A Clear Target Account Selling Definition for B2B Sales

Target Account Selling (TAS) is a B2B sales strategy that forces your team to stop chasing everything that moves and instead focus its energy on a handpicked group of high-value accounts. It’s a complete shift from the traditional volume game. Instead of blasting out a thousand emails, TAS is about quality over quantity, focusing every ounce of your resources on companies that are a perfect fit for your Ideal Customer Profile (ICP).

What Is Target Account Selling and Why It Matters

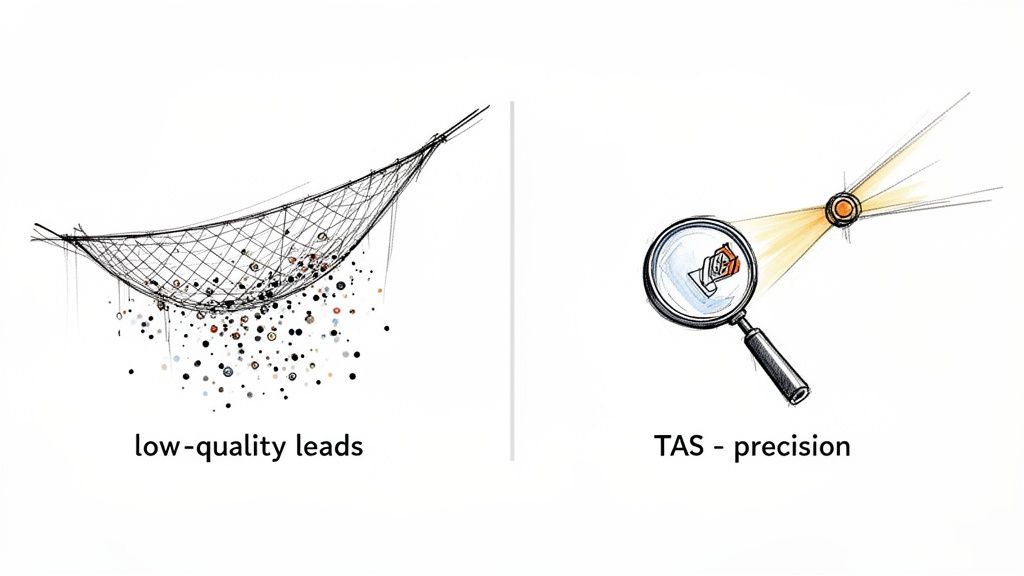

Think about the old-school sales floor. The mantra was always "more." More calls, more emails, more leads. It’s like casting a giant fishing net and hoping you catch something worthwhile, but you spend most of your day sorting through junk. This "spray and pray" model is exhausting and inefficient, burning out reps on leads that were never going to close.

Target Account Selling flips that script entirely. Your team doesn't cast a net; they become spear fishers. They identify the biggest, most valuable fish in the sea and go after them with precision and patience. It’s a deliberate, strategic, and frankly, much smarter way to run a sales operation.

The Problem with Traditional Sales

The biggest issue with the volume-based approach is just how much time it wastes. Sales reps historically spend a measly 28% of their time actually selling. The rest of the week? It's buried in admin tasks, CRM updates, and chasing down leads that have a low probability of ever converting.

TAS tackles this problem head-on. By making sure every single account on your team's list has a high potential for success, you dramatically increase the time they spend on what actually matters: building relationships and closing deals.

Target Account Selling isn't about finding more leads. It's about winning the right accounts. It turns sales from a reactive numbers game into a proactive, revenue-driven machine.

Target Account Selling vs Traditional Outbound At a Glance

To really get why TAS is so effective, it helps to see it side-by-side with the old way of doing things. The first step in TAS is always identifying those high-value accounts, and modern tools can make this much easier—for instance, a solid guide on social listening for B2B lead generation can give your team a real edge.

Here’s a quick comparison to make the differences crystal clear.

| Attribute | Target Account Selling (TAS) | Traditional Outbound |

|---|---|---|

| Focus | Quality of accounts over quantity | High volume of leads |

| Approach | Personalized and research-driven | Standardized and scripted |

| Sales Cycle | Often shorter due to high relevance | Can be long and unpredictable |

| Resources | Concentrated on a select list | Spread thinly across many leads |

| Outcome | Higher contract values, better win rates | Lower conversion rates, smaller deals |

Ultimately, adopting TAS means your team finally stops wasting cycles on dead ends. Instead, they start building a real, meaningful pipeline with accounts that can actually move the needle for your business.

Target Account Selling vs. Account-Based Selling

You’ve probably heard “Target Account Selling” (TAS) and “Account-Based Selling” (ABS) thrown around, sometimes even in the same sentence. They sound almost identical, but mixing them up is a classic way to get sales and marketing moving in different directions.

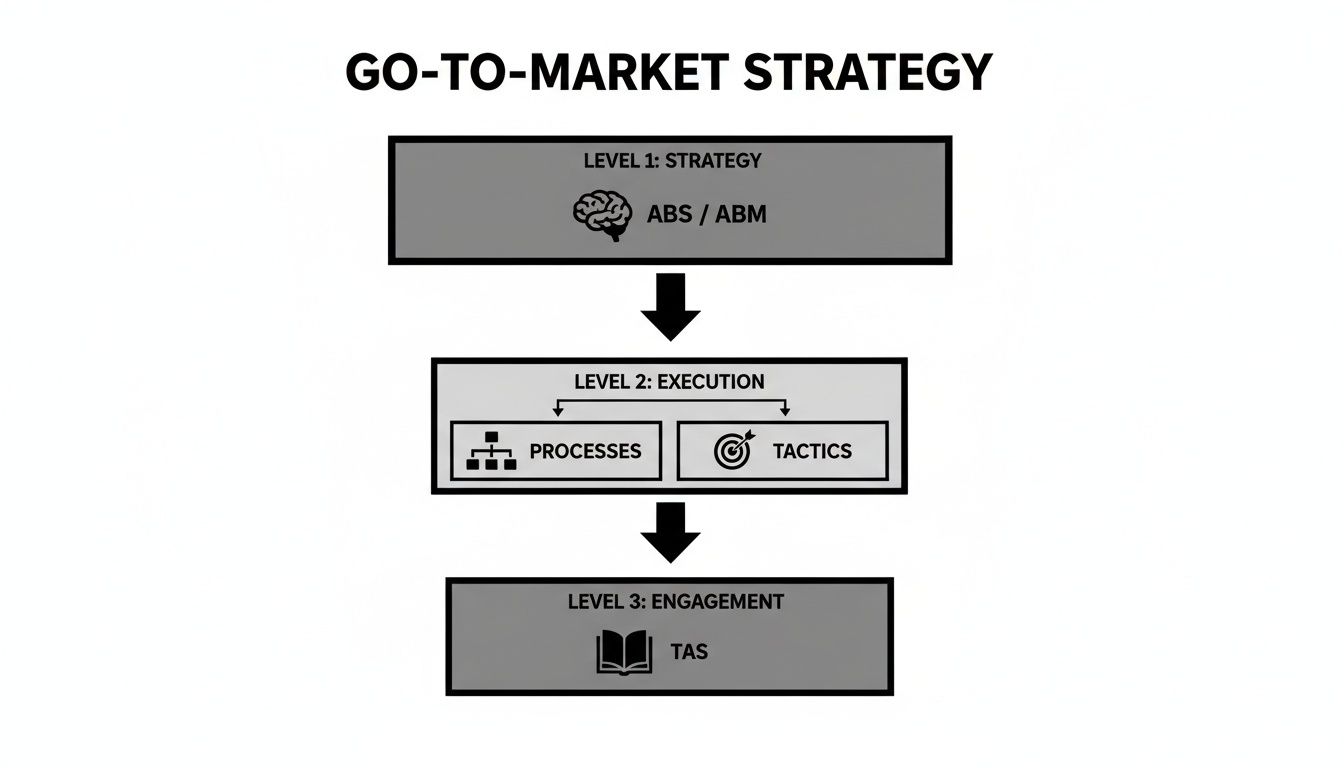

It’s actually pretty simple. One is the strategy, the other is the execution.

Account-Based Selling, and its marketing twin, account-based marketing (ABM), is the overarching strategy. It’s the game plan. This is the high-level thinking where your revenue team decides which high-value companies are a perfect match for what you sell. It’s the blueprint that tells everyone which accounts matter most.

Target Account Selling is the tactical execution. It’s the playbook your team runs to actually crack into those accounts and win them. TAS is the boots-on-the-ground action plan that turns a name on a list into a real, closed-won deal.

How Strategy and Tactics Work in Harmony

Let's make this real. Imagine your company decides to go after a massive enterprise client, let's call them "Global Tech Inc."

-

The ABS/ABM Strategy (The "What"): Your revenue team uses data to flag Global Tech Inc. as a top-tier target. Marketing gets to work, designing a hyper-specific ad campaign, spinning up a custom landing page, and hosting a webinar that speaks directly to the pains of their industry. They're warming up the target.

-

The TAS Execution (The "How"): Now that marketing has provided the air cover, the sales team’s TAS playbook kicks in. An SDR launches a multi-threaded outreach cadence, hitting up the VP of Engineering and a Director of Operations on LinkedIn and email, referencing the webinar they just attended. The Account Executive then steps in with deep research to build a custom demo that solves Global Tech’s specific, known problems.

One can't exist without the other. Marketing’s strategic work makes the sales team’s tactical assault much more effective.

Think of it like a football game. The head coach’s game plan is the ABS/ABM strategy—they've studied the opponent, identified weaknesses, and drawn up the plays. Target Account Selling is the quarterback and the offense on the field, executing those specific plays to put points on the board.

Why This Distinction Actually Matters for Your Team

When you clearly define these roles, the friction between sales and marketing just melts away.

Marketing knows its job is to strategically warm up the right accounts. Sales knows its job is to execute a surgical TAS playbook on those warmed-up accounts. This creates a powerful, unified go-to-market motion.

Your whole operation becomes more efficient. Marketing isn't burning budget spraying ads everywhere, and sales isn’t wasting precious time on cold accounts that have no idea who you are. To see this flow in action, check out these real-world account-based marketing campaign examples that bring this strategic-to-tactical handoff to life.

Ultimately, TAS provides the actionable framework that turns the big-picture promise of ABS into reality, driving deeper engagement and much higher win rates.

The Four Pillars of a Winning TAS Strategy

Moving from theory to practice is where the real work begins. A winning Target Account Selling (TAS) strategy isn't built on luck; it's a machine built on four pillars that guide your team from picking the right targets to closing the deal. This is how your sales team stops reacting and starts proactively hunting.

This framework shows you exactly how TAS fits into the bigger picture. It’s the tactical execution layer that lives right under your high-level Account-Based Selling strategy.

Think of it this way: the Account-Based strategy points you toward the right mountain. TAS is the detailed map your sales team uses to climb it.

Pillar 1: Strategic Account Selection

The whole game is won or lost here. You have to choose the right accounts to go after. This isn’t about letting reps pick their favorite logos from a list. It’s a data-driven hunt for accounts with the highest chance of closing and the biggest potential payoff.

The selection process has to go way beyond basic details like industry or company size. Modern teams blend multiple data points to build a potent Target Account List (TAL).

- Firmographic and Technographic Fit: First, the basics. Does the account look like your Ideal Customer Profile (ICP)? Think size, industry, location, and—critically—the tech they already use.

- Buying Intent Signals: Are they already out there looking for a solution like yours? This is where understanding what is intent data becomes a superpower. It tells you who’s in-market right now.

- Behavioral Triggers: Have people from the account been poking around your website, downloading whitepapers, or clicking on your ads? These are breadcrumbs you can’t afford to ignore.

When you mix these ingredients, you’re not guessing anymore. You’re building a target list based on hard evidence, giving your sales team a head start before they even send the first email.

Pillar 2: Deep Account Intelligence

Once your list is locked in, it’s time to go deep. Just knowing a company’s name and industry is table stakes. That leads to the kind of generic outreach that gets deleted on sight. Real TAS demands that your team becomes an expert on every single account.

This means mapping the entire organization. You need to understand its structure, its culture, and even its internal politics to figure out who really holds the power. The goal isn't to find one contact; it's to map the entire buying committee.

A rookie mistake is aiming only for the C-suite. The truth is, deals are made by a committee—a mix of decision-makers, champions who will fight for you internally, and influencers who have the boss’s ear.

Good intelligence work answers the critical questions:

- Who are the key players and what do they actually care about?

- What are the company’s biggest strategic goals for the next quarter?

- What specific pains are they feeling that your solution can fix?

This is the fuel for truly personal and effective engagement.

Pillar 3: Personalized, Multi-Threaded Engagement

With a smart target list and deep intel, your team is finally ready to make a move. And this is where TAS really breaks from the old playbook. Forget one rep sending a canned email to one person. We're talking about a coordinated, multi-threaded attack.

Multi-threading is simple: you build relationships with multiple people inside the target account at the same time. This strategy builds consensus, saves the deal if your main contact leaves, and speeds up the entire sales cycle by getting everyone on board faster.

The outreach itself has to be sharp and hyper-personalized. You use the intelligence you gathered to craft messages that hit home. A lazy "I saw you're the VP of X" is a waste of everyone's time. Good personalization talks about their specific company projects, recent news, or challenges you know they’re facing. It proves you’ve done your homework.

Pillar 4: Consistent Measurement and Optimization

The last pillar is what keeps the engine running and improving. You can't manage what you don't measure. In a TAS world, old-school sales metrics like call volume and emails sent become background noise. What really matters are metrics that show you’re making progress inside your target accounts.

The shift to this model has paid off massively for B2B companies. As Account-Based Marketing took hold, 76% of companies adopted a TAS-style approach to fuel their growth. The results speak for themselves: teams saw a 30% average revenue increase when focusing on high-value accounts. Some even cut their sales cycles by 33% and saw win rates jump from 12% to 25%.

These pillars are the key to those wins. A top SaaS company even reported a 41% increase in pipeline velocity after implementing a similar framework.

For a modern TAS program, you should be tracking KPIs like these:

- Account Engagement Score: How many of your key contacts are actually interacting with your team?

- Pipeline Velocity: How fast are target accounts moving from one stage to the next?

- Meetings Booked within Target Accounts: Are you getting in front of the right people?

- Win Rate for Target Accounts: When you go after these accounts, are you winning?

By keeping a close eye on these numbers, you can spot what’s working, ditch what isn’t, and turn your TAS strategy into a predictable revenue machine.

The Payoff: What Target Account Selling Actually Does for Your Business

Switching to Target Account Selling isn't just a minor tweak to your sales process; it's a complete overhaul of your company's revenue engine. You stop obsessing over vanity metrics like calls made and emails sent. Instead, you get laser-focused on what really matters: business outcomes. For sales leaders, this is the leap from a chaotic, unpredictable pipeline to a model that delivers consistent, profitable growth.

The whole idea is beautifully simple. When you pour your best resources into your best-fit accounts, every important sales metric naturally goes up. Your team is no longer spread thin, chasing a mountain of low-quality leads that go nowhere. Every single action becomes a high-impact investment aimed at landing the accounts that will define your success. This strategic focus is what separates a good sales team from an elite one.

Drive Higher Average Contract Value

One of the first and most powerful results you'll see from TAS is a serious jump in your Average Contract Value (ACV). When your sales team is exclusively chasing enterprise clients or accounts that are a perfect mirror of your ICP, they're talking to companies with bigger budgets and more complex problems. That conversation naturally leads to bigger deals.

The data backs this up in a big way. The statistical edge of Target Account Selling is its power to dramatically increase deal sizes by concentrating on premium accounts. Industry benchmarks show that teams practicing TAS can see 2.5x higher ACVs compared to spray-and-pray outbound methods. We're talking deals averaging $250,000 versus $100,000. On top of that, profit margins often climb by 15-25% because you're building long-term relationships, not just closing one-off transactions. For more data-driven insights on these kinds of account-based strategies, Highspot has some great resources.

Accelerate Sales Cycles and Win Rates

This might sound backward, but focusing on fewer, bigger accounts can actually shorten your sales cycle. Think about it: traditional outbound is clogged with delays from unqualified leads and endless chats with people who can't sign a check. TAS cuts out all that waste.

Because your team starts with deep research (that's Pillar 2 of our TAS strategy), their first touchpoint is already hyper-relevant. That relevance builds trust and credibility almost instantly, getting your reps in front of key decision-makers much earlier in the game.

By engaging multiple stakeholders at once—a move we call "multi-threading"—your team builds consensus across the entire buying committee. This is your secret weapon against deals that stall because one contact goes quiet. It helps you navigate the internal politics of a big company, leading to faster approvals and much higher win rates.

Improve Sales Team Efficiency and Alignment

For any sales leader, maybe the most critical win is the surge in team efficiency. Picture your reps' calendars, wiped clean of pointless discovery calls and dead-end demos. With TAS, their time is gold, spent only on high-potential activities within a hand-picked list of dream accounts.

This sharp focus sends powerful ripples across your entire revenue organization.

- Eliminates Wasted Effort: Reps stop burning the bulk of their week on low-probability prospecting and busywork.

- Boosts Morale: Nothing motivates a salesperson more than working on high-quality, winnable deals day in and day out.

- Sharpens Skills: Your reps become genuine consultants, developing deep expertise in the specific industries and personas they target.

And finally, TAS forces sales and marketing to lock arms. When both teams are rowing in the same direction—working from the same Target Account List with the same goals—all the old friction just melts away. Marketing delivers qualified engagement from the right companies, and sales runs a precise playbook to turn that interest into revenue. This unified front is how you build a predictable, scalable growth machine.

How to Power Your TAS Execution with Technology

A winning Target Account Selling strategy is more than a smart playbook. It lives or dies by the tech you use to turn that playbook into a scalable, repeatable workflow. For any RevOps or sales leader, the right tools are what close the gap between a great plan and consistent execution day in and day out.

Without tech, even the best TAS strategy is just a theory on a whiteboard.

You simply can't scale deep personalization and account intelligence with spreadsheets and manual data entry. It just doesn't work. The modern TAS engine is built on a foundation of integrated tools that feed each other, creating a smooth, automated handoff from identifying an account to orchestrating complex outreach. This isn’t about buying a dozen new platforms; it’s about making a few core tools work together like a well-oiled machine.

The Core Components of a TAS Tech Stack

To bring a target account selling strategy to life, you need technology that supports each of the four pillars we talked about earlier. The goal is simple: automate the grunt work so your reps can focus on high-impact, human activities like building relationships and closing deals.

Here are the essential tool categories:

- Account Identification Platforms: Think of these as your eyes and ears in the market. Tools that surface firmographic, technographic, and intent data are crucial for building a data-driven Target Account List. They help you move past guesswork and zero in on companies actively looking for a solution like yours.

- Sales Engagement Tools: Once you know who to target, these platforms help you manage how you reach them. They orchestrate multi-touch, multi-channel outreach cadences, making sure no contact or follow-up ever slips through the cracks.

- CRM (Customer Relationship Management): This is your single source of truth. A well-maintained CRM like Salesforce or HubSpot is the central hub where all account data, contact info, and interaction history lives. Clean CRM data is completely non-negotiable for a successful TAS program.

While this core stack is powerful, it often leaves a critical execution gap. The platforms can spot opportunities and give you a way to send messages, but they don't solve the SDR's daily dilemma: "Out of hundreds of possible actions, what is the single most important thing I should do right now?"

This is where a new category of tool becomes essential.

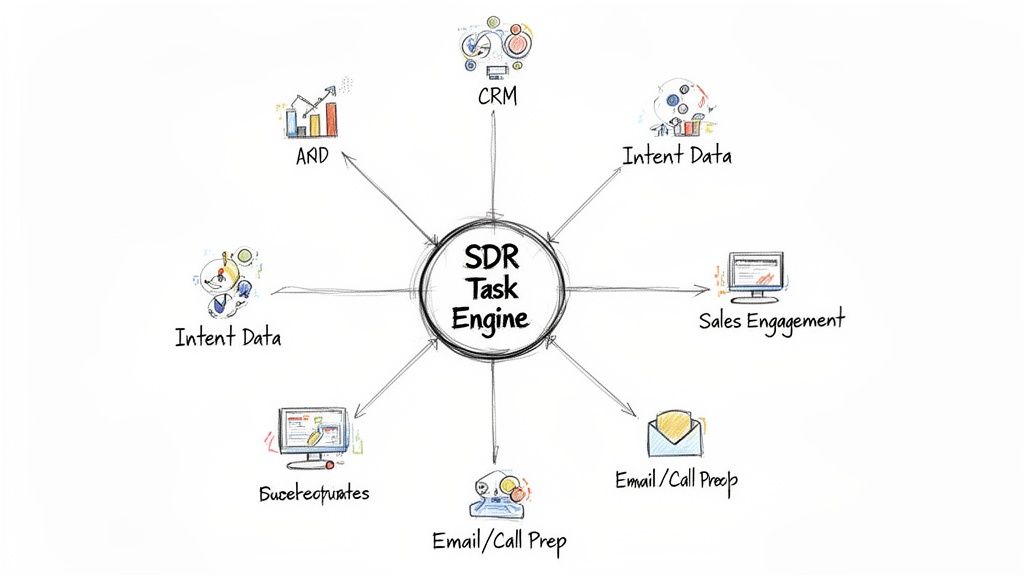

The Rise of the SDR Task Engine

A modern SDR Task Engine like marketbetter.ai sits at the center of your stack, acting as the brain that directs your team's daily activities. It’s the tool that finally answers that "what to do next" question by turning a flood of buyer signals from all your other tools into a simple, prioritized task queue—right inside your CRM.

This is what it looks like when a task engine organizes all those signals into a clear, actionable workflow for an SDR.

Instead of forcing reps to juggle multiple tabs and dashboards, the engine translates intent data spikes, website visits, and engagement triggers into a clear "next best action," complete with all the context needed to make a smart move.

The real power of a task engine is that it closes the loop between insight and action. A signal from your intent data provider doesn't just become another data point; it instantly becomes a prioritized call or email task for the right SDR, assigned to the right contact.

This technology directly attacks the biggest challenges in scaling TAS: consistency and quality. With AI-powered email and call prep workflows, reps can execute high-quality, personalized outreach without spending hours on manual research.

Every single action is then automatically logged back to the CRM, ensuring perfect data hygiene—a lifesaver for any data-driven sales leader. This integrated approach is a key piece of building a modern marketing tech stack that actually drives sales execution. By automating the operational side of TAS, you free your team to do what they do best: sell.

Common TAS Pitfalls and How to Sidestep Them

Even a perfectly designed Target Account Selling strategy can fall flat without sharp execution. Let's be clear: switching to TAS is a major operational shift, and a few common traps can completely derail your progress before you even see the good stuff.

Honestly, I’ve seen teams get tripped up by the same few mistakes over and over. They get fired up about the idea of TAS, but their execution lacks the discipline to see it through. These aren't minor hiccups; they're fundamental errors that can crater your entire outbound motion.

Knowing what these traps are is the first step. By anticipating them, you can build guardrails into your process and turn potential failures into lessons that just make your approach stronger.

Pitfall 1: Your Target List is Just a Wish List

This is the most frequent—and fatal—error. It happens when teams treat their Target Account List (TAL) like a casual collection of logos they’d like to win. Gut feelings and a sales rep's familiarity with a brand end up overruling actual data, and you start the game on the wrong foot.

What you end up with is a weak foundation where your team sinks a massive amount of effort into accounts that were never a good fit to begin with. It’s the difference between making a calculated investment and just gambling. A data-driven list is built on firmographics, buying signals, and tech matches. A list built on assumptions is just a prayer.

How to Fix It: Set up a formal, data-driven selection committee. Pull in sales leadership, marketing, and RevOps. The rule is simple: every single account proposed must meet specific, pre-defined criteria from your ICP. This forces objectivity and kills the bias, ensuring every account on your list earned its spot.

Pitfall 2: You're Faking Personalization

Another classic failure is mistaking token gestures for real, research-backed outreach. Dropping {company_name} and {first_name} into a generic template isn't TAS. It's spam with mail merge, and decision-makers at top-tier accounts can spot it from a mile away. They get dozens of these lazy emails a day and have become experts at hitting "delete."

This approach doesn't just fail; it actively disrespects the buyer’s time. It screams, "I haven't done my homework." It completely misses the whole point of TAS, which is to prove from the very first touch that you understand their world and have something relevant to say.

How to Fix It: Enforce a "research-before-reach" rule for all your Tier 1 accounts. No exceptions. Require reps to find a specific company initiative, a piece of recent news, or a quote from a key executive before they're allowed to hit send. Better yet, build this research step directly into your CRM workflow with required fields reps have to fill out before they can even enroll a contact in a sequence.

True personalization isn’t using someone’s name. It’s proving you understand their world. It’s the difference between saying, "I see you're a VP at Acme Corp" and "I saw your keynote on supply chain efficiency, and I have an idea for how you could apply that to your new distribution center."

Pitfall 3: You're Too Impatient

Target Account Selling is a marathon, not a sprint. A huge pitfall is giving up way too early. When teams who are used to high-volume, transactional sales don't see meetings pop up after a few emails, they panic, declare the strategy a failure, and go right back to their old habits.

This impatience comes from a fundamental misunderstanding of the model. You're not just booking demos; you're building relationships inside complex organizations. That takes a persistent, multi-threaded approach that builds trust and consensus over time. One study found it can take over 18 touches just to connect with a buyer. Quitting after five or six is like walking off the field in the first inning.

How to Fix It: Set realistic expectations from day one. Define your cadences to be long-term, multi-touch sequences that span several weeks and multiple channels (email, LinkedIn, calls). More importantly, change what you celebrate. Instead of only cheering for "meetings booked," start tracking and rewarding the leading indicators: positive replies, content engagement from key personas, and new contacts identified within an account. This shifts the team's focus from instant gratification to strategic progress.

Answering Your Top Questions About Target Account Selling

When teams start digging into target account selling, the same practical questions always pop up. It's one thing to understand the theory, but another thing entirely to make it work on the ground. Let's clear up some of the most common hurdles around team structure, resource planning, and just getting the darn thing started.

How Many Accounts Should an SDR Actually Handle?

This is the big one, and the answer is always: "It depends." It's not a cop-out, it's just the truth. Everything hinges on your account tiers.

For your Tier 1 accounts—the absolute must-win, company-changing deals—an SDR should be focused on a tiny list, maybe 10-20 accounts at most. These aren't just names in a CRM; they're full-blown research projects that demand deep, manual, and highly personalized outreach to multiple people.

Move down to Tier 2, and the list can grow a bit. These are still fantastic fits for your ICP, but the personalization can be a little less intense. Here, an SDR might manage 20-50 accounts. For Tier 3, where your outreach can be more programmatic and templatized, a rep could handle 50-100+ accounts.

The golden rule? Don't overload your reps. If you do, they'll inevitably neglect the top-tier accounts that require the most thought and effort.

What's the Real Difference Between a Target Account List and an ICP?

Think of it like building a house.

- Your Ideal Customer Profile (ICP) is the architect's blueprint. It’s a detailed, data-backed description of the type of company that gets insane value from your product—think industry, company size, revenue, and the tech they use. It’s the model of perfection.

- Your Target Account List (TAL) is the actual list of street addresses you're going to build on this quarter. These are the specific, named companies that perfectly match that blueprint. This is the list your entire go-to-market team obsesses over.

You have to nail down your ICP first. Without a solid blueprint, you're just picking addresses at random and hoping for the best.

Your ICP tells you what a perfect customer looks like. Your TAL tells you which specific companies are on your "we absolutely must win these" list.

We're a Small Team. How Do We Even Start with TAS?

Don't try to boil the ocean. The secret is to start incredibly small and prove the concept. You don't need a huge team or a complicated tech stack to get going. Just run a pilot program.

- Pick Your Champions: Grab one or two of your most strategic-minded sales reps. The ones who think beyond the script.

- Build a Micro-List: Work with them to hand-pick just 10-15 high-potential accounts that are a dead-on match for your ICP.

- Go Manual: Have them do the deep-dive research and run a coordinated, multi-touch outreach campaign without fancy automation. Just pure, thoughtful selling.

- Measure and Learn: Keep a close eye on everything: engagement, positive replies, meetings booked. Use those early wins to build a rock-solid case for expanding the program.

This approach lets you work out all the kinks and prove the model works before you go asking for a bigger budget.

Ready to stop guessing and start executing? marketbetter.ai turns your TAS strategy into a prioritized task list for your SDRs, right inside your CRM. It provides AI-powered tools for writing personalized emails and preparing for calls, ensuring your team executes high-quality outreach consistently. See how marketbetter.ai can power your outbound motion.