How to Qualify Sales Leads: A Practical Framework

Let's be real: "qualifying sales leads" is just a business-school way of saying "separating the tire-kickers from the real buyers." It’s about cutting through the noise to find people who have a genuine need and are actually ready to talk, not just browsing. This guide provides an actionable framework to do just that.

This means we have to look past flimsy metrics like a form fill for a whitepaper and start focusing on actions that scream "I'm ready to buy."

Why Old Lead Qualification Methods Are Broken

The old playbook for qualifying leads is, frankly, failing sales teams everywhere. Relying on a simple Marketing Qualified Lead (MQL) from a PDF download or a newsletter sign-up just doesn't work anymore. Why? Because today's buyers are smarter, their research process is longer, and those old signals are now completely unreliable.

This outdated approach creates a massive amount of friction. Sales Development Reps (SDRs) burn hours chasing ghosts—prospects with zero real intent—which leads to burnout and a pipeline that’s all smoke and no fire. Worse, your CRM gets clogged with low-quality contacts, making it impossible to see which opportunities are actually worth a damn.

Comparing Old vs. New Qualification Signals

The heart of the problem is what we choose to trust. Old-school methods value passive engagement, while modern, high-performing teams focus on signals of active buying intent. The difference isn't just semantic; it's the difference between a cold pipeline and a hot one.

| Old Method (Passive Engagement) | Modern Method (Active Intent) | Actionable Difference |

|---|---|---|

| Downloading a general ebook | Visiting your pricing page multiple times | An ebook download is research. Pricing page visits signal budget consideration and active evaluation. |

| Subscribing to a newsletter | Starting a free trial or product demo | A subscription is passive interest. A trial start is active product engagement and a desire to solve a problem now. |

| Liking a social media post | Viewing specific case studies or integrations | A 'like' is fleeting. Viewing a case study shows the prospect is trying to visualize your solution in their world. |

| Attending a high-level webinar | Adding team members to a trial account | A webinar is top-of-funnel education. Adding colleagues signals a team evaluation and a move toward purchase. |

See the shift? An ebook download just means someone is in research mode. But multiple visits to your pricing page? That person is actively evaluating you against competitors. One is a whisper; the other is a shout. The latter is a far more reliable sign of a sales-ready lead.

"A staggering 67% of lost sales are a result of sales reps not properly qualifying their potential customers before taking them through the full sales process."

That stat should be a wake-up call. When your team operates without a modern qualification framework, you aren't just losing time—you're actively bleeding revenue by chasing the wrong conversations.

The Pain of a Broken Process

The fallout from a bad qualification process poisons the entire sales organization. SDRs get slammed with rejection from people who never should have been called, managers can't forecast accurately to save their lives, and marketing gets blamed for sending "bad leads."

It’s a vicious cycle of frustration where:

- Time is wasted: Reps are stuck doing research instead of selling.

- Morale drops: Who wants a job where you get told "no" all day by unqualified prospects?

- Pipeline suffers: The whole funnel gets clogged with dead-end deals.

Moving to a process driven by real buying signals isn't just a "nice-to-have" anymore. It's absolutely essential for building a high-quality pipeline that actually fuels growth. While old methods fall short, a robust approach is essential; dive deeper with a comprehensive guide on how to qualify sales leads effectively.

Building Your Signal-Based Qualification Framework

Pouring the foundation for a skyscraper is a high-stakes job. Get it right, and you can build something massive. Get it wrong, and the whole thing crumbles. Building a durable qualification framework is no different. It's time to finally retire outdated, static models like BANT and build a dynamic system that actually understands how modern buyers behave.

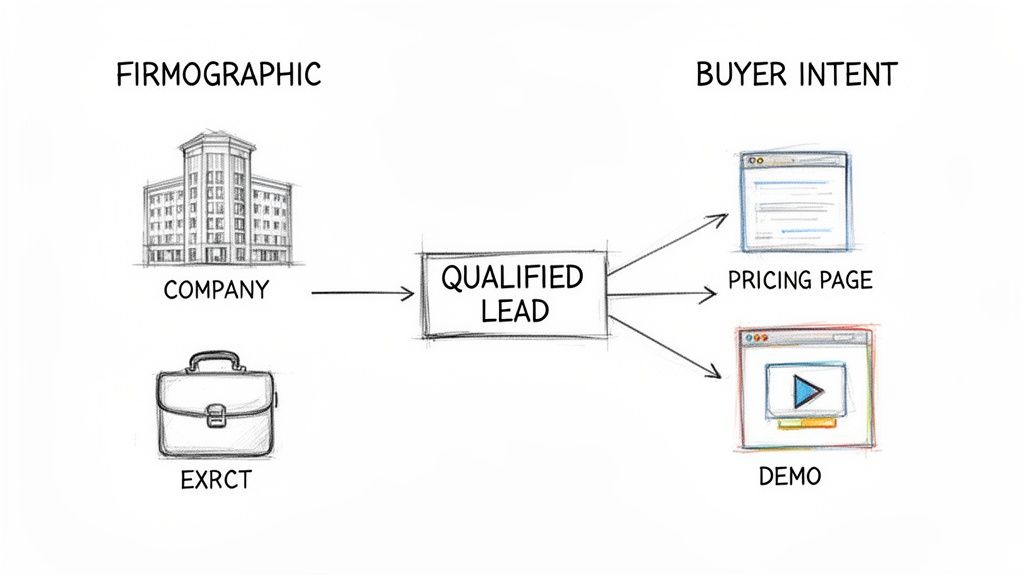

What does that look like? It means blending two critical data types: firmographics (who they are) and intent signals (what they’re doing). Sure, a lead from a Fortune 500 company is interesting. But a lead from that same company who just binge-watched your entire product demo library? That’s a conversation you need to have right now.

This synergy—combining the who with the what—is the absolute core of a signal-based framework that works. It’s how you separate the window shoppers from the real buyers.

Define Your Ideal Customer Profile with Precision

Before you can spot the right signals, you have to know who you’re looking for. Your Ideal Customer Profile (ICP) is the North Star for your entire go-to-market motion. This isn't a one-and-done exercise you knock out in an afternoon; it’s a living document that describes the perfect-fit company for your solution.

A weak ICP is vague and useless. A strong one is ruthlessly specific.

- Weak ICP: Tech companies in North America.

- Actionable ICP: B2B SaaS companies with 100-1,000 employees, a dedicated sales development team of at least 5 SDRs, and a tech stack that includes Salesforce and a sales engagement platform.

Action Step: To build your actionable ICP, analyze your top 10 best customers. Look for commonalities in industry, company size, revenue, and technology used. Document these criteria and make them the non-negotiable filter for all new leads. Your SDRs should be able to look at a company and give a hard "yes" or "no" to the ICP criteria in under 60 seconds.

Your Ideal Customer Profile isn’t a suggestion; it’s a non-negotiable filter. If a lead doesn’t fit your ICP, their buying signals are irrelevant. They are, by definition, a poor fit and a drain on your resources.

Comparing High vs. Low Intent Signals

Not all buyer actions are created equal. This is where most teams get it wrong. The secret to a killer signal-based framework is mapping specific activities to different levels of buying intent. This simple comparison helps you prioritize who gets a call now versus who gets nurtured.

| Low-Intent Signals (Informational) | High-Intent Signals (Transactional) |

|---|---|

| Following your company on social media | Visiting your pricing page three times this week |

| Downloading a top-of-funnel ebook | Requesting a personalized product demo |

| Attending a general industry webinar | Watching a 20-minute on-demand demo video |

| Opening a marketing newsletter | Exploring your integrations or API documentation |

Action Step: Create a two-column list like the one above for your own business. Under "High-Intent," list the top 3-5 actions a prospect takes right before they become a customer. These are the signals your sales team must be alerted to immediately.

A lead showing low-intent signals is still in the "learning" phase. But one showing high-intent signals has moved into the "evaluating" phase. Making this distinction is critical for qualifying leads efficiently and ensuring your sales team only spends time on conversations with active buyers. To go deeper, check out our guide on what is intent data.

Create a Unified Definition of a Qualified Lead

The historic tug-of-war between sales and marketing over lead quality ends here. A unified definition of a qualified lead, agreed upon by both teams, is the single most important document in your framework. This Service Level Agreement (SLA) must be clear, documented, and enforced. No exceptions.

It should precisely outline what constitutes each lead stage. Here’s a practical example you can steal:

- Marketing Qualified Lead (MQL): A lead that fits our ICP (demographics and firmographics) and has taken at least one high-intent action, like viewing a case study.

- Sales Accepted Lead (SAL): An MQL that an SDR has reviewed, confirmed meets all ICP criteria, and shows legitimate buying intent. It's now flagged for immediate outreach.

- Sales Qualified Lead (SQL): An SAL that has engaged in a discovery call, confirming a specific pain point and a potential project within the next six months.

This tiered approach creates a clean, unambiguous handoff. Marketing knows exactly what to deliver, and sales knows exactly what to expect.

The focus is shifting fast from broad marketing engagement to tangible product interaction. In today’s B2B world, Product Qualified Leads (PQLs) are proving far more valuable than their MQL cousins. A recent survey from Databox highlighted this trend, showing that 46.4% of respondents identified PQLs as the most qualified lead type. That significantly outpaced SQLs (37.5%) and left MQLs in the dust (16.1%). The data confirms what top teams already know: leads who have actively used your product are the ones most likely to buy. They are the ultimate signal.

Designing a Lead Scoring Model That Converts

So, you've nailed down your ideal customer and you know what their buying signals look like. Now what? The next move is to turn that intel into a system that can actually keep up with your business. That's where a sharp lead scoring model comes in—it’s the engine that powers an efficient qualification machine.

A good model assigns points to leads based on who they are (firmographics) and what they're doing (behaviors), giving your sales team a crystal-clear, prioritized list of who to call next.

Prospecting is tough. No one's debating that. A recent SPOTIO report even flagged it as the top challenge for 42% of salespeople. But the real battle is won or lost in qualification. It’s shocking how many companies fumble here: only 44% use a lead scoring system, and a measly 39% even bother to apply consistent criteria. The result? A jaw-dropping 55% of leads get completely ignored. You can see the full breakdown in these crucial sales statistics from SPOTIO.

Without a scoring model, your reps are flying blind. They're treating a CEO who just requested a demo with the same urgency as an intern who downloaded an old ebook. A great model fixes this by turning qualification from a guessing game into a science.

Point-Based vs. Predictive Models: Which Is Right for You?

When you start building your model, you’ve basically got two paths: a classic point-based system or a more advanced predictive one. The right choice really just depends on your team's size, technical chops, and how many leads you're juggling.

A point-based model is the perfect place to start. Your team sits down and manually assigns positive or negative points to different attributes and actions. It’s transparent, simple to tweak, and you have total control over the logic.

A predictive model, on the other hand, is the next level up. It uses machine learning to comb through your historical CRM data, identifying the common threads between leads who actually became customers. New leads are then scored based on how closely they match those winning patterns. It's incredibly powerful, but it needs a ton of clean historical data to do its job.

Lead Scoring Model Comparison

This table breaks down the core differences to help you decide where to begin.

| Feature | Simple Point-Based Model | Predictive AI Model | Actionable Choice |

|---|---|---|---|

| Setup | Fast and manual. Can be built in a spreadsheet or your CRM. | Requires significant, clean historical data and setup time. | Choose Point-Based if you're new to scoring or have < 1000 leads/month. |

| Maintenance | Requires regular manual reviews and adjustments (quarterly). | Self-optimizes over time but needs periodic data health checks. | Predictive models are lower maintenance after a complex setup. |

| Accuracy | Good, but based on human assumptions and can be biased. | Potentially higher accuracy as it uncovers non-obvious patterns. | Predictive is more accurate at scale, but Point-Based is better than nothing. |

| Best For | Teams new to lead scoring or with lower lead volume. | Mature teams with high lead volume and clean CRM data. | Start with Point-Based. Evolve to Predictive when you have the data and resources. |

Ultimately, a well-built point-based model will beat a poorly-fed predictive model every time. Start simple, get it right, and then evolve.

Assigning Scores That Actually Mean Something

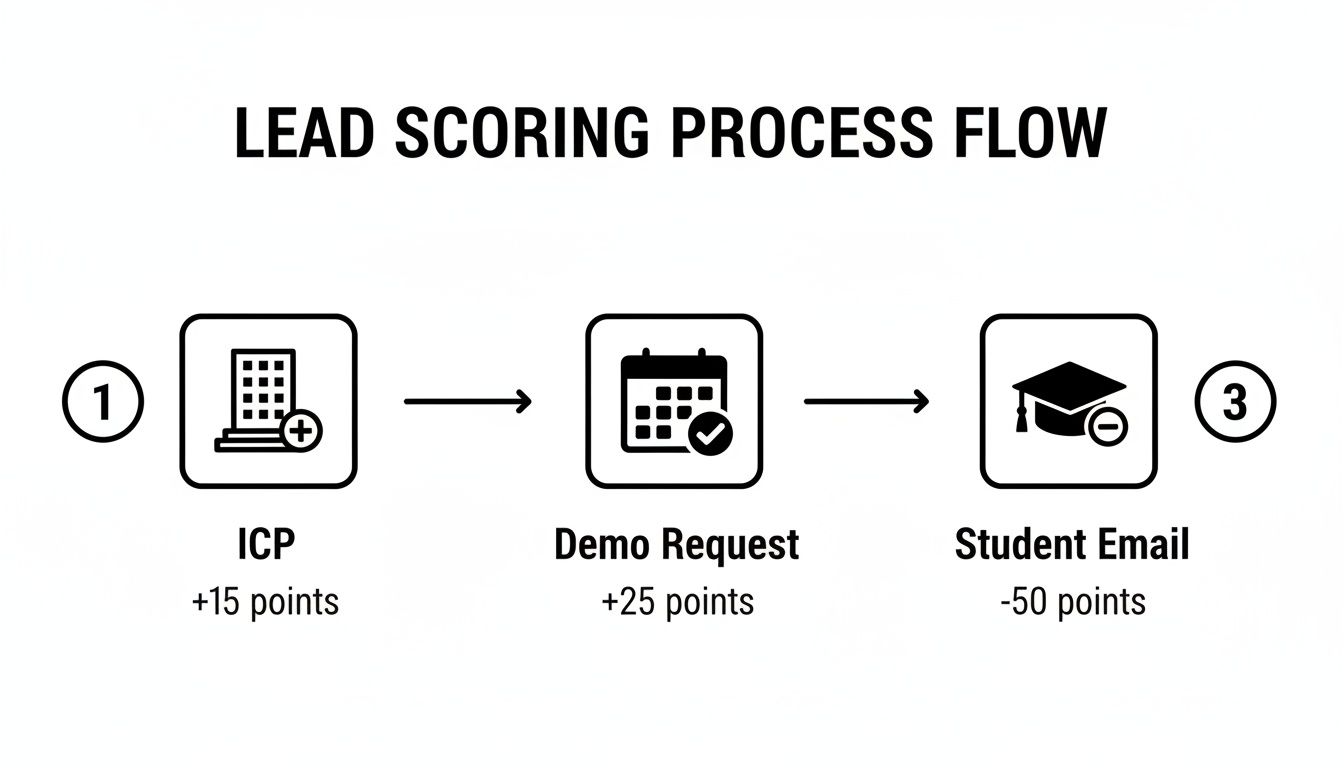

The real magic of a point-based model is in the numbers you choose. Each score should directly reflect a lead's potential value and how serious they are about buying. This means looking at both who they are (firmographics) and what they do (behaviors).

Let’s walk through a real-world example for a B2B SaaS company that sells to sales teams.

Positive Scoring Examples (Adding Points):

-

Firmographic Fit:

- Company size is 100-1,000 employees: +10 points

- Industry is "Software" or "Business Services": +10 points

- Job title contains "Sales," "Revenue," or "Business Development": +15 points

-

High-Intent Behaviors:

- Requested a product demo: +25 points (This is the gold standard!)

- Visited the pricing page more than twice in one week: +20 points

- Viewed a customer case study: +10 points

Negative Scoring Examples (Subtracting Points):

Just as important is docking points for actions that signal a poor fit. This is how you keep your reps focused on real opportunities, not distractions.

- Used a student or personal email address (e.g., @gmail.com): -50 points

- Company size is less than 10 employees: -20 points

- Job title contains "Intern" or "Student": -30 points

By combining these, you get a full picture. A "VP of Sales" (+15) at a 500-person software company (+10, +10) who requested a demo (+25) hits a score of 60. That's a hot lead. Meanwhile, an intern (-30) from a tiny startup (-20) ends up with a negative score, keeping them safely off your SDR's radar.

Your Model Isn't Set in Stone—Refine It

Your lead scoring model shouldn’t be a "set it and forget it" project. Think of it as a living system that needs regular check-ups to stay effective. The goal is simple: make sure your scores are accurately predicting who turns into a customer.

Action Step: Put a recurring quarterly meeting on the calendar titled "Lead Score Model Review" and invite sales and marketing leaders. The agenda should cover these three questions:

- Are high-scoring leads actually converting? Pull a report of all closed-won deals from the last 90 days. If your best new customers came in with low scores, your model is broken.

- Is sales happy with the quality? Get direct feedback from the reps. Are leads with scores over 50 consistently ready for a real conversation? If not, why?

- Do we need to adjust any point values? Maybe you launched a new integrations page and you're noticing that visitors there are converting at a higher rate than pricing page visitors. Time to adjust the scores to reflect that new insight.

This constant feedback loop is what makes a lead scoring model truly powerful. And for teams ready to take the next step, you can explore how to use AI for advanced lead scoring to make your model even smarter and more predictive over time.

Putting Your Qualification on Autopilot with AI

Your framework and scoring model are the blueprints. Now, it's time to build the engine that brings it all to life. This is where you connect your strategy to your sales tech stack, using AI to put the entire qualification process on autopilot.

Imagine this: a Director of Sales from one of your top-tier target accounts hits your pricing page. Instantly, an AI engine enriches their profile with fresh firmographic data, runs your scoring model, and flags them as a hot lead. Before they even click to another page, a task lands in your CRM for the right SDR, complete with a personalized email draft referencing their company’s recent Series B.

This isn’t science fiction; it’s how the sharpest sales teams operate right now. These automated workflows cut out the soul-crushing hours reps waste on manual research, letting them connect with qualified leads in minutes, not days.

From Manual Drudgery to AI-Powered Precision

Let's be honest, the old way of qualifying leads is a massive bottleneck. It’s slow, riddled with human error, and just doesn't scale. Your reps are stuck juggling browser tabs, digging through LinkedIn profiles, and manually punching data into the CRM—all while the lead's buying intent is cooling off.

The difference between the old way and the new way is night and day.

Manual vs AI-Powered Qualification Workflow

This table compares the practical impact on your team's time.

| Qualification Step | Manual Process (Time/Effort) | AI-Powered Workflow (Time/Effort) |

|---|---|---|

| Data Enrichment | 10-15 mins per lead: Reps manually search for company size, tech stack, and contact details. | Instant: AI pulls and validates data from multiple sources, appending it to the CRM record. |

| Lead Scoring | 5 mins per lead: Reps mentally calculate or use a clunky spreadsheet, often inconsistently. | Instant: The system automatically applies your scoring model based on firmographic and behavioral data. |

| Prioritization | Ongoing guesswork: Reps scan a long list of leads, often defaulting to the newest or most familiar names. | Automatic: The highest-scoring leads are pushed to the top of the queue or into a dedicated "hot leads" view. |

| Task Creation | 2-3 mins per lead: Reps manually create a task, add notes, and set a due date in the CRM. | Instant: A task is auto-created and assigned based on pre-set rules (e.g., territory, account owner). |

AI doesn’t just make the process faster. It makes it smarter and way more consistent, ensuring a high-potential lead never slips through the cracks because a rep was having a busy day or missed a notification.

The Key Pieces of an Automated Workflow

You don't need a team of data scientists to set this up. Modern platforms are built around simple, trigger-based rules that you can configure to run the whole show.

Action Step: Map out a simple workflow on a whiteboard. Start with a trigger, then define the action. Example: Trigger: "Lead Score > 50." Action: "Create task in CRM for assigned SDR with 'High Priority' flag."

Your workflow will usually have a few core components working together:

- Triggers: These are the events that kick everything off. A trigger could be a prospect hitting your pricing page, a new lead from a specific G2 campaign, or a contact’s title changing to a decision-making role.

- Enrichment: Once triggered, the system automatically fetches critical data points—think employee count, industry, funding status, and the tech they use. This gives you the context for accurate scoring.

- Scoring & Routing: With that enriched data, the lead gets scored against your model. Based on that score, you can set rules to route them to the right SDR, drop them into a nurture sequence, or create an urgent task.

This flow chart shows how just a few simple rules can instantly separate the signal from the noise.

This is how AI applies both positive and negative scoring to qualify leads in real-time. To see this in action, it's worth checking out some of the top AI SaaS companies building solutions specifically for this.

The point of automation isn’t to replace your sales reps. It's to free them from low-value, repetitive tasks so they can spend their time on what humans do best: building relationships and closing deals.

Keeping Your Data Clean and Your Insights Sharp

A huge—and often overlooked—benefit of an AI-driven process is its effect on your data hygiene. Manual data entry is a disaster waiting to happen, full of typos, outdated info, and inconsistent formatting. An automated system that enriches and updates records keeps your CRM as a reliable source of truth.

Clean data feeds directly into your analytics, giving you a much clearer picture of what's actually working. You can finally answer the big questions with confidence:

- Which lead sources are actually generating our highest-scoring leads?

- What behaviors are most correlated with a closed-won deal?

- How fast are my reps really getting to high-priority leads?

This feedback loop lets you constantly tweak your ICP, scoring model, and overall sales strategy. Lead quality is everything, yet the data shows a massive disconnect: only 5% of sales reps rate their marketing leads as 'very high quality,' while 34% see qualification as their biggest challenge. This is the exact problem AI automation was built to solve.

By hooking your qualification framework up to a smart automation engine, you turn it from a static document into a living system that actively builds your pipeline. For a deeper dive, check out our guide on integrating AI for marketing automation.

Measuring and Refining Your Qualification Process

Your lead qualification process isn't a museum piece—you don't build it once and admire it from behind glass. It’s a living, breathing system that needs constant attention to stay sharp. Without tracking the right numbers, you're flying blind, unable to tell if your shiny new framework is actually building pipeline or just creating busywork.

This is where you move from theory to results. Measuring your process is how you prove its value and, more importantly, find opportunities to make it even better. The goal is to create a tight feedback loop that keeps your entire go-to-market engine perfectly tuned.

Key Metrics That Tell the Real Story

Forget vanity metrics like the total number of MQLs. They're distracting. You need to focus on the KPIs that directly measure the health and efficiency of your qualification engine. These are the numbers that tell you if your efforts are turning into actual revenue.

Here are the essentials to build your dashboard around:

-

Lead-to-Opportunity Conversion Rate: This is the big one. It measures the percentage of leads that successfully convert into a legitimate sales opportunity. If this number is low, it’s a bright red flag that your definition of a "qualified lead" is out of sync with reality.

-

Sales Cycle Length by Lead Source: Are leads from your G2 campaign closing twice as fast as those from webinars? This metric helps you understand which channels are delivering not just leads, but highly-motivated buyers. It’s how you learn where to double down.

-

Win Rate from Qualified Leads: Of all the opportunities that came from qualified leads, what percentage are you actually winning? A high conversion rate but a low win rate might mean you're qualifying on surface-level interest but missing true purchase intent or budget realities.

Lagging vs. Leading Indicators

To really understand performance, you have to know the difference between lagging and leading indicators. One tells you what already happened; the other helps you see what's coming. A healthy process tracks both.

| Indicator Type | Lagging Indicators (The Result) | Leading Indicators (The Predictor) |

|---|---|---|

| What It Measures | Historical outcomes and past performance. | Future performance and pipeline health. |

| Example Metrics | - Revenue from qualified leads (last quarter) - Average deal size by lead source | - Number of demo requests this week - Percentage of leads hitting a high score threshold |

| Use Case | Proving ROI and reviewing past strategy. | Forecasting future pipeline and making real-time adjustments. |

Focusing only on lagging indicators like quarterly revenue is like driving while looking in the rearview mirror. Leading indicators give you the forward-looking view you need to steer the ship.

A common mistake is to obsess over the total number of MQLs (a leading indicator of activity) without tying it to the lead-to-opportunity conversion rate (a lagging indicator of quality). A successful team knows that quality trumps quantity every time.

Creating a Powerful Feedback Loop

Data is crucial, but it's only half the story. The other half is communication. A structured, consistent feedback loop between your sales and marketing teams is what turns good data into great strategy. Without it, you’ll just have two teams working from different playbooks.

This isn't about blaming marketing for "bad leads." It's about collaborative refinement.

-

Hold Weekly Huddles: Get your SDR and marketing leaders in a room for 30 minutes every week. No exceptions. Review the top leads that were passed over. What were the specific reasons a lead was accepted or rejected? Was the data wrong? Did they not fit the ICP? Get into the weeds.

-

Use a "Lead Status" Field: Add a simple, mandatory dropdown in your CRM for reps to mark why a lead was disqualified. Use concrete reasons like "Not a decision-maker," "No budget," or "Unresponsive." This turns anecdotal complaints into structured data you can actually analyze.

-

Share the Wins: When a lead that marketing sourced turns into a closed-won deal, broadcast it. Send a Slack message. Mention it in the all-hands. This reinforces what a perfect lead looks like and keeps both teams motivated and aligned on the real goal: creating more revenue.

Common Questions About Lead Qualification

Even with the best game plan, questions always pop up. Here are some of the most common ones we hear from sales and marketing leaders, along with some straight answers from our experience.

What’s the Real Difference Between MQLs, SQLs, and PQLs?

Getting the alphabet soup of lead types straight is non-negotiable. They sound alike, but they represent totally different stages of interest. Messing them up is a classic way to create friction between sales and marketing. Here’s a comparative breakdown:

| Lead Type | Definition | Source of Signal | Conversion Potential |

|---|---|---|---|

| MQL | A lead who fits your ICP and has engaged with top-of-funnel marketing content (e.g., ebook download). | Interest in your content. | Lowest |

| SQL | An MQL that a sales rep has spoken to and verified has a legitimate need, budget, and timeline. | Interest in a conversation. | Medium |

| PQL | A user of your product (trial/freemium) who has taken high-value actions (e.g., invited a teammate). | Interest proven through product usage. | Highest |

The difference boils down to the source of the signal. MQLs show interest in your content. SQLs confirm interest in a conversation. PQLs demonstrate interest through their actions in your product. In today's market, PQLs crush other lead types on conversion rates because the product has already done the heavy lifting.

How Often Should We Revisit Our Lead Scoring Model?

Your scoring model isn't a "set it and forget it" document. Think of it as a living system that needs regular tune-ups to stay sharp. A full review at least once a quarter is a solid baseline.

In that quarterly review, you're looking at your closed-won deals and working backward. Are the leads that turned into your best customers actually scoring high? If your biggest new logo last quarter came in with a score of 35, something is broken. That's a huge red flag that your points are misaligned with what actually drives revenue.

But don't wait for the quarterly review if something big changes. Launching a new product, overhauling your ICP, or pivoting your GTM strategy all demand an immediate update.

Can a Small Team Actually Pull This Off?

Absolutely. You don't need a massive tech stack and a team of data scientists to get this right. The trick for smaller teams is to prioritize clarity over complexity. Start with a strong foundation and build from there.

For a lean team, the path is simple:

- Get ridiculously specific with your ICP. This costs zero dollars and has the single biggest impact.

- Pick just 3-5 high-intent signals. Don’t boil the ocean. Start with the obvious ones like "Requested a demo," "Visited the pricing page 3+ times," or "Started a free trial."

- Build a simple scoring model in a spreadsheet or your CRM's basic scoring feature. Give points to your ICP criteria and those key intent signals.

The goal is to create a documented, repeatable process first. A simple framework that everyone on the team understands and follows will always beat a complicated system nobody uses. You can add more sophisticated tools and automation later as you grow.

Ready to stop wasting time on unqualified leads? marketbetter.ai turns buyer signals into prioritized SDR tasks, complete with AI-generated emails and a dialer that lives inside your CRM. See how you can build a consistent outbound motion without the busywork at https://www.marketbetter.ai.