month later, giving you a very low lifetime value (LTV). The real goal isn't just the lowest possible CAC; it's finding an optimal CAC that fuels sustainable, profitable growth by bringing in the right kind of high-value customers.

Ready to move from spreadsheets to strategy? marketbetter.ai integrates all your marketing data to give you a clear, real-time view of your acquisition costs and campaign performance. See how our AI-powered platform can help you optimize your marketing spend and drive profitable growth. Explore the marketbetter.ai platform today.