Top Marketing Budget Allocation Best Practices for 2025

In 2025, allocating your marketing budget effectively isn't just a financial exercise; it's a critical strategic advantage. The difference between a thriving marketing engine and a stalled one often comes down to how and where you invest each dollar. Making the right choices means the difference between capturing market share and losing ground to more agile competitors.

This guide moves beyond generic advice to provide a clear, actionable roundup of eight proven marketing budget allocation best practices. We will compare distinct methodologies, from data-driven historical analysis to the versatile 70-20-10 rule and agile, rebalanced approaches. You will learn not just what these strategies are, but how to implement them with practical steps and real-world examples.

Whether you're a startup founder, a demand generation manager, or a CMO, these insights will help you build a resilient and high-performing budget framework. For instance, a fundamental aspect of marketing budget allocation best practices involves carefully assessing how to approach determining your Google Ads budget to align with overall business objectives. By mastering these techniques, you'll be equipped to optimize spend, maximize ROI, and make smarter, data-informed decisions that drive sustainable growth.

1. Data-Driven Budget Allocation Based on Historical ROI Analysis

The most fundamental of all marketing budget allocation best practices is grounding your decisions in hard data. Instead of relying on assumptions or replicating last year’s plan, this method involves a systematic analysis of historical performance metrics. By examining past return on investment (ROI), customer acquisition cost (CAC), and customer lifetime value (LTV) across every channel, you can confidently direct funds toward strategies with proven success and away from those that underperform.

This approach transforms budgeting from a guessing game into a strategic, evidence-based exercise. It ensures that every dollar is invested with a clear expectation of returns, maximizing efficiency and minimizing wasted spend. Compare this to a "gut-feel" approach, which often leads to overfunding familiar but inefficient channels while overlooking hidden high-performers.

How It Works in Practice

The core principle is simple: fund what works. For example, after a thorough ROI analysis, HubSpot famously shifted 60% of its budget from traditional trade shows to its content marketing engine. The data revealed that content generated leads with three times better quality at a fraction of the cost, a clear signal for reallocation.

Similarly, a company like Warby Parker might analyze its campaign data and discover that its Instagram ad campaigns have a 25% lower CAC than its programmatic display ads. In response, they would strategically increase their social media advertising budget by 40% for the next quarter to capitalize on that efficiency. This data-backed pivot is far more effective than simply spreading the budget evenly across both channels.

Actionable Implementation Tips

To effectively implement data-driven allocation, follow these steps:

- Implement Robust Attribution Modeling: Don't just credit the last click. Action: Use multi-touch attribution models (linear, time-decay, or U-shaped) to understand the full customer journey and assign proper value to each touchpoint. This prevents you from undervaluing top-of-funnel channels that assist conversions.

- Standardize Your ROI Calculations: Ensure you use the same formula to calculate ROI across all channels, from paid search to email marketing. Action: Create a shared document defining the ROI formula

((Net Return - Marketing Cost) / Marketing Cost) * 100and ensure all teams use it for reporting. This creates a level playing field for direct comparison, preventing apples-to-oranges evaluations. - Analyze at Least 12 Months of Data: Using a full year of performance data helps smooth out anomalies and account for seasonality. Action: Pull the last 12-18 months of data from your analytics platform. A spike in sales for a retailer in Q4 doesn't mean that channel is superior year-round; historical context is crucial.

- Automate Your Dashboards: Utilize tools like Google Analytics, HubSpot, or Salesforce Marketing Cloud to create real-time reporting dashboards. Action: Set up a dashboard that pulls key metrics (CAC, CPL, ROI by channel) automatically. This allows for continuous monitoring and agile budget adjustments rather than waiting for quarterly reviews.

2. The 70-20-10 Budget Allocation Rule

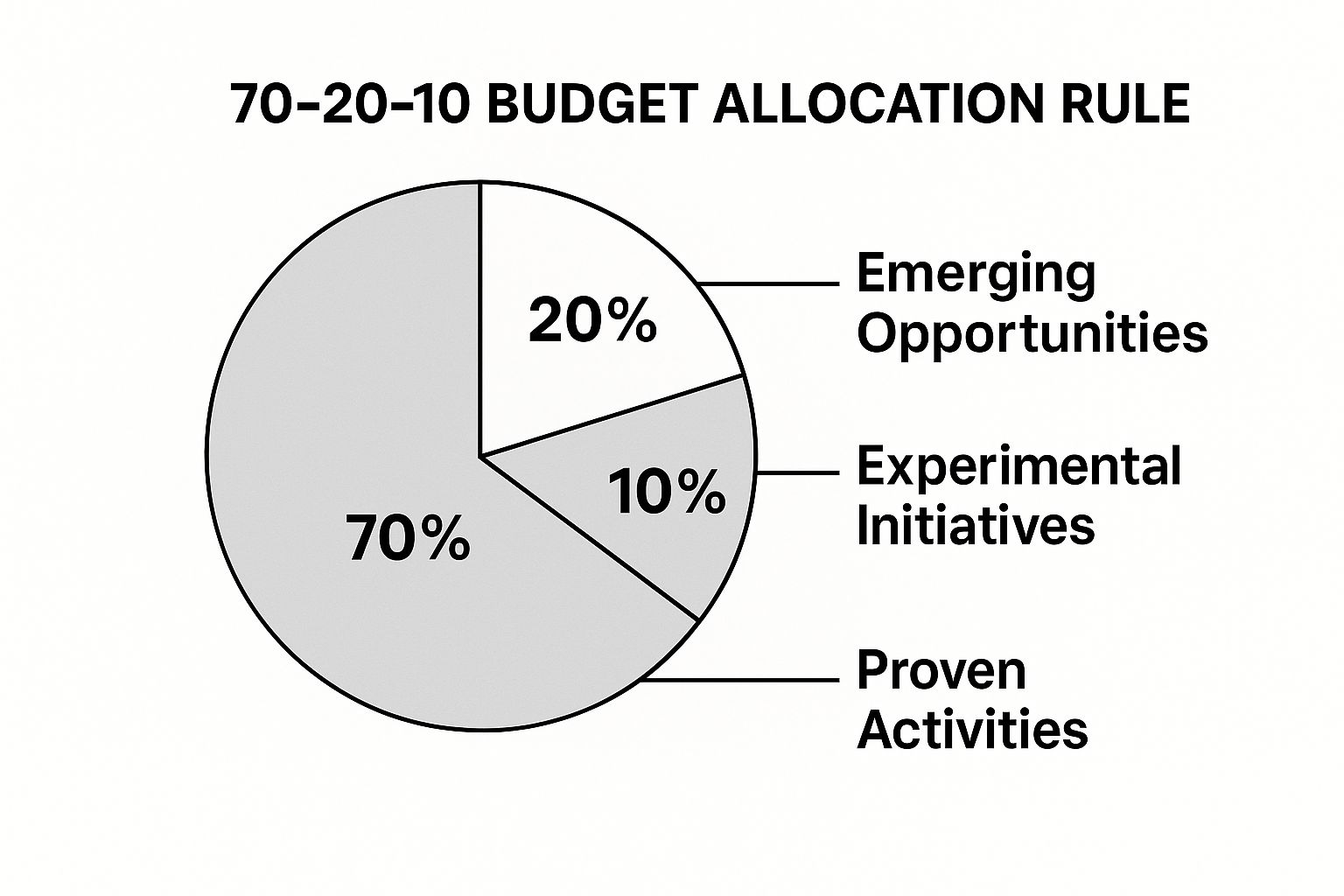

One of the most effective marketing budget allocation best practices is to adopt a framework that balances stability with innovation. The 70-20-10 rule provides exactly that: a structured approach to ensure you're protecting your core revenue drivers while simultaneously exploring future growth opportunities. It divides your budget into three distinct categories, preventing over-investment in unproven tactics and under-investment in game-changing experiments.

This model, famously used by Google, guides you to allocate 70% to proven, low-risk activities, 20% to emerging opportunities, and 10% to high-risk experiments. This creates a portfolio that ensures consistent performance today while seeding the ground for tomorrow’s breakthroughs. This structured approach is a clear contrast to chaotic, "shiny object" budgeting where funds are unpredictably diverted to the latest trend without a clear strategy.

The following pie chart visualizes this strategic split, showing how the majority of funds support core strategies while a significant portion is reserved for innovation and growth.

This visual breakdown clearly illustrates the balanced approach, with the largest slice dedicated to reliable, established marketing channels that form the bedrock of your strategy.

How It Works in Practice

The principle is to create a diversified portfolio of marketing investments. For example, Airbnb might allocate 70% of its budget to proven channels like performance marketing (Google Ads, Meta Ads) and established SEO practices. The next 20% could be directed toward expanding brand awareness campaigns on newer platforms like TikTok or investing in high-production value video content. The final 10% might be used for experimental community-building initiatives or testing nascent AI-driven advertising tools.

Similarly, Coca-Cola might dedicate 70% to traditional TV and outdoor advertising, 20% to scaling up its digital and social media marketing, and 10% to pioneering new technologies like augmented reality experiences or NFT-based loyalty programs.

Actionable Implementation Tips

To effectively implement the 70-20-10 rule, follow these steps:

- Clearly Define Each Category: Action: Create a spreadsheet listing all your marketing activities. Add a column and categorize each one as "Proven," "Emerging," or "Experimental." Proven channels should have at least 12 months of consistent, positive ROI data. Emerging channels might have promising early results but lack long-term validation.

- Set Different Success Metrics: Don't judge experiments by the same ROI standards as your core channels. Action: For the 70% bucket, set KPIs like CAC and ROAS. For the 10% bucket, set learning-based KPIs like engagement rates, user feedback scores, or lead quality.

- Create a Graduation Path: Regularly review your activities. Action: Hold a quarterly review where you decide if an experimental tactic (10%) should be promoted to the emerging bucket (20%) or an emerging channel should become a core part of your proven strategy (70%). For instance, once you validate your experimental channels, you can improve conversion rates by applying AI-powered lead scoring to qualify the new influx of leads.

- Remain Flexible with Percentages: The 70-20-10 rule is a guideline, not a rigid law. Action: If you are a startup in a rapid growth phase, consider adjusting to a 60-30-10 model to be more aggressive. In contrast, a mature, risk-averse company might prefer an 80-15-5 split.

3. Channel Diversification Strategy

Channel diversification involves strategically spreading your marketing budget across multiple channels to reduce risk, maximize reach, and engage prospects at every stage of the buying journey. Rather than leaning heavily on a single platform—a high-risk approach known as putting "all your eggs in one basket"—this strategy balances investments in social media, paid search, email, events, and more. It creates multiple touchpoints that adapt to shifting audience behaviors and ensures you’re not left vulnerable if one channel underperforms. As one of the top marketing budget allocation best practices, diversification drives resilience and long-term growth.

How It Works in Practice

In practice, brands like Nike maintain a presence across social media, influencer partnerships, traditional advertising, retail collaborations, and direct-to-consumer channels. This mix lets them capture customers at awareness (TV ads), consideration (Instagram Stories), and purchase (Nike app notifications).

Peloton balances spend on connected TV, social media, influencer partnerships, retail showrooms, and referral programs. When Facebook ad costs spiked, Peloton shifted 20 percent of that budget into CTV pilots and saw a 15 percent drop in acquisition cost. This agility is impossible with a single-channel strategy.

Actionable Implementation Tips

- Action: Start with 3–4 core channels before expanding to avoid diluting resources and focus your efforts effectively.

- Action: Create a brand style guide to maintain consistent messaging while tailoring creative to each platform’s unique format (e.g., vertical video for TikTok, carousels for Instagram).

- Action: Implement a UTM tracking system and a multi-touch attribution model in your analytics platform to measure cross-channel impact accurately.

- Action: Allocate a test budget (5-10%) for small pilot campaigns on new channels, then scale winners by reallocating 30–50% of an underperforming channel's budget.

- Action: Schedule a quarterly channel audit in your team calendar to formally review performance and reallocate funds from underperforming tactics.

By following this channel diversification strategy, you’ll build a robust, flexible marketing mix that withstands platform shifts, optimizes ROI, and aligns with leading marketing budget allocation best practices.

4. Customer Journey-Based Budget Mapping

Instead of focusing solely on channels, this advanced strategy allocates funds across the different stages of the customer lifecycle. This method ensures you invest appropriately at each phase of the buying process, from initial awareness to post-purchase retention. By mapping your marketing budget allocation to the customer journey, you create a balanced, holistic experience that nurtures leads from prospects into loyal brand advocates.

This approach prevents the common pitfall of over-investing in top-of-funnel acquisition while neglecting the crucial mid-funnel consideration and bottom-funnel conversion stages. Compare this to a channel-based model that might overfund Google Ads (bottom-funnel) while starving the blog and social media channels (top/mid-funnel) that create demand in the first place.

How It Works in Practice

The core principle is to fund the entire customer lifecycle, not just the first touchpoint. For instance, Mailchimp might allocate its budget to support its journey-centric model: 35% on awareness (educational content, podcasts), 25% on consideration (feature comparisons, webinars), 25% on conversion (free trial optimization), and 15% on expansion (premium feature promotion to existing users).

Similarly, Salesforce is known for its massive investment in the awareness stage through its Dreamforce events and thought leadership content. It then allocates significant budget to the consideration and decision stages with targeted product demos and free trials, and finally invests heavily in retention and loyalty through its Trailhead educational platform.

Actionable Implementation Tips

To effectively map your budget to the customer journey, follow these steps:

- Create Detailed Customer Journey Maps: Action: Hold a workshop with sales and marketing teams to visually map out every touchpoint, from the first ad a prospect sees to the post-purchase follow-up email. This map becomes the blueprint for your budget.

- Assign Different Metrics to Each Stage: Action: Define your KPIs for each stage. For Awareness, track brand search volume and reach. For Consideration, track webinar sign-ups or case study downloads. For Decision, track conversion rates.

- Survey Customers to Validate Your Map: Don't rely solely on assumptions. Action: Use a tool like SurveyMonkey or Typeform to ask new customers how they heard about you and what influenced their decision. Their feedback might reveal critical touchpoints you've overlooked.

- Use Progressive Profiling: Action: Configure your marketing automation forms to ask for more information over time (e.g., ask for company size on the second download). This helps you accurately identify where they are in their journey and allows for more precise, stage-specific marketing efforts.

5. Agile Budget Allocation with Regular Rebalancing

Agile budget allocation involves setting aside a portion of your marketing budget for rapid deployment based on real-time performance data and emerging market opportunities. Rather than locking funds into an annual plan, teams conduct monthly or quarterly reviews and shift spend toward high-momentum channels. This ensures you’re always investing where ROI is peaking, not where projections once indicated.

How It Works in Practice

The key principle is continuous rebalancing. For example:

- Spotify reallocates up to 20% of its ad spend each month, moving budget between North America and Europe by comparing user acquisition cost (UAC) in real time.

- Uber shifts digital ad spend between regions when competitor promotions or regulatory changes drive spikes in CPC.

- Zoom rapidly redeployed 25% of its budget into performance channels during early COVID-19 lockdowns, capturing surging demand almost overnight.

Comparing a static annual plan to this agile approach highlights dramatic differences. Static budgeting can leave you overspending on underperforming channels for months. Agile allocation fixes that by treating your budget as a living document—always tuned to current metrics.

Actionable Implementation Tips

To adopt agile rebalancing, follow these steps:

- Action: Reserve 15%–25% of your total budget as a "flex fund" for flexible allocation, ensuring you have room to pivot quickly.

- Action: Set clear triggers for reallocation. For example: "If CPA on LinkedIn Ads increases by over 20% for 7 consecutive days, we reallocate 50% of its remaining monthly budget to Google Ads."

- Action: Automate real-time dashboards with tools like Google Data Studio or Looker to monitor key metrics and your defined triggers.

- Action: Establish fast approval workflows so budget shifts under a certain amount (e.g., $5,000) can be signed off by a manager within hours, not days.

- Action: Maintain a base budget for long-term brand and SEO initiatives to avoid sacrificing stability for short-term gains.

For more on dynamic spending models, Learn more about Agile Budget Allocation with Regular Rebalancing on marketbetter.ai.

When and Why to Use This Approach

Use agile allocation when you operate in fast-moving markets or run multiple concurrent campaigns. It’s ideal for performance-driven teams that need to capitalize on real-time trends, seasonal spikes, or competitor moves. This practice maximizes ROI by ensuring your spend aligns continuously with the highest performing channels.

6. Competitive Intelligence-Informed Budget Allocation

Another one of the most effective marketing budget allocation best practices involves looking outside your organization to inform what happens inside. This method uses systematic competitive intelligence to guide spending decisions, turning your rivals' actions into a strategic roadmap. By monitoring competitor marketing activities, spending patterns, and channel mix, you can identify market gaps, anticipate threats, and capitalize on opportunities they miss.

This approach shifts your budget from a reactive stance to a proactive, strategic offensive. In contrast to an internally focused budget, which can create blind spots, a competitor-informed model ensures your marketing dollars are positioned to win market share and neutralize competitive threats.

How It Works in Practice

The core principle is to invest where you can gain a competitive edge. For example, Samsung famously allocates a significant portion of its mobile advertising budget to coincide with Apple product launches. By bidding heavily on related keywords, they capture high-intent search traffic and directly challenge Apple for attention at a critical moment.

Similarly, Slack strategically ramped up its investment in content marketing and SEO after its competitive intelligence revealed that Microsoft Teams was underinvesting in thought leadership. This allowed Slack to dominate conversations around the future of work, solidifying its brand authority and capturing organic traffic that its larger competitor was ignoring.

Actionable Implementation Tips

To effectively implement competitive intelligence-informed allocation, follow these steps:

- Utilize Competitive Analysis Tools: Action: Use platforms like SEMrush, Ahrefs, and SimilarWeb to run reports on 3-5 top competitors. Analyze their traffic sources, top-performing keywords, and ad copy to pinpoint their primary channels.

- Monitor Strategic Signals: Go beyond marketing campaigns. Action: Set up alerts to track competitor job postings (e.g., a "Head of TikTok Marketing" signals a new channel focus) and use a tool to analyze their customer reviews to identify service gaps you can exploit.

- Analyze Messaging and Positioning: Action: Once a month, review the homepages, blog content, and social media themes of your top competitors. This helps you identify gaps in market positioning, allowing you to allocate budget toward a unique brand voice.

- Set Up Real-Time Alerts: Action: Use tools like Google Alerts and social media monitoring software (e.g., Brand24) to track mentions of your competitors in real time. This allows you to react swiftly to new campaigns, product launches, or PR crises.

7. Lifetime Value to Customer Acquisition Cost (LTV:CAC) Optimization

Moving beyond short-term ROI, this advanced strategy centers on maximizing long-term profitability. LTV:CAC optimization involves allocating your marketing budget based on the ratio between a customer's lifetime value (LTV) and the cost to acquire them (CAC). By prioritizing channels and segments that yield a higher LTV:CAC ratio, you build a more sustainable and profitable growth engine.

This approach shifts the focus from simply minimizing acquisition costs to investing in customers who will deliver the most value over time. For example, a campaign with a $50 CAC is not necessarily worse than one with a $25 CAC. If the first campaign acquires customers with an LTV of $500 (10:1 ratio) and the second acquires customers with an LTV of $100 (4:1 ratio), the more "expensive" channel is actually more profitable. To effectively optimize your marketing budget for maximum ROI, a fundamental understanding of your customer acquisition cost is essential. For a deeper dive, you can explore this guide on What Is Customer Acquisition Cost Explained.

How It Works in Practice

The goal is to invest in profitable relationships, not just cheap leads. For example, Netflix allocates more marketing spend to channels that acquire subscribers with higher retention rates, even if the initial CAC is slightly higher. A user acquired via a targeted content partnership may cost more upfront but has a lower churn rate, resulting in a superior LTV:CAC ratio compared to a low-cost, low-intent click from a generic display ad.

Similarly, Shopify might discover that acquiring enterprise-level customers through high-touch sales and account-based marketing has a much higher CAC. However, the significantly greater LTV of these clients creates a far more attractive LTV:CAC ratio, justifying a larger budget allocation to these more expensive, higher-value channels.

Actionable Implementation Tips

To effectively implement LTV:CAC optimization, follow these steps:

- Segment Your Ratios: Don't use a single, blended LTV:CAC ratio. Action: Calculate LTV:CAC for each acquisition channel (e.g., Google Ads vs. Organic Search), customer segment (e.g., SMB vs. Enterprise), and even geographic region to uncover hidden pockets of profitability.

- Establish a Minimum Threshold: Action: Set a clear minimum LTV:CAC ratio for continued investment, typically 3:1 for healthy SaaS businesses. Channels or campaigns that fall below this benchmark should be flagged for re-evaluation in your next budget review.

- Include All Acquisition Costs: Your CAC calculation must be comprehensive. Action: Create a checklist of all costs to include in your CAC formula: ad spend, salaries for marketing/sales teams, software costs, and any agency fees.

- Regularly Update LTV Calculations: Customer behavior and retention rates change over time. Action: Schedule a quarterly or bi-annual task to update your LTV models with fresh data. This ensures your budget decisions are based on current reality, not outdated assumptions. You can also leverage modern tools to supercharge this process; learn more about using AI content analysis to better understand customer value drivers.

8. Seasonality and Market Timing-Based Allocation

Adjusting marketing spend based on seasonal trends and market timing is a core element of marketing budget allocation best practices. By aligning your budget with predictable peaks and troughs, you seize high-conversion windows and avoid wasteful spend during slow periods.

This strategy relies on analyzing historical data to pinpoint when consumers are most active. A static, evenly-spread budget will underperform compared to a dynamic one that concentrates resources at exactly the right moment and even leverages off-peak advantages when competition eases and costs drop.

How It Works in Practice

The process begins with a deep dive into at least three years of performance data. Retailers like Target often allocate 40–50% of their annual marketing budget to Q4 holiday shopping, while TurboTax concentrates 70% of spend between January and April during tax season. Fitness brands such as Peloton ramp up campaigns in January for New Year resolutions and pull back in summer months when demand dips. Similarly, B2B software firms typically cut budgets in December and August when decision-makers are offline.

Comparing these approaches reveals two tactics:

- Peak-Period Maximization - Invest heavily when demand spikes to capture maximum market share.

- Counter-Cyclical Positioning - Test modest budgets in off-peak windows to capture lower CPMs and reduced competition.

Actionable Implementation Tips

-

Action: Analyze 3+ years of Google Analytics or sales data

Identify consistent monthly or quarterly patterns to avoid being misled by one-off anomalies. -

Action: Blend industry and brand cycles

Create a calendar that overlays sector-wide trends (e.g., Black Friday) with your own historical sales peaks and lulls. -

Action: Set creative production deadlines 8–12 weeks before peak seasons

This ensures high-quality assets are ready and prevents last-minute rushes. -

Action: Allocate 10–15% of your experimental budget to test counter-cyclical ads and measure their cost-efficient reach.

-

Action: Schedule a pre-season kickoff meeting to sync marketing spend with sales, operations, and customer service to manage seasonal capacity.

Using seasonality and market timing-based allocation enhances efficiency, maximizes conversion, and ensures your marketing budget adapts to real-world rhythms rather than static plans.

Marketing Budget Allocation Strategies Comparison

| Budget Allocation Method | Implementation Complexity 🔄 | Resource Requirements 🔄 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Data-Driven Budget Allocation Based on Historical ROI Analysis | High – Needs robust data & analytics expertise | High – Requires analytics infrastructure | Maximizes ROI; predictable forecasting | Companies with sufficient historical data | Reduces guesswork; focus on proven channels |

| The 70-20-10 Budget Allocation Rule | Medium – Framework is simple, but requires discipline | Medium – Easy to implement across teams | Balanced growth and innovation | Businesses balancing stability and experimentation | Balances risk & innovation; easy to understand |

| Channel Diversification Strategy | High – Managing multiple channels increases complexity | High – More resources and expertise required | Risk reduction; broader reach | Brands wanting multi-channel presence | Reduces dependence on single channel; cross-channel synergy |

| Customer Journey-Based Budget Mapping | High – Requires deep customer insights | Medium to High – Needs customer journey mapping | Balanced nurture and conversion across stages | Businesses focusing on full lifecycle marketing | Optimizes spend by journey stage; improves experience |

| Agile Budget Allocation with Regular Rebalancing | High – Demands frequent analysis and agility | High – Continuous monitoring and decision making | Rapid response and optimization | Fast-moving markets with shifting opportunities | Enables quick adaptation; reduces waste |

| Competitive Intelligence-Informed Budget Allocation | Medium to High – Needs ongoing competitor analysis | Medium to High – Requires competitive intelligence tools | Strategic advantage; market-aware allocation | Highly competitive markets seeking edge | Provides market context; identifies gaps |

| Lifetime Value to Customer Acquisition Cost (LTV:CAC) Optimization | High – Sophisticated analytics and data integration | High – Requires detailed tracking & segment analysis | Maximizes long-term profitability | Subscription and SaaS companies focusing on unit economics | Focuses on profitable customer segments; sustainable growth |

| Seasonality and Market Timing-Based Allocation | Medium – Needs historical data analysis | Medium – Requires forecasting & coordination | Maximizes impact during peak periods | Seasonal industries like retail, finance, travel | Aligns spend with market cycles; reduces waste |

Next Steps: Putting These Practices into Action

We've explored eight powerful marketing budget allocation best practices, moving from foundational data analysis to sophisticated, agile frameworks. The journey from a reactive, gut-feel approach to a strategic, data-informed allocation model is the single most significant lever you can pull to maximize marketing ROI. Remember, the goal isn't just to spend money; it's to invest every dollar with precision and purpose.

A reactive budget often pours funds into familiar but underperforming channels, while a strategic budget is dynamic, predictive, and ruthlessly efficient. By embracing these principles, you shift from simply funding activities to architecting growth.

Synthesizing Your Strategy: Key Takeaways

The most successful marketing leaders don't just pick one method; they build a hybrid model tailored to their unique business context. Let's recap the core themes and how they interconnect:

-

Foundation First: Always start with Data-Driven Allocation (Practice #1) and LTV:CAC Optimization (Practice #7). These aren't just best practices; they are non-negotiable prerequisites for intelligent spending. Without understanding past performance and unit economics, every other decision is a guess.

-

Framework for Growth: Layer the 70-20-10 Rule (Practice #2) on top of your data foundation. This framework provides a disciplined structure for balancing proven tactics (your 70%), emerging opportunities (your 20%), and high-risk, high-reward experiments (your 10%). It ensures you exploit current wins while actively searching for future ones.

-

Dynamic and Responsive Allocation: True mastery comes from being agile. Implement Agile Budget Rebalancing (Practice #5) and adjust allocations based on Seasonality (Practice #8). This transforms your budget from a static annual document into a living, breathing tool that responds to real-time market signals and performance data. Compare this to a rigid, set-it-and-forget-it plan that quickly becomes obsolete.

-

Audience and Market Centricity: Finally, ensure your budget is aligned with your customers and competitors. Use Customer Journey Mapping (Practice #4) to fund every touchpoint effectively and leverage Competitive Intelligence (Practice #6) to identify gaps and opportunities your rivals are missing.

Your Action Plan for Smarter Budgeting

Transforming your approach from theory to practice can feel daunting, but you can start today with a few focused steps.

- Conduct a Performance Audit: Before planning your next quarter, pull performance data from all active channels. Calculate the ROI and CAC for each one. This initial analysis is your new baseline.

- Map Your Customer Journey: Whiteboard the typical path a customer takes from awareness to purchase and advocacy. Identify which channels and content assets support each stage. Are there glaring gaps in your funding?

- Pilot the 70-20-10 Model: For one specific campaign or product line, formally allocate your budget using this rule. Designate a small portion for an experimental channel you've been hesitant to try.

- Schedule a Monthly Budget Review: Put a recurring meeting on the calendar with key stakeholders. The goal is simple: review performance against targets and decide if any funds need to be reallocated. This simple habit enforces the agility needed for modern marketing.

Mastering these marketing budget allocation best practices is not a one-time task but an ongoing discipline. It's the critical link between your marketing efforts and tangible business outcomes like revenue growth, market share, and profitability. By adopting a more strategic, data-driven, and agile mindset, you empower your team to not just execute campaigns, but to drive predictable and scalable success.

Ready to move beyond spreadsheets and guesswork? marketbetter.ai harnesses the power of AI to automate ROI analysis, model allocation scenarios, and provide real-time rebalancing recommendations based on live performance data. Stop guessing and start investing with confidence by visiting us at marketbetter.ai.