10 Actionable Voice of the Customer Examples to Drive Revenue in 2026

Voice of the Customer (VoC) isn't just a collection of quotes; it's a strategic asset. While most companies gather feedback, few know how to turn raw customer comments into tangible actions that improve sales workflows, reduce churn, and directly impact the bottom line. This disconnect between feedback and action often leaves sales teams frustrated and valuable insights buried in spreadsheets.

This guide provides a deep dive into 10 actionable voice of the customer examples, moving beyond surface-level analysis to deliver a strategic blueprint. For each example, we'll break down the original feedback, compare its strategic value against other VoC types, and provide a replicable framework for analysis and action. You will get concrete, step-by-step instructions on how to transform qualitative data into quantifiable results.

You’ll learn not only what to listen for but exactly how to translate that insight into measurable improvements, especially for B2B sales teams drowning in administrative work and disconnected tools. We'll explore how modern platforms like marketbetter.ai use these very signals to create prioritized, context-rich tasks that transform raw feedback into an efficient sales engine. Instead of just collecting data, you'll learn to activate it, making every customer comment a potential catalyst for growth. This listicle is your tactical guide to turning customer sentiment into your most powerful sales and demand generation tool.

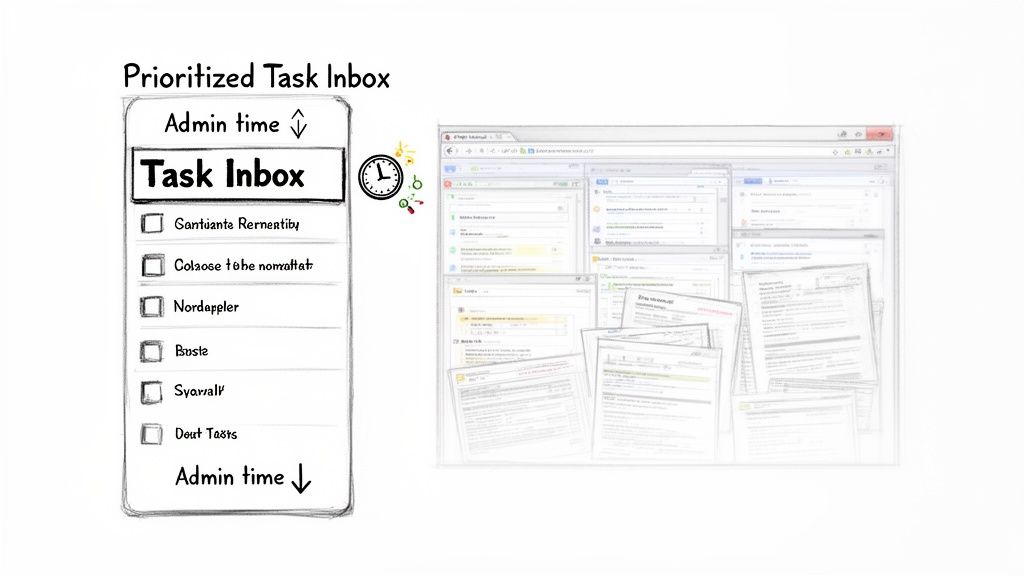

1. NPS Comment: Task Inbox Reduces Admin Burden

Net Promoter Score (NPS) surveys are a powerful Voice of the Customer (VoC) tool, but their true value lies in the qualitative comments that accompany the scores. For SaaS companies like MarketBetter, which offers sales engagement platforms, a comment attached to a high score (9 or 10) provides a direct line into the user's perception of value. This specific example highlights how a feature, the "Task Inbox," directly addresses a critical pain point: administrative overload for Sales Development Representatives (SDRs).

When an SDR writes, "The new task inbox is a game-changer. I’m saving at least an hour a day on admin and can focus on my actual calls," this isn't just feedback; it's a quantifiable ROI statement. It validates the product's "execution-first" workflow and gives marketing and sales teams a powerful, authentic message to use in their campaigns.

Strategic Analysis & Actionable Insights

Analyzing this type of VoC data goes beyond simple satisfaction tracking. It’s about segmenting feedback to drive targeted improvements and marketing efforts.

- Actionable Step: Immediately follow up with promoters who leave detailed comments. Ask them, "Could you share a specific example of how this feature saved you time this week?" This turns a general comment into a specific, powerful testimonial you can use in marketing materials.

- Strategic Comparison: While a CSAT survey might tell you if a user is happy at that moment, an NPS comment reveals the reason for their long-term loyalty. This is more strategically valuable for identifying sticky features that drive retention, unlike a support ticket which often focuses on a point-in-time problem.

- Feature Adoption & Impact: Track NPS trends immediately following a new feature release. A spike in promoter scores directly linked to comments about that feature confirms successful product-market fit and validates the development roadmap. Use this data to justify further investment in similar workflow enhancements.

Key Takeaway: Treat high-scoring NPS comments as mini-case studies. Follow up with these promoters to gather more detailed testimonials, quantify their success, and understand the core drivers of user retention and advocacy. This is one of the most direct voice of the customer examples you can leverage for growth.

2. Customer Quote: Dialer Integration Solves Adoption Friction

Direct customer quotes, especially from decision-makers, are goldmines for B2B SaaS companies. They move beyond feature-level feedback to articulate business-level outcomes. For a company like Gong, which provides revenue intelligence, a quote from a VP of Sales isn't just about call recording; it's about solving a core operational challenge: user adoption of new technology. This is one of the most powerful voice of the customer examples because it reframes the product's value proposition.

When a RevOps leader states, "The native Salesforce dialer integration was the key. We saw 90% adoption in the first month because our reps never had to leave their workflow," it elevates the conversation. This quote shifts the focus from a technical feature (a dialer) to a strategic benefit (solving adoption friction). It validates that embedding tools into existing CRMs like Salesforce or HubSpot is critical for driving usage and, ultimately, ROI.

Strategic Analysis & Actionable Insights

Analyzing this VoC data is about connecting a specific product capability to a high-level business problem. It’s a roadmap for creating targeted sales and marketing collateral.

- Actionable Step: Turn this quote into a "challenge/solution" slide in your sales deck. The challenge: "Low adoption plagues new sales tools." The solution: "Our native integration drove 90% adoption in 30 days for a customer just like you." This makes the value instantly relatable.

- Strategic Comparison: This direct quote is far more powerful than an aggregated NPS score. An NPS of +50 is good, but a VP-level quote about 90% adoption provides a concrete business outcome that resonates with economic buyers. It offers proof, whereas survey scores offer a pulse.

- Sales Enablement Fuel: Equip your sales team with this exact quote. Coach them to use it during discovery calls when a prospect mentions past struggles with tool rollouts. This proactively addresses a common objection with a real-world success story, building immediate credibility.

Key Takeaway: Leverage quotes from leadership personas to create sales assets that speak to business outcomes, not just features. Use their exact words to build trust and demonstrate a deep understanding of the strategic challenges associated with rolling out new sales technology.

3. Support Ticket Excerpt: CRM Data Hygiene as Hidden Value

While often seen as a cost center, the customer support queue is a goldmine for Voice of the Customer (VoC) data, revealing unexpected product value. For a sales engagement platform like MarketBetter, a support ticket can uncover benefits that go beyond the primary user's experience. This example shows how an inquiry from a Revenue Operations (RevOps) manager about activity logging highlights a critical, often overlooked value proposition: automated CRM data hygiene.

When a RevOps leader submits a ticket stating, "I noticed our Salesforce activity logging is at 98% for reps using MarketBetter, up from 65% with our last tool. This is giving us the cleanest attribution data we’ve ever had," it’s more than a simple query. It’s a powerful testimonial about a secondary, strategic benefit. This feedback validates the product's impact on a critical business function that sales leaders and operations teams care deeply about.

Strategic Analysis & Actionable Insights

Analyzing support tickets for hidden value allows a company to reposition features and target new, influential personas within a customer’s organization.

- Actionable Step: Create a system to tag support tickets by "persona" (e.g., SDR, RevOps, Manager) and "theme" (e.g., Data Quality, Feature Request). Once a month, review the "RevOps" tag to identify strategic insights like this one and share them directly with the marketing and product teams.

- Strategic Comparison: Unlike a formal case study which is a polished, post-hoc narrative, a support ticket is an unfiltered, real-time signal of value. It's more authentic and often reveals benefits you didn't even know to ask about. Use this raw insight as the seed to create a more detailed case study.

- ROI Quantification: Don't let this data sit in a support system. Model the financial impact. Calculate the cost of poor data (e.g., wasted marketing spend on bad attribution) and create a one-pager: "How 98% data accuracy can save your marketing budget." Use this as a mid-funnel content piece.

Key Takeaway: Scour support tickets for comments from operational roles like RevOps and Sales Ops. These personas often quantify your product's "hidden" value in ways your primary users don't. This specific type of voice of the customer examples can be used to build powerful case studies and sales enablement materials that speak directly to strategic buyers.

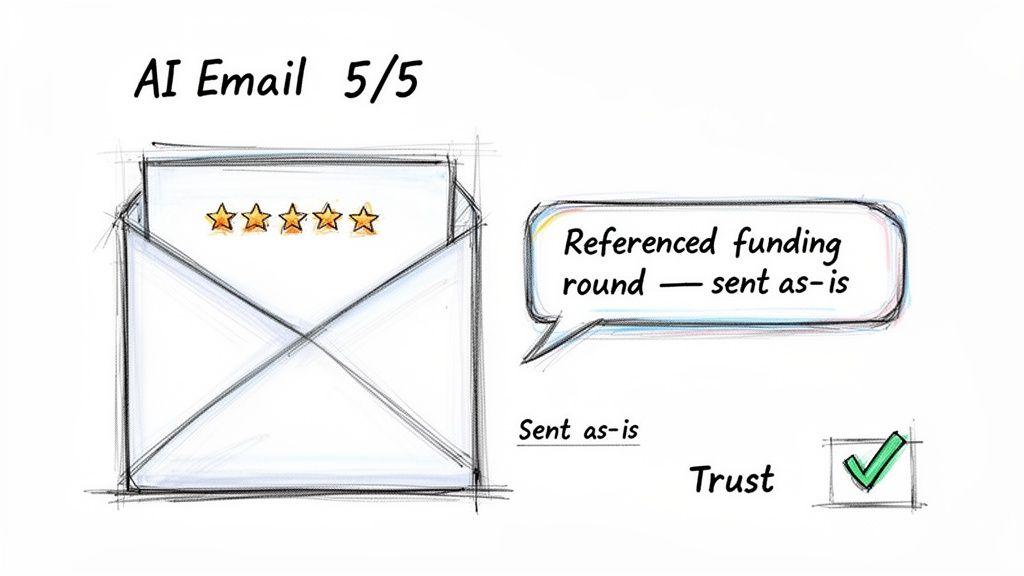

4. In-App Feedback: AI Email Quality and Relevance Validation

As AI-powered tools like MarketBetter become central to sales workflows, capturing VoC directly within the application is critical for building user trust. In-app feedback mechanisms, particularly those focused on the quality of AI-generated content, offer a real-time pulse on whether the technology is truly helping or hindering. This approach validates the platform's core promise of delivering high-quality, account-informed emails that reps feel confident sending.

When an SDR rates an AI-generated email 5-stars and sends it without edits, it’s a powerful trust signal. Conversely, a 1-star rating with the comment, "Context was stale; mentioned a funding round from last year," provides an immediate, actionable data point for the product team. This feedback loop is essential for refining the AI models that drive personalization and directly impacts the effectiveness of outreach, which is why understanding these signals is a key step to improve email open rates.

Strategic Analysis & Actionable Insights

Analyzing in-app AI quality feedback moves beyond simple feature satisfaction. It's about measuring the core trust and reliability of your platform’s intelligence layer.

- Actionable Step: For every 1-star rating, trigger an automated but personalized follow-up from the product manager. "Thanks for the feedback on the AI email. To help us improve, could you tell us what context was missing?" This turns a negative experience into a collaborative product development session.

- Strategic Comparison: This method is far more immediate and granular than a quarterly survey. A survey might ask, "How satisfied are you with our AI features?" which is vague. In-app feedback provides a precise, actionable signal on a specific output, allowing for much faster iteration cycles.

- AI Model Refinement: Use negative feedback to create a direct pipeline for model improvement. A comment like "Account context was stale" can trigger a process to re-evaluate the intent data sources or recency filters for that specific account, turning a single user's experience into a platform-wide enhancement.

Key Takeaway: Treat in-app AI feedback as a direct conversation with your users about your core value proposition. Low ratings are not failures; they are precise, invaluable instructions on where to improve your data and algorithms. This is one of the most dynamic voice of the customer examples for any company leveraging generative AI.

5. Survey Question/Verbatim: Ramp Time and Productivity Lift

Quantitative survey data is a crucial Voice of the Customer (VoC) channel, especially for measuring operational impact. For companies like MarketBetter, targeting high-turnover sales environments, a key value proposition is reducing the time it takes for new Sales Development Representatives (SDRs) to become fully productive. A targeted survey question asking for ramp time metrics provides concrete evidence of the platform's ROI, moving beyond subjective feedback to hard numbers.

When a sales manager completes a survey and states, "Our average SDR ramp time dropped from 75 days to just 40 days after implementing MarketBetter," it becomes a powerful, quantifiable success story. This data directly validates the platform's ability to streamline workflows, improve onboarding, and accelerate a new hire's path to quota attainment. It provides marketing and sales teams with a compelling metric to build case studies and ROI calculators around.

Strategic Analysis & Actionable Insights

Analyzing this VoC data is about translating a single metric into a comprehensive value narrative that resonates with VPs of Sales and enablement leaders.

- Actionable Step: Create a simple ROI calculator on your website based on this data. Let prospects input their number of new SDR hires per year and their average salary. The calculator then shows the potential cost savings based on the 35-day reduction in ramp time. This makes the value tangible and self-service.

- Strategic Comparison: This quantitative data is the perfect complement to qualitative interview snippets. An interview might reveal how managers feel coaching is better, but this survey data proves the outcome of that better coaching—a 46% faster ramp time. Combining them creates an undeniable narrative.

- Persona-Targeted Content: Use this data to create hyper-relevant content. For a Head of Sales Enablement, create a webinar titled "How to Cut SDR Ramp Time in Half." For a VP of Sales, publish a blog post, "The Hidden Costs of a 90-Day Ramp Time and How to Avoid Them."

Key Takeaway: Use quantitative survey data on operational metrics like ramp time as the foundation for a compelling ROI story. Follow up with respondents to build detailed case studies, transforming this powerful voice of the customer examples into a tool that directly addresses the financial and productivity concerns of executive buyers.

6. Review Excerpt: Integration Simplicity and Workflow Consolidation

Third-party review sites like G2, Capterra, and Trustpilot are treasure troves of Voice of the Customer (VoC) data, offering unfiltered feedback that directly influences B2B buying decisions. For a SaaS platform like MarketBetter, a review highlighting its seamless Salesforce integration and workflow consolidation is incredibly potent. It addresses a major pain point for sales teams: the "tool-switching" fatigue that drains productivity and complicates tech stacks.

When a sales manager posts, "Finally, a platform that lives inside Salesforce. We ditched three separate tools because MarketBetter consolidates our task management, dialer, and email sequencing in one place," it's a powerful narrative. This feedback validates the product's core value proposition as a central hub, shifting the conversation from individual features to holistic operational efficiency.

Strategic Analysis & Actionable Insights

Analyzing review excerpts is about identifying and weaponizing your strategic advantages. This VoC feedback provides the exact language needed to differentiate your product in a crowded market.

- Actionable Step: Take a screenshot of the G2 review, get permission from the user, and feature it prominently on your product and pricing pages. Add a headline like, "Tired of juggling multiple tools? See why our customers consolidate their tech stack with us."

- Strategic Comparison: Unlike internal NPS comments, G2 reviews provide public, third-party validation that is highly trusted by prospects. A prospect might be skeptical of your marketing claims, but they are far more likely to believe an unsolicited review from a peer. This makes review excerpts more valuable for top-of-funnel marketing.

- Competitive Positioning: Use this language in competitive battle cards. When a prospect mentions they are evaluating a competitor, a rep can respond, "That's a great tool, but we often hear from customers like [reviewer name] that they switched to us to consolidate three tools into one. Is reducing tool fatigue a priority for you?"

Key Takeaway: Treat positive third-party reviews focused on consolidation as a strategic asset. Amplify these voice of the customer examples in sales decks, on your website, and in ad campaigns to build a powerful narrative around efficiency and simplicity, directly addressing the common industry problem of a fragmented tech stack.

7. Interview Snippet: Manager Coaching Leverage and Visibility

While quantitative data provides scale, qualitative customer interviews uncover the “why” behind user behavior. For a sales engagement platform like MarketBetter, a snippet from a conversation with a Sales Manager provides rich, narrative-driven VoC data. This example reveals how integrated context (task priority, intent signals, call notes) is not just a rep-level feature but a strategic tool for managers to elevate team performance.

When a manager says, “Before, I’d listen to a call and give feedback, but I was missing the full picture. Now I see the prospect's intent data and the exact email sequence they’re in. My coaching is 10x more impactful,” they are articulating a high-value, second-order benefit. This feedback shifts the product's value proposition from a simple productivity tool for reps to a strategic coaching and visibility platform for leaders. To capture such nuanced feedback effectively, consider leveraging specialized tools for efficient interview and focus group transcription to turn spoken insights into structured data.

Strategic Analysis & Actionable Insights

Analyzing interview feedback is about identifying recurring themes and pain points that reveal new market positioning opportunities. It’s a core method for gathering deep voice of the customer examples.

- Actionable Step: Create a two-minute video clip of this interview snippet (with permission). Use it in targeted LinkedIn ad campaigns aimed at Sales Managers and VPs of Sales. The authenticity of a real manager speaking will be far more compelling than a standard ad.

- Strategic Comparison: Interviews provide a level of narrative depth that surveys or support tickets can't match. A survey can confirm that managers are satisfied, but an interview reveals the specific scenario—the "before and after" of their coaching process—that makes for a powerful story.

- Persona Value Expansion: This feedback proves the platform’s value extends beyond the end-user (SDR) to the economic buyer (Sales Manager/VP). Use this insight to justify a higher price point or a separate pricing tier for manager-specific features, as the ROI is clearly demonstrated.

Key Takeaway: Treat in-depth interview snippets as strategic gold. Pull direct quotes to use in marketing materials, build case studies around the manager's success story, and feed these insights directly to the product team to double down on features that enhance leader visibility and coaching effectiveness.

8. Focus Group Insight: Reps Want Task Context, Not More Tools

While quantitative data from surveys is crucial, qualitative insights from focus groups offer a deeper, more nuanced understanding of user needs. For B2B SaaS companies, especially in the sales tech space, these sessions reveal the "why" behind user behavior. A common theme emerging from focus groups with Sales Development Representatives (SDRs) is a strong preference for contextual, task-oriented workflows over an ever-expanding list of features. They don't want more tools; they want one place to get their work done efficiently.

This insight, often aligned with the Jobs to Be Done framework, shows that SDRs "hire" a platform to execute tasks faster and with more context. When a focus group participant says, “I don’t need another dashboard. I need to know who to call next, why they’re a priority, and what to say, all in one view,” they are providing a direct mandate for product design and marketing. This feedback guided the development of platforms like HubSpot, which consolidated tools for small teams, and it continues to be a core principle for user-centric companies like Slack and Notion.

Strategic Analysis & Actionable Insights

Leveraging this type of VoC data is about translating qualitative feedback into a core product philosophy and a compelling market position. It shifts the focus from feature-stacking to workflow optimization.

- Actionable Step: Translate this insight into a design principle for your product team: "Every new feature must reduce clicks or consolidate information, not add another screen." Before any feature is approved, ask, "Does this simplify the SDR's core workflow?"

- Strategic Comparison: A focus group allows for interactive validation, which an interview does not. When one SDR makes this point, the moderator can ask the rest of the group, "Does that resonate with everyone?" This group validation makes the insight more reliable and less anecdotal than a single interview.

- Competitive Differentiation: Use this insight to craft your market positioning. Your homepage headline could be, "Stop Drowning in Dashboards. Start Closing Deals." This directly targets the pain point uncovered in the focus group and sets you apart from competitors who brag about their number of features.

Key Takeaway: Use focus group insights to define your product's core value proposition. This specific voice of the customer example validates a "less is more" approach, allowing you to build a more intuitive product and craft marketing messages that resonate deeply with the daily struggles of your target users. Run follow-up sessions post-launch to confirm you've delivered on this promise.

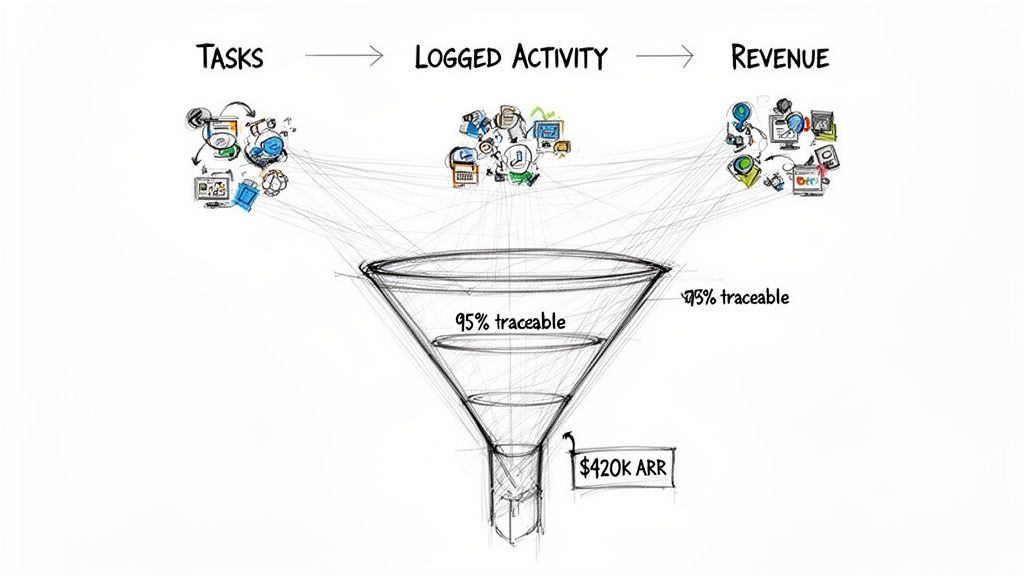

9. Case Study: Pipeline Attribution and Revenue Impact (Quantified)

A detailed case study is one of the most powerful forms of Voice of the Customer (VoC) data, transforming qualitative satisfaction into quantifiable business results. For a sales engagement platform like MarketBetter, a case study moves beyond simple feedback to prove its direct impact on revenue. It captures the customer's entire journey, showcasing a "before and after" scenario backed by hard metrics, such as increased deal velocity or improved pipeline attribution.

When a mid-market B2B SaaS customer states, "MarketBetter gave our RevOps team the data integrity needed to prove a 35% lift in SDR-sourced pipeline, directly influencing $420K in ARR last quarter," it becomes a cornerstone marketing and sales asset. This quantified success story provides concrete proof of the platform's value, directly addressing the ROI questions that CFOs and VPs of Sales care about most.

Strategic Analysis & Actionable Insights

Analyzing a case study involves reverse-engineering the customer's success to create a replicable framework for sales, marketing, and product development.

- Actionable Step: Break the case study down into micro-assets. Create a one-slide summary for sales decks, a series of social media graphics with pull quotes, and a short video testimonial with the customer. This maximizes the reach and impact of a single piece of content.

- Strategic Comparison: A case study is the pinnacle of VoC data. While an NPS comment indicates satisfaction and a support ticket reveals a hidden benefit, a case study connects all the dots and ties your product's value directly to revenue—the ultimate metric for any business. It is the most powerful form of social proof.

- Sales Enablement & Discovery: Arm your sales team with specific data points from the case study. Coach them to ask during discovery, "Our customers typically see a 30-40% lift in SDR-sourced pipeline. What would that kind of impact mean for your revenue goals this year?" This frames the conversation around tangible outcomes.

Key Takeaway: A quantified case study is the ultimate VoC deliverable, translating user success into a powerful sales tool. Use it to build persona-specific messaging, create downloadable lead magnets, and provide your sales team with undeniable proof points that accelerate deals and build trust with prospects.

10. CSAT Feedback: Onboarding and Training Support Quality

Customer Satisfaction (CSAT) scores measured immediately after onboarding are a critical Voice of the Customer (VoC) signal. For complex B2B platforms, the initial setup and training experience directly dictates long-term user adoption and retention. A high CSAT score at this stage isn't just about a pleasant first impression; it's a leading indicator of future account health, expansion potential, and lifetime value. It confirms that the customer feels equipped and confident to achieve their desired outcomes with the product.

When a customer rates their onboarding a 5/5 and adds, "The training specialist understood our unique workflow and showed us exactly how to set up the integration we needed," it provides specific, actionable validation. This feedback proves the enablement strategy is working and highlights which parts of the training process are most valuable. It’s why companies like HubSpot target an onboarding CSAT of 4.7 or higher, as they've correlated this metric with retention rates exceeding 90%.

Strategic Analysis & Actionable Insights

Analyzing post-onboarding CSAT goes beyond a simple "good" or "bad" score. It’s about diagnosing the customer's initial journey to predict and improve future success.

- Actionable Step: For every low CSAT score (1-2), implement a service recovery process. A manager should reach out within 24 hours to understand the issue and offer a follow-up training session. This proactive step can turn a detractor into a loyal advocate.

- Strategic Comparison: CSAT is a transactional metric, unlike NPS which measures overall loyalty. This makes CSAT perfect for pinpointing specific friction points in the customer journey (like onboarding). Use CSAT to fix the "leaks in the bucket" and NPS to measure the overall strength of the bucket.

- Identify Friction Points: Always follow up a low score with an open-ended question like, "What is one thing we could have done to make your onboarding experience better?" This feedback is a goldmine for identifying specific gaps in your documentation, training curriculum, or product UI that are causing early-stage friction.

Key Takeaway: Treat onboarding CSAT as a foundational health metric for the entire customer lifecycle. Low scores predict churn, while high scores identify your future advocates and expansion opportunities. Use this early voice of the customer example to refine your enablement and learn more about customer onboarding best practices on marketbetter.ai.

10 Voice-of-the-Customer Examples Compared

| Example | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| NPS Comment: Task Inbox Reduces Admin Burden | Low — periodic survey + open comment collection | Low — survey tool, segmentation | Signals adoption & time-savings (hours/day) | Validate feature-level adoption & retention | Direct PMF indicator; easy to aggregate |

| Customer Quote: Dialer Integration Solves Adoption Friction | Low — capture testimonial during rollout | Low — customer relationship + permission | Persuasive adoption lift (20% → 85%) | Sales decks for RevOps / VP Sales | Credible, metric-driven social proof |

| Support Ticket Excerpt: CRM Data Hygiene as Hidden Value | Low–Medium — tag & surface support feedback | Medium — support analytics & anonymization | Shows data-quality gains (40% → 95%) and better attribution | RevOps/Finance proof points for switching tools | Unfiltered operational insight; strategic ROI |

| In-App Feedback: AI Email Quality and Relevance Validation | Medium — realtime UI hooks + feedback flow | Medium–High — engineering + analytics | Instant quality signals; improves model trust | Build AI trust, iterate email generation models | Fast feedback loop; per-email trust metric |

| Survey Question/Verbatim: Ramp Time and Productivity Lift | Medium — survey design and segmentation | Medium — survey platform, analysis effort | Quantified ramp reduction (60–90 → 30–45 days; 68% report) | High-turnover teams; hiring ROI messaging | Direct enablement metric tied to cost savings |

| Review Excerpt: Integration Simplicity and Workflow Consolidation | Low — monitor and curate public reviews | Low — review platform monitoring | Third-party credibility; adoption signal | Competitive positioning vs. tool sprawl | Public social proof; resonates with buyers |

| Interview Snippet: Manager Coaching Leverage and Visibility | Medium — structured interviews and synthesis | Medium — interviewer time, transcript analysis | Shows coaching impact (e.g., 5 → 12 meetings; 140% lift) | Manager enablement; scaling SDR teams | Qualitative depth that demonstrates manager ROI |

| Focus Group Insight: Reps Want Task Context, Not More Tools | Medium — facilitation and thematic analysis | Medium — recruit participants, moderate effort | UX/positioning validation; reduces feature creep | Product roadmap and messaging prioritization | User-centered insight; guides simple UX design |

| Case Study: Pipeline Attribution and Revenue Impact (Quantified) | High — data collection, verification, customer sign-off | High — cross-functional analytics, legal, customer time | Multi-metric impact (activity ↑35%, attribution ↑43%, $420K ARR) | Long sales cycles; CFO/VP-level ROI conversations | Most compelling evidence; multi-stakeholder credibility |

| CSAT Feedback: Onboarding and Training Support Quality | Low–Medium — post-onboarding surveys & follow-up | Low–Medium — survey + enablement improvements | Adoption predictor; Avg CSAT 4.6/5 correlates with retention | Improve onboarding, drive 30–90 day adoption | Actionable enablement insight; retention signal |

From Signal to Strategy: Making VoC Your Competitive Edge

Throughout this guide, we've dissected ten distinct voice of the customer examples, moving far beyond surface-level quotes to uncover the strategic gold hidden within. We’ve seen how a simple NPS comment about reduced admin burden isn't just a compliment; it's a quantifiable value proposition that can be woven into sales discovery questions and marketing campaigns. A support ticket detailing CRM data hygiene issues becomes a powerful, unprompted testimonial for your platform's hidden value, directly addressing a critical pain point for RevOps leaders.

The true power of VoC emerges not from isolating these examples, but from connecting them. The focus group insight that "reps want task context, not more tools" perfectly explains the "why" behind the in-app feedback praising workflow consolidation. Similarly, the quantifiable ROI from a case study on pipeline attribution gains credibility when backed by a customer interview snippet where a manager praises the newfound visibility and coaching leverage. Your goal is to build a mosaic of evidence, where qualitative sentiment validates quantitative impact.

Turning Insight into Actionable Intelligence

Passive collection is where most VoC programs fail. Storing feedback in a spreadsheet or a Slack channel is not a strategy; it's a digital graveyard for good intentions. The key is to operationalize these insights, transforming raw feedback into a revenue-driving engine.

- Connect the Dots: Don't analyze a CSAT score in a vacuum. Compare it against support ticket themes and onboarding survey results. For instance, if CSAT feedback praises your onboarding quality, it's a signal to double down on that process. Effective training is paramount for improving support quality and customer satisfaction. To dive deeper into this specific area, explore an actionable guide to mastering customer support training to ensure your team is equipped for success from day one.

- Segment and Prioritize: Not all feedback is created equal. A feature request from a high-growth account in your ideal customer profile (ICP) carries more weight than a complaint from a churn-risk customer who was never a good fit. Use your CRM data to segment feedback and prioritize actions that will have the greatest impact on retention and expansion revenue.

- Systematize the Loop: Create a formal process for turning VoC insights into action. When a sales manager mentions improved coaching leverage in an interview, how does that translate into a new sales playbook? When a user review praises integration simplicity, how quickly can your marketing team turn that into a social media asset? This system ensures customer feedback directly influences go-to-market execution.

Your Path Forward: From VoC Examples to VoC Excellence

The voice of the customer examples we've explored serve as a blueprint. Your next step is to move from theory to practice. Don't try to boil the ocean by launching ten new surveys at once. Instead, identify the single most critical unknown in your sales process. Is it ramp time for new SDRs? Is it friction in tool adoption? Or is it proving the ROI of your solution to executive buyers?

Choose that one question and align your VoC collection methods to answer it. Use targeted in-app feedback to understand adoption, run a focused survey to measure productivity lift, or schedule three customer interviews to get the unfiltered story on revenue impact. By focusing your efforts, you create a tangible feedback loop that delivers immediate value.

Ultimately, a world-class VoC program isn't about collecting feedback; it's about embedding the customer's perspective into every decision your sales, marketing, and product teams make. It’s the difference between guessing what your buyers want and knowing what they need to succeed. When you make the customer's voice the loudest one in the room, you don't just build a better product; you build an unbeatable competitive advantage.

Ready to stop manually compiling feedback and start automatically turning customer insights into winning sales plays? marketbetter.ai ingests these diverse voice of the customer examples and uses AI to generate battlecards, email templates, and talking points, embedding your customer's voice directly into your team's workflow. See how it works at marketbetter.ai.